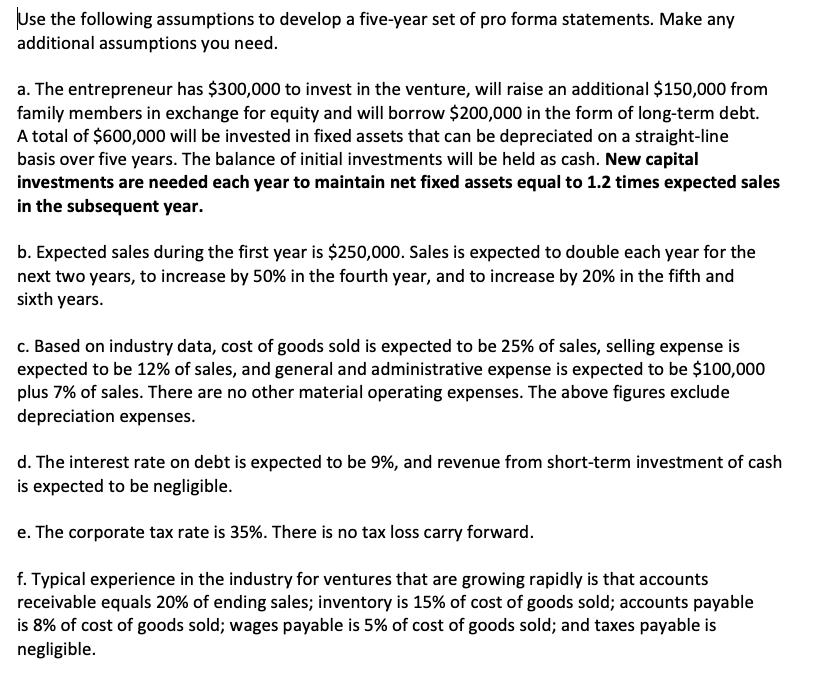

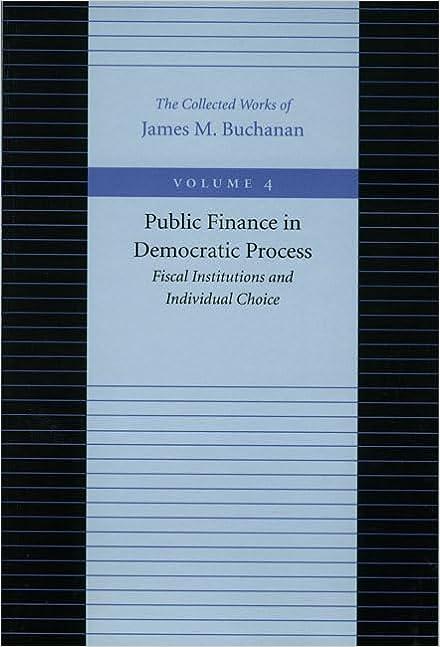

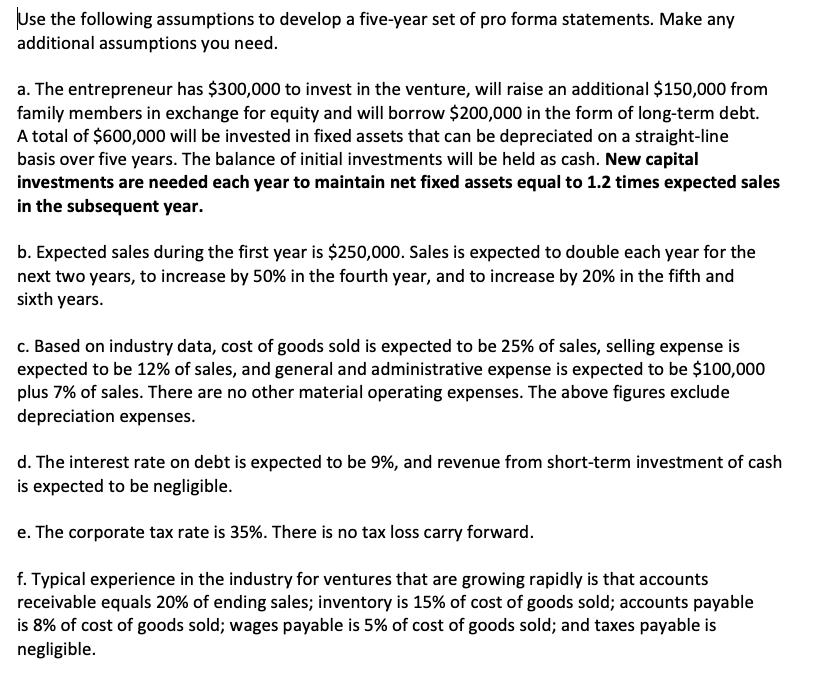

Use the following assumptions to develop a five-year set of pro forma statements. Make any additional assumptions you need. a. The entrepreneur has $300,000 to invest in the venture, will raise an additional $150,000 from family members in exchange for equity and will borrow $200,000 in the form of long-term debt. A total of $600,000 will be invested in fixed assets that can be depreciated on a straight-line basis over five years. The balance of initial investments will be held as cash. New capital investments are needed each year to maintain net fixed assets equal to 1.2 times expected sales in the subsequent year. b. Expected sales during the first year is $250,000. Sales is expected to double each year for the next two years, to increase by 50% in the fourth year, and to increase by 20% in the fifth and sixth years. c. Based on industry data, cost of goods sold is expected to be 25% of sales, selling expense is expected to be 12% of sales, and general and administrative expense is expected to be $100,000 plus 7% of sales. There are no other material operating expenses. The above figures exclude depreciation expenses. d. The interest rate on debt is expected to be 9%, and revenue from short-term investment of cash is expected to be negligible. e. The corporate tax rate is 35%. There is no tax loss carry forward. f. Typical experience in the industry for ventures that are growing rapidly is that accounts receivable equals 20% of ending sales; inventory is 15% of cost of goods sold; accounts payable is 8% of cost of goods sold; wages payable is 5% of cost of goods sold; and taxes payable is negligible. g. The venture needs to maintain a cash balance equal to the lesser of 20% of annual sales or $50,000. h. If additional financing is needed, the entrepreneur hopes to use long-term debt to the extent that profitability is sufficient to cover interest expense (so that the full tax advantage of debt financing is realized). Use the following assumptions to develop a five-year set of pro forma statements. Make any additional assumptions you need. a. The entrepreneur has $300,000 to invest in the venture, will raise an additional $150,000 from family members in exchange for equity and will borrow $200,000 in the form of long-term debt. A total of $600,000 will be invested in fixed assets that can be depreciated on a straight-line basis over five years. The balance of initial investments will be held as cash. New capital investments are needed each year to maintain net fixed assets equal to 1.2 times expected sales in the subsequent year. b. Expected sales during the first year is $250,000. Sales is expected to double each year for the next two years, to increase by 50% in the fourth year, and to increase by 20% in the fifth and sixth years. c. Based on industry data, cost of goods sold is expected to be 25% of sales, selling expense is expected to be 12% of sales, and general and administrative expense is expected to be $100,000 plus 7% of sales. There are no other material operating expenses. The above figures exclude depreciation expenses. d. The interest rate on debt is expected to be 9%, and revenue from short-term investment of cash is expected to be negligible. e. The corporate tax rate is 35%. There is no tax loss carry forward. f. Typical experience in the industry for ventures that are growing rapidly is that accounts receivable equals 20% of ending sales; inventory is 15% of cost of goods sold; accounts payable is 8% of cost of goods sold; wages payable is 5% of cost of goods sold; and taxes payable is negligible. g. The venture needs to maintain a cash balance equal to the lesser of 20% of annual sales or $50,000. h. If additional financing is needed, the entrepreneur hopes to use long-term debt to the extent that profitability is sufficient to cover interest expense (so that the full tax advantage of debt financing is realized)