Answered step by step

Verified Expert Solution

Question

1 Approved Answer

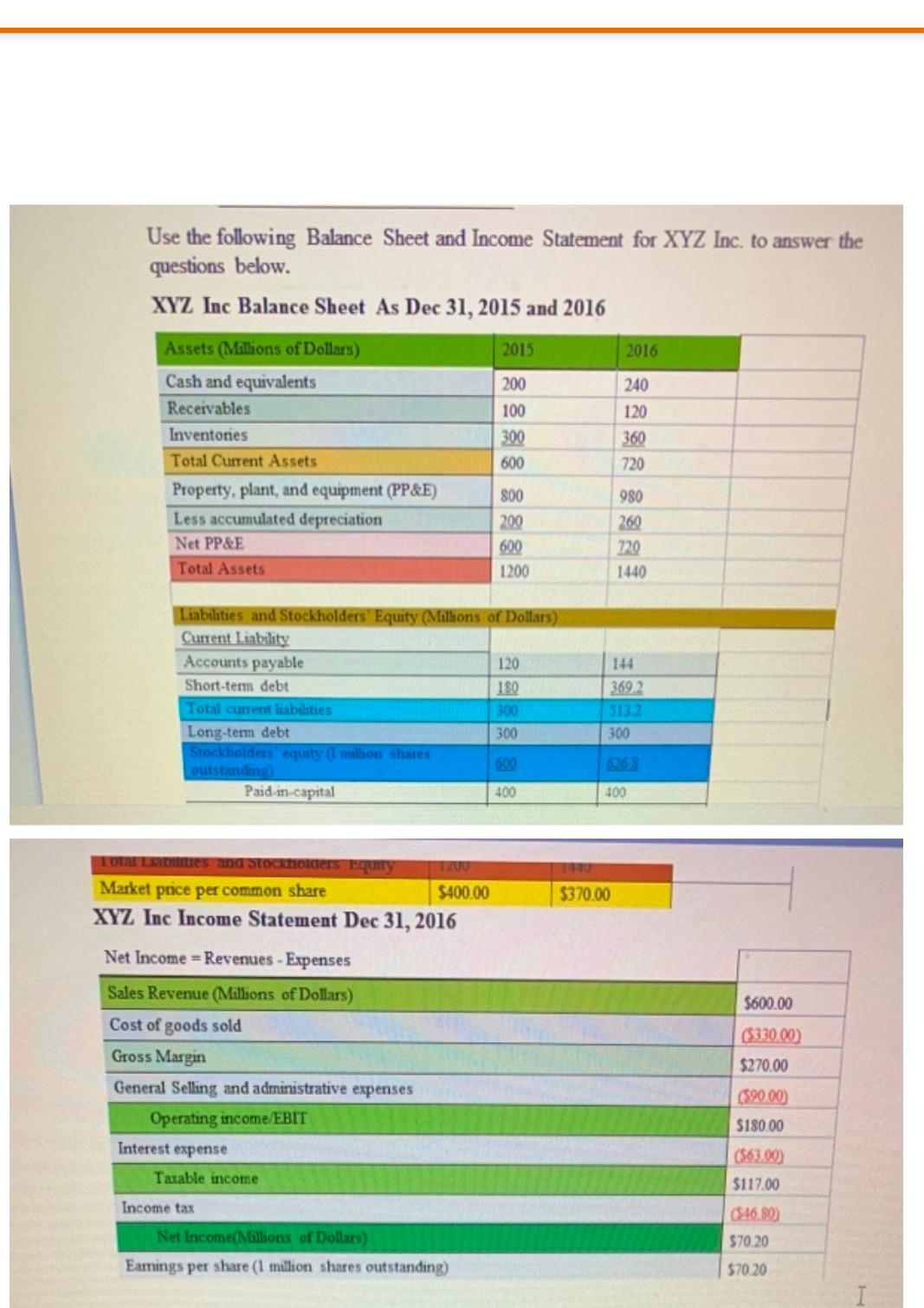

Use the following Balance Sheet and Income Statement for XYZ Inc. to answer the questions below. XYZ Inc Balance Sheet As Dec 31, 2015 and

Use the following Balance Sheet and Income Statement for XYZ Inc. to answer the questions below. XYZ Inc Balance Sheet As Dec 31, 2015 and 2016 2015 2016 Assets (Millions of Dollars) Cash and equivalents Receivables Inventories Total Current Assets Property, plant, and equipment (PP&E) Less accumulated depreciation Net PP&E Total Assets 200 100 300 600 240 120 360 720 800 200 600 1200 980 260 720 1440 Liabilities and Stockholders' Equity (Millions of Dollars) Current Liability Accounts payable 120 Short-term debt 180 Total current liabilities 300 Long-term debt 300 Stockholdets equity (million shares outstanding Paid in capital 400 144 3692 5132 300 400 Totates and stockholders Equity Market price per common share $400.00 XYZ Inc Income Statement Dec 31, 2016 $370.00 $600.00 Net Income = Revenues - Expenses Sales Revenue (Millions of Dollars) Cost of goods sold Gross Margin General Selling and administrative expenses Operating income/EBIT (533000) $270.00 (590.00 $180.00 Interest expense Taxable income (563.00) $117.00 Income tax (546.80) $70,20 Net Income Millions of Dollars) Eamings per share (1 million shares outstanding) $70 20 calculate all the following financial ratios. 1. ROE 2. ROA 3. Book value /price per share 4. Ps 5. P/E 6. Net income margin 7. Turn over ratio 8. Leverage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started