Answered step by step

Verified Expert Solution

Question

1 Approved Answer

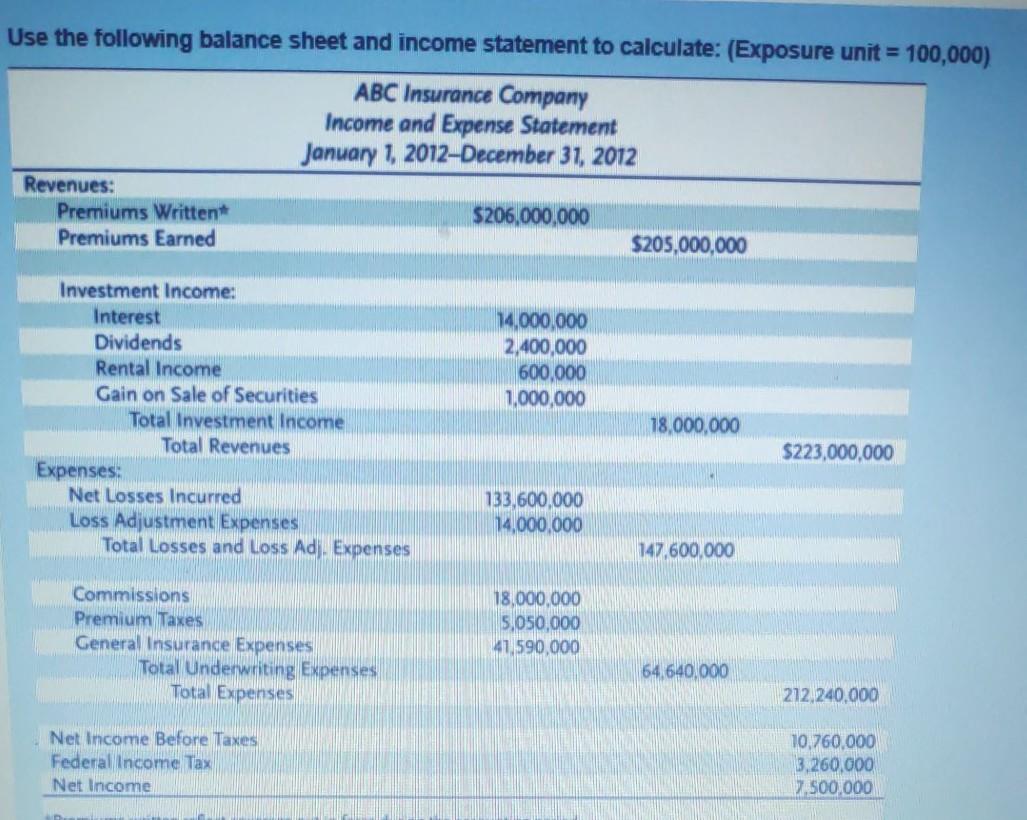

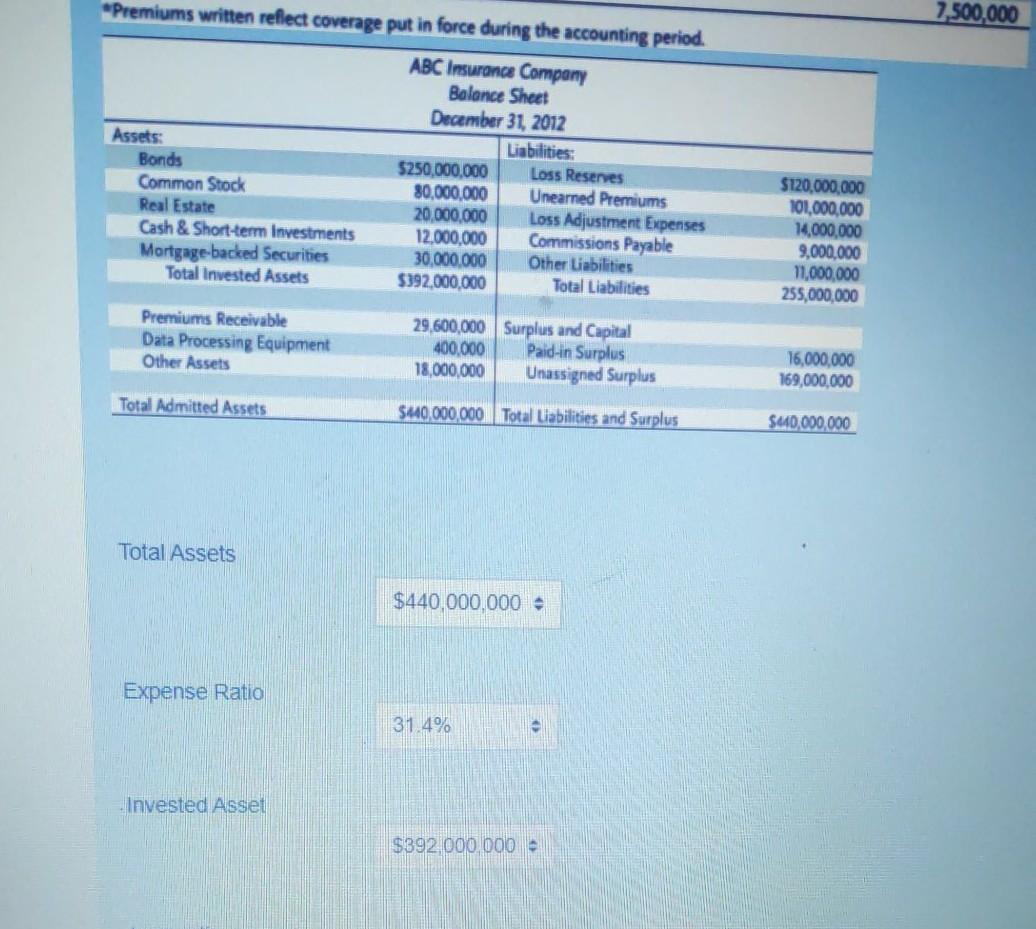

Use the following balance sheet and income statement to calculate: (Exposure unit = 100,000) ABC Insurance Company Income and Expense Statement January 1, 2012-December 31,

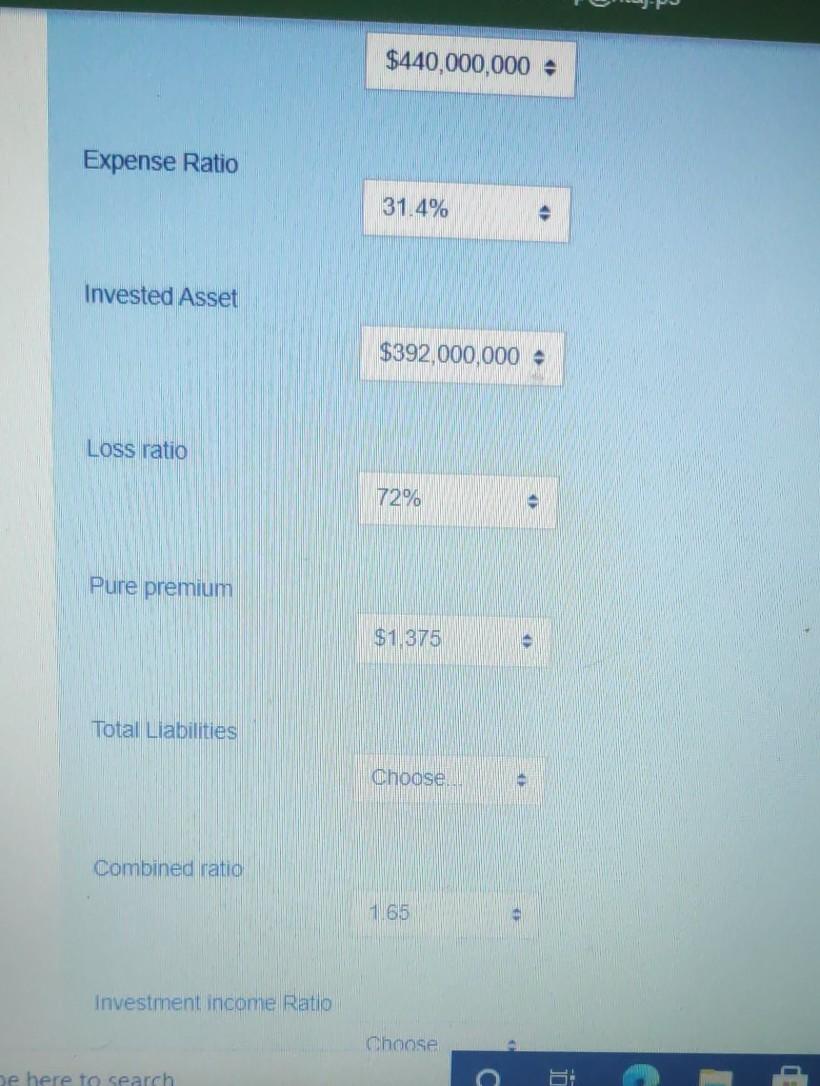

Use the following balance sheet and income statement to calculate: (Exposure unit = 100,000) ABC Insurance Company Income and Expense Statement January 1, 2012-December 31, 2012 Revenues: Premiums Written $206,000,000 Premiums Earned $205,000,000 14,000,000 2,400,000 600,000 1,000,000 Investment Income: Interest Dividends Rental Income Gain on Sale of Securities Total Investment Income Total Revenues Expenses: Net Losses incurred Loss Adjustment Expenses Total Losses and loss Ad). Expenses 18,000,000 $223,000,000 133,600,000 14,000,000 147,600,000 Commissions Premium Taxes General Insurance Expenses Total Underwriting Expenses Total Expenses 18,000,000 5,050,000 41.590,000 64, 640,000 212,240.000 Net Income Before Taxes Federal Income Tax Net Income 10,760.000 3.260.000 27.500.000 2,500,000 *Premiums written reflect coverage put in force during the accounting period. ABC Insurance Company Balance Sheet December 31, 2012 Assets: Liabilities: Bonds 5250,000,000 Loss Reserves Common Stock 80,000,000 Unearned Premiums Real Estate 20,000,000 Loss Adjustment Expenses Cash & Short-term Investments 12.000.000 Commissions Payable Mortgage-backed Securities 30,000,000 Other Liabilities Total Invested Assets $392,000,000 Total Liabilities $120,000,000 101,000,000 14,000,000 9,000,000 11,000,000 255,000,000 Premiums Receivable Data Processing Equipment Other Assets 29,600,000 Surplus and Capital 400,000 Paid-in Surplus 18,000,000 Unassigned Surplus 16,000,000 169,000,000 Total Admitted Assets $40,000,000 Total Liabilities and Surplus $40,000,000 Total Assets $440,000,000 Expense Ratio 31.49% Invested Asset $392 000 000 $440,000,000 Expense Ratio 31.4% Invested Asset $392,000,000 - Loss ratio 72% Pure premium $1,375 Total Liabilities Choose + Combined ratio 165 Investment income Ratio Choose Be here to search c Use the following balance sheet and income statement to calculate: (Exposure unit = 100,000) ABC Insurance Company Income and Expense Statement January 1, 2012-December 31, 2012 Revenues: Premiums Written $206,000,000 Premiums Earned $205,000,000 14,000,000 2,400,000 600,000 1,000,000 Investment Income: Interest Dividends Rental Income Gain on Sale of Securities Total Investment Income Total Revenues Expenses: Net Losses incurred Loss Adjustment Expenses Total Losses and loss Ad). Expenses 18,000,000 $223,000,000 133,600,000 14,000,000 147,600,000 Commissions Premium Taxes General Insurance Expenses Total Underwriting Expenses Total Expenses 18,000,000 5,050,000 41.590,000 64, 640,000 212,240.000 Net Income Before Taxes Federal Income Tax Net Income 10,760.000 3.260.000 27.500.000 2,500,000 *Premiums written reflect coverage put in force during the accounting period. ABC Insurance Company Balance Sheet December 31, 2012 Assets: Liabilities: Bonds 5250,000,000 Loss Reserves Common Stock 80,000,000 Unearned Premiums Real Estate 20,000,000 Loss Adjustment Expenses Cash & Short-term Investments 12.000.000 Commissions Payable Mortgage-backed Securities 30,000,000 Other Liabilities Total Invested Assets $392,000,000 Total Liabilities $120,000,000 101,000,000 14,000,000 9,000,000 11,000,000 255,000,000 Premiums Receivable Data Processing Equipment Other Assets 29,600,000 Surplus and Capital 400,000 Paid-in Surplus 18,000,000 Unassigned Surplus 16,000,000 169,000,000 Total Admitted Assets $40,000,000 Total Liabilities and Surplus $40,000,000 Total Assets $440,000,000 Expense Ratio 31.49% Invested Asset $392 000 000 $440,000,000 Expense Ratio 31.4% Invested Asset $392,000,000 - Loss ratio 72% Pure premium $1,375 Total Liabilities Choose + Combined ratio 165 Investment income Ratio Choose Be here to search c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started