Question

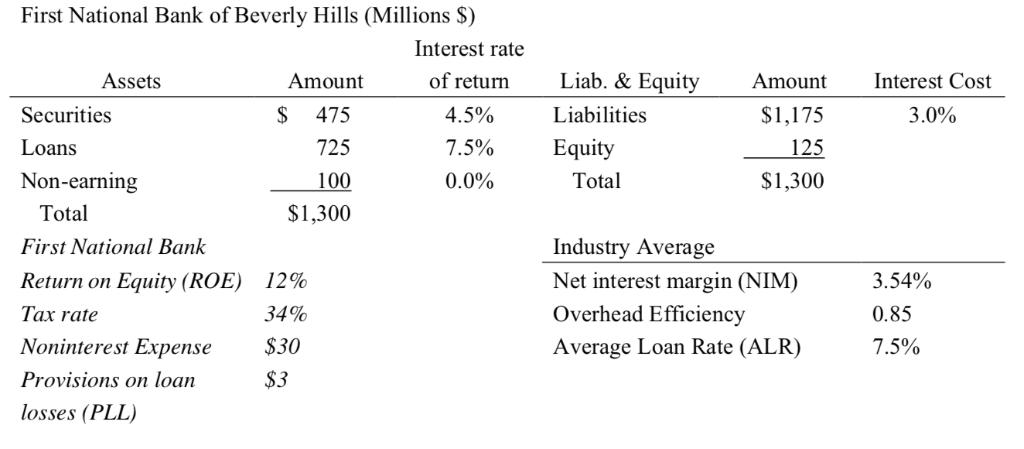

1. What is the bank's net interest margin (NIM)? Is the bank performing better or worse than average? A) 2.54%, worse than average B) 3.38%,

1. What is the bank's net interest margin (NIM)? Is the bank performing better or worse than average?

A) 2.54%, worse than average

B) 3.38%, worse than average

C) 4.00%, better than average

D) 5.72%, better than average

E) 4.00%, worse than average

2. What must net noninterest income (net of noninterest expense) be in order for FNB to have a 12% return on equity (ROE)? Based on your answer, must FNB be performing better or worse than the industry average in this area?

A) -$14.77 (millions), worse

B) -$17.23 (millions), worse

C) $14.77 (millions), better

D) $17.23 (millions), better

E) -$17.23 (millions), better

3. If the net noninterest income were to change to -$16, what would the average loan rate (ALR) have to be to generate a 12% return on equity (ROE)? does this ALR appear feasible?

A) 5.00%, feasible

B) 3.5%, feasible

C) 6.25%, feasible

D) 7.67%, not feasible

E) 6.25, not feasible

First National Bank of Beverly Hills (Millions $) Interest rate Assets Amount of return Liab. & Equity Amount Interest Cost Securities 2$ 475 4.5% Liabilities $1,175 3.0% Loans 725 7.5% Equity 125 Non-earning 100 0.0% Total $1,300 Total $1,300 Industry Average Net interest margin (NIM) First National Bank Return on Equity (ROE) 12% 3.54% Tax rate 34% Overhead Efficiency 0.85 Noninterest Expense $30 Average Loan Rate (ALR) 7.5% Provisions on loan $3 losses (PLL)

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

AS we Fnow Nef interest margin Interest Ex pense 10one Interes t ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started