Answered step by step

Verified Expert Solution

Question

1 Approved Answer

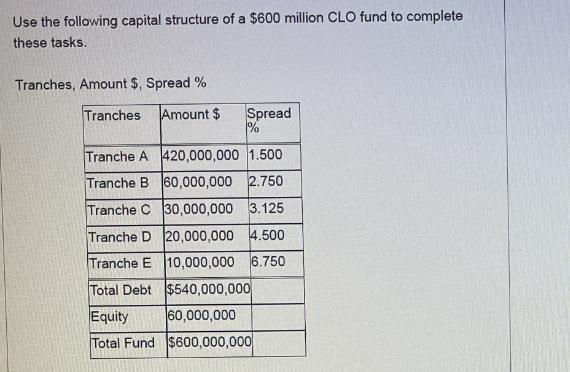

Use the following capital structure of a $600 million CLO fund to complete these tasks. Tranches, Amount $, Spread % Tranches Amount $ Spread

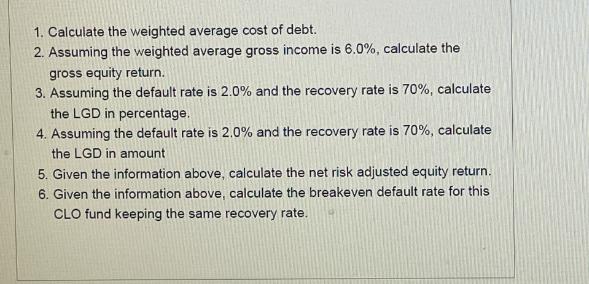

Use the following capital structure of a $600 million CLO fund to complete these tasks. Tranches, Amount $, Spread % Tranches Amount $ Spread % Tranche A 420,000,000 1.500 Tranche B 60,000,000 2.750 Tranche C 30,000,000 3.125 Tranche D 20,000,000 4.500 Tranche E 10,000,000 6.750 $540,000,000 Total Debt Equity 60,000,000 Total Fund $600,000,000 1. Calculate the weighted average cost of debt. 2. Assuming the weighted average gross income is 6.0%, calculate the gross equity return. 3. Assuming the default rate is 2.0% and the recovery rate is 70%, calculate the LGD in percentage. 4. Assuming the default rate is 2.0% and the recovery rate is 70%, calculate the LGD in amount 5. Given the information above, calculate the net risk adjusted equity return. 6. Given the information above, calculate the breakeven default rate for this CLO fund keeping the same recovery rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To complete the tasks using the provided capital structure of the CLO fund lets go through each task 1 Calculate the weighted average cost of debt 2 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started