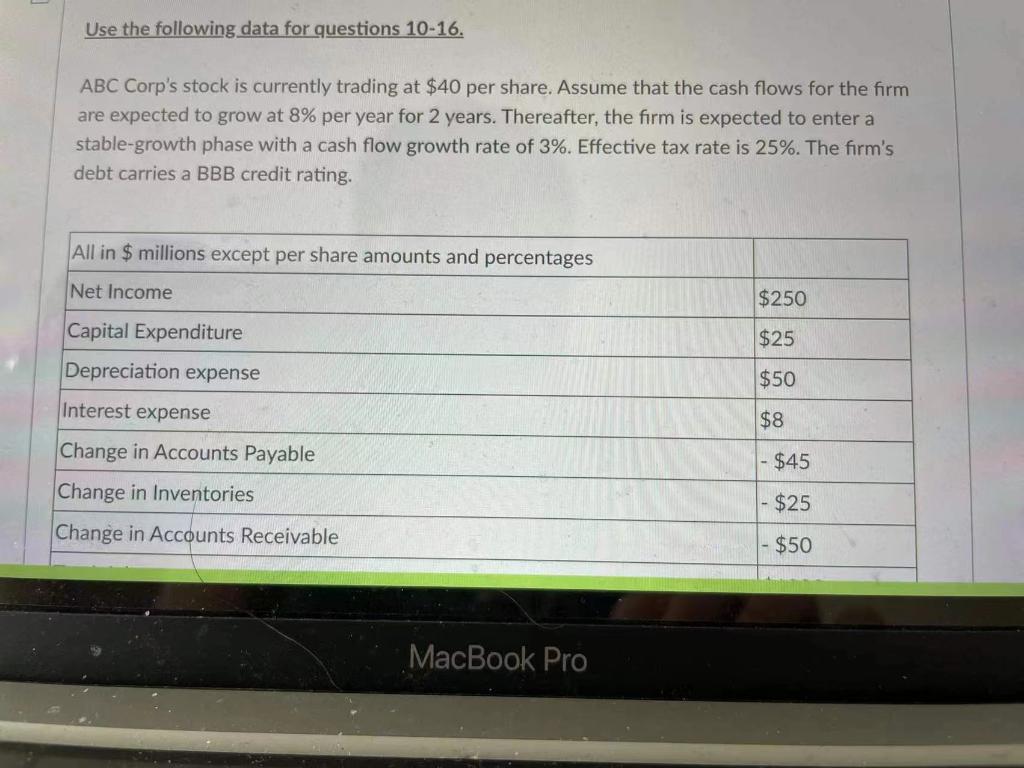

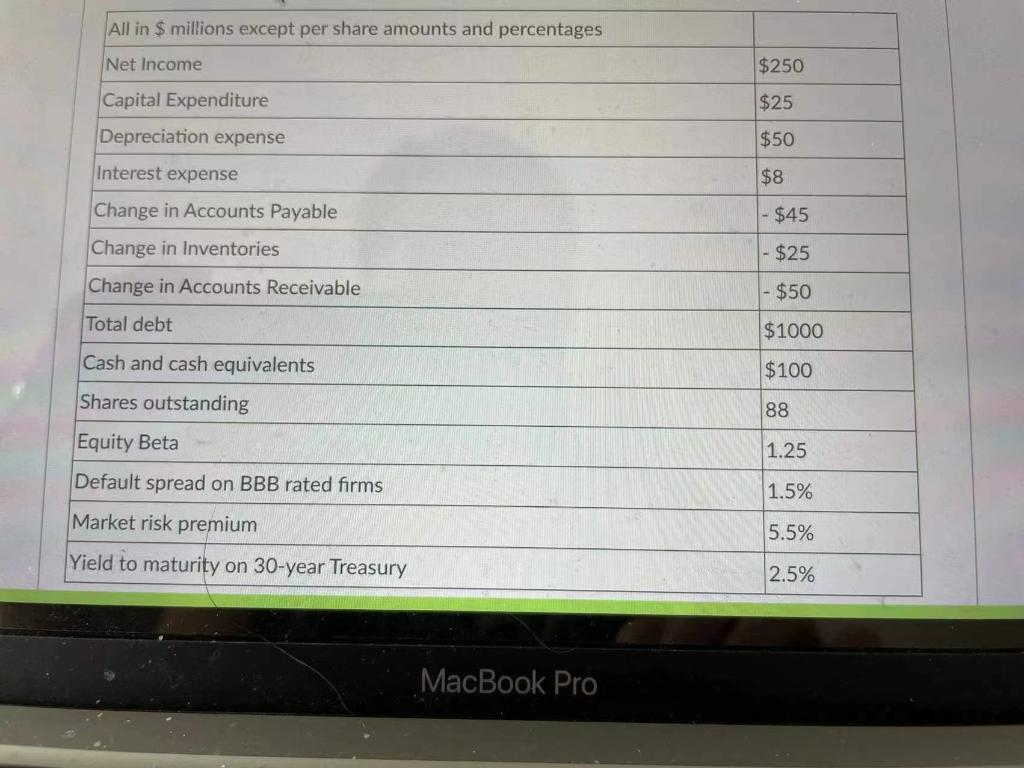

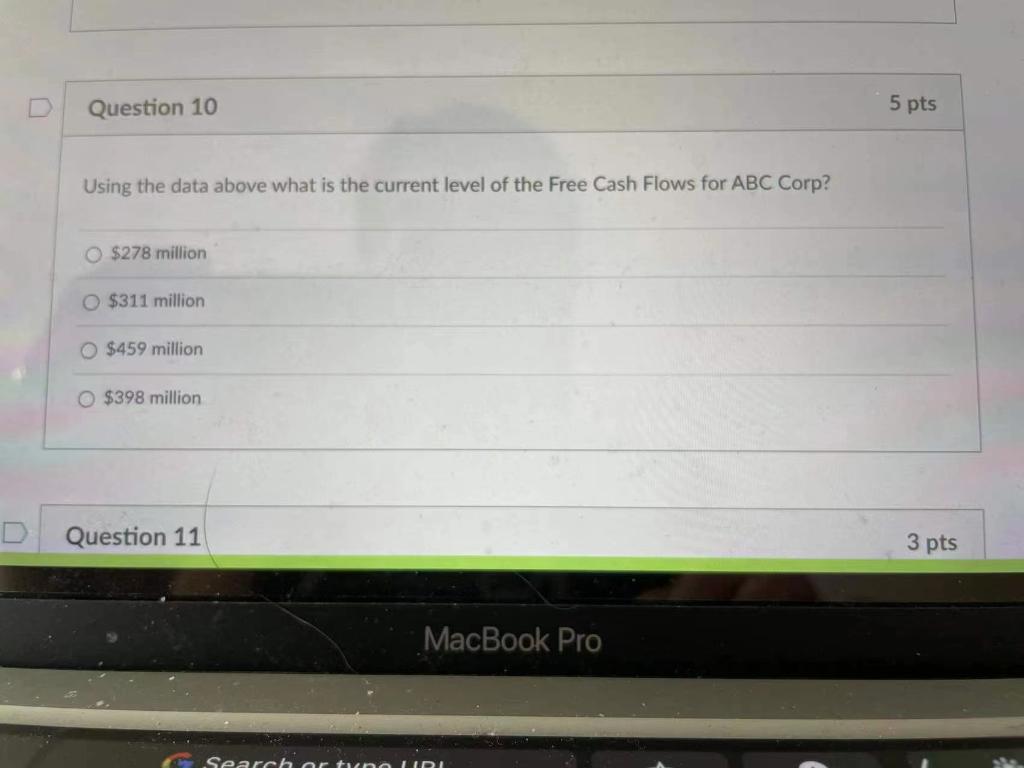

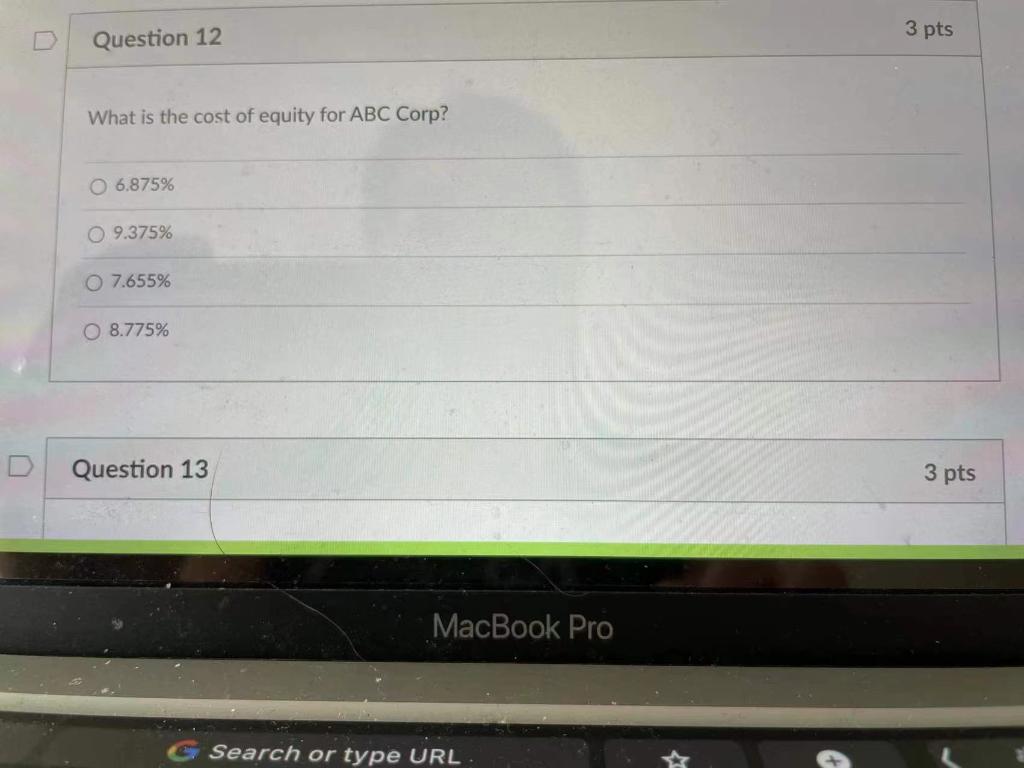

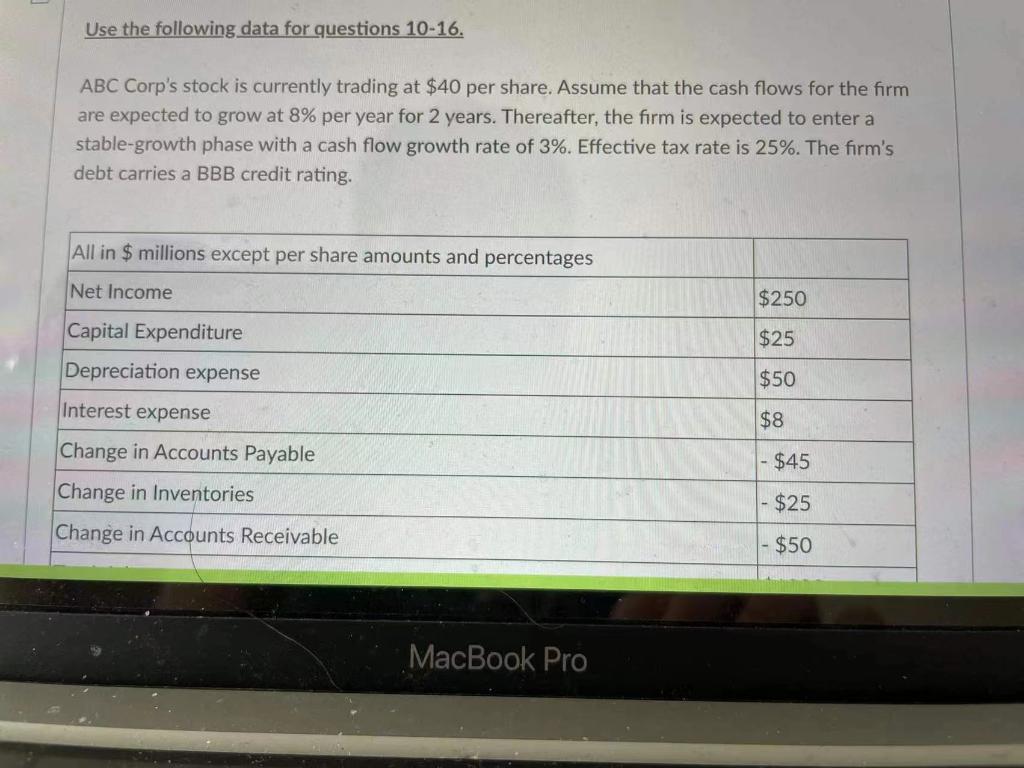

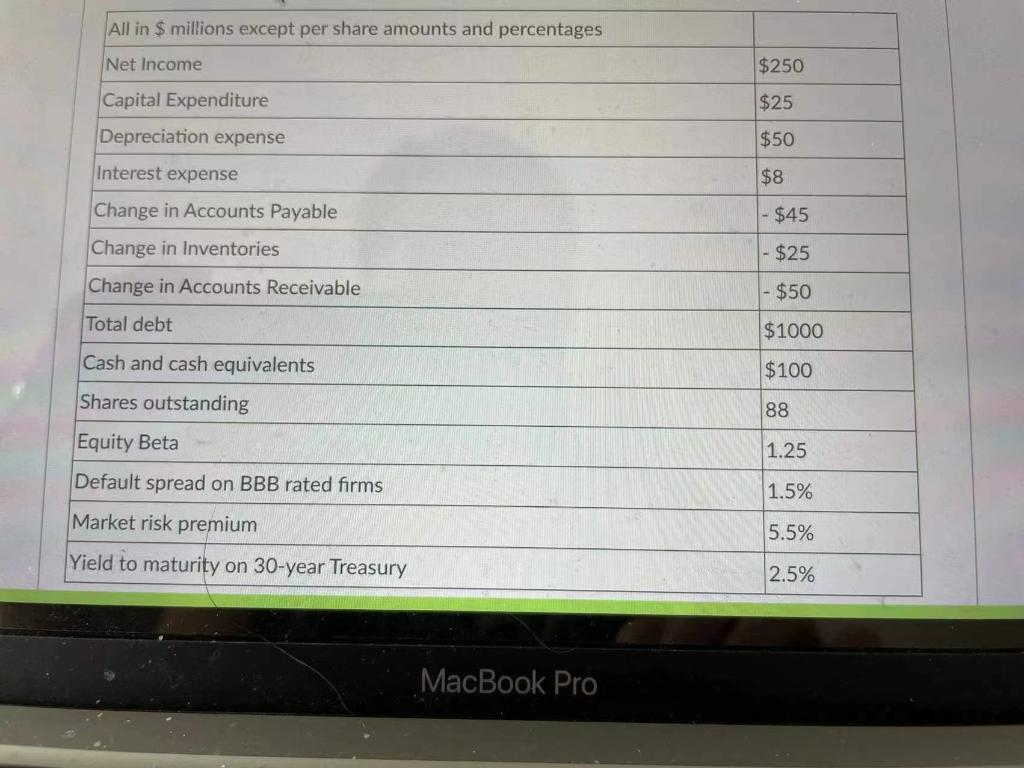

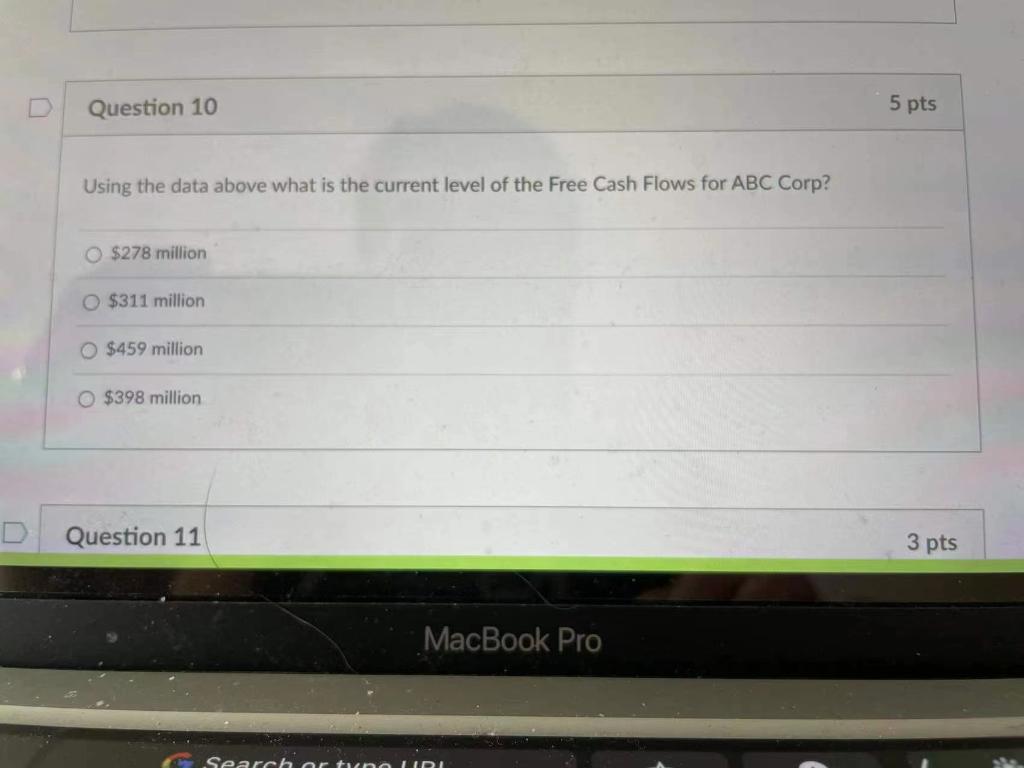

Use the following data for questions 10-16. ABC Corp's stock is currently trading at $40 per share. Assume that the cash flows for the firm are expected to grow at 8% per year for 2 years. Thereafter, the firm is expected to enter a stable-growth phase with a cash flow growth rate of 3%. Effective tax rate is 25%. The firm's debt carries a BBB credit rating. All in $ millions except per share amounts and percentages Net Income $250 Capital Expenditure $25 Depreciation expense $50 Interest expense $8 - $45 Change in Accounts Payable Change in Inventories Change in Accounts Receivable $25 - $50 MacBook Pro All in $ millions except per share amounts and percentages Net Income $250 $25 Capital Expenditure Depreciation expense $50 Interest expense $8 - $45 Change in Accounts Payable Change in Inventories - $25 Change in Accounts Receivable - $50 Total debt $1000 $100 Cash and cash equivalents Shares outstanding 88 1.25 1.5% Equity Beta Default spread on BBB rated firms Market risk premium Yield to maturity on 30-year Treasury 5.5% 2.5% MacBook Pro D Question 10 5 pts Using the data above what is the current level of the Free Cash Flows for ABC Corp? $278 million $311 million $459 million $398 million Question 11 3 pts MacBook Pro Search ar tina LRT 3 pts Question 12 What is the cost of equity for ABC Corp? 6.875% 09.375% 0 7.655% O 8.775% Question 13 3 pts MacBook Pro G Search or type URL - Question 13 3 pts What is the WACC for ABC Corp? 5.784% 0 6.7129 0 7.965% 8.761% Question 14 5 pts MacBook Pro Ey Search or type URL 5 pts Question 14 Assuming the current level of the Free Cash Flows is $402 million, what is the enterprise value of ABC Corp? $7,559 million $8,128 million $8,802 million 0 $9,150 million Question 15 3 pts MacBook Pro G Search or type URL 3 pts Question 15 Assuming the current level of the Free Cash Flows is $402 million, what is the total value of equity for ABC Corp? O 8,250 million O 6,750 million O 8,550 million O 5,870 million MacBook Pro G Search or type URL Question 16 3 pts Based on the current stock price of $40 per share and the current level of the Free Cash Flows of $402 million, is ABC Corp's stock under/overvalued or correctly valued? O Undervalued O Overvalued O Correctly valued Use the following data for questions 17-20. MacBook Pro Search or type URL