Answered step by step

Verified Expert Solution

Question

1 Approved Answer

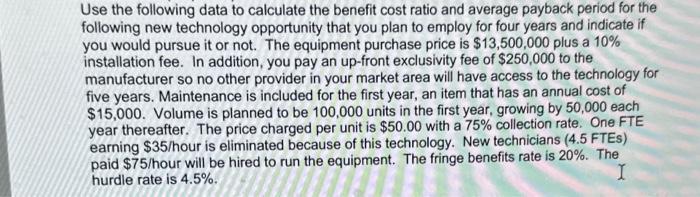

Use the following data to calculate the benefit cost ratio and average payback period for the following new technology opportunity that you plan to

Use the following data to calculate the benefit cost ratio and average payback period for the following new technology opportunity that you plan to employ for four years and indicate if you would pursue it or not. The equipment purchase price is $13,500,000 plus a 10% installation fee. In addition, you pay an up-front exclusivity fee of $250,000 to the manufacturer so no other provider in your market area will have access to the technology for five years. Maintenance is included for the first year, an item that has an annual cost of $15,000. Volume is planned to be 100,000 units in the first year, growing by 50,000 each year thereafter. The price charged per unit is $50.00 with a 75% collection rate. One FTE earning $35/hour is eliminated because of this technology. New technicians (4.5 FTES) paid $75/hour will be hired to run the equipment. The fringe benefits rate is 20%. The I hurdle rate is 4.5%.

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the benefitcost ratio we first need to calculate the total benefits and total costs Equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started