Answered step by step

Verified Expert Solution

Question

1 Approved Answer

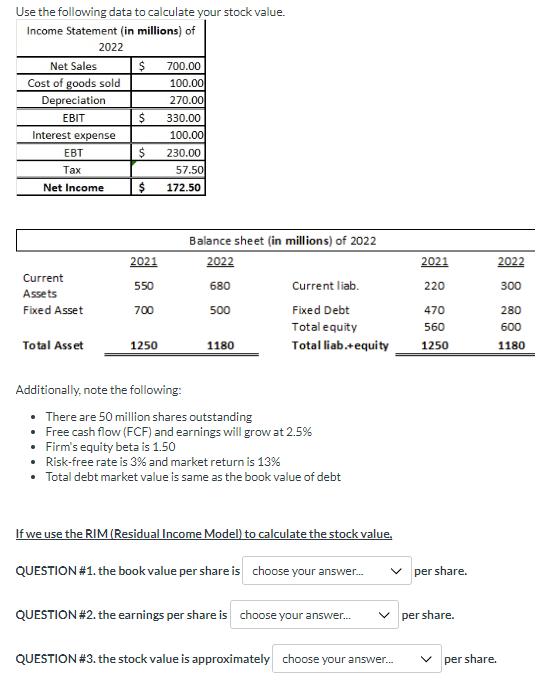

Use the following data to calculate your stock value. Income Statement (in millions) of 2022 Net Sales Cost of goods sold Depreciation EBIT Interest

Use the following data to calculate your stock value. Income Statement (in millions) of 2022 Net Sales Cost of goods sold Depreciation EBIT Interest expense EBT Tax Net Income Current Assets Fixed Asset Total Asset $ 700.00 100.00 270.00 $ 330.00 100.00 230.00 57.50 172.50 $ $ 2021 550 700 1250 Balance sheet (in millions) of 2022 2022 680 500 1180 Current liab. Fixed Debt Total equity Total liab.+equity Additionally, note the following: There are 50 million shares outstanding Free cash flow (FCF) and earnings will grow at 2.5% Firm's equity beta is 1.50 Risk-free rate is 3% and market return is 13% Total debt market value is same as the book value of debt If we use the RIM (Residual Income Model) to calculate the stock value. QUESTION #1. the book value per share is choose your answer.... QUESTION #2. the earnings per share is choose your answer... QUESTION #3. the stock value is approximately choose your answer... 2021 220 470 560 1250 per share. per share. per share. 2022 300 280 600 1180

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the book value per share earnings per share and stock value using the Residual Income M...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started