Answered step by step

Verified Expert Solution

Question

1 Approved Answer

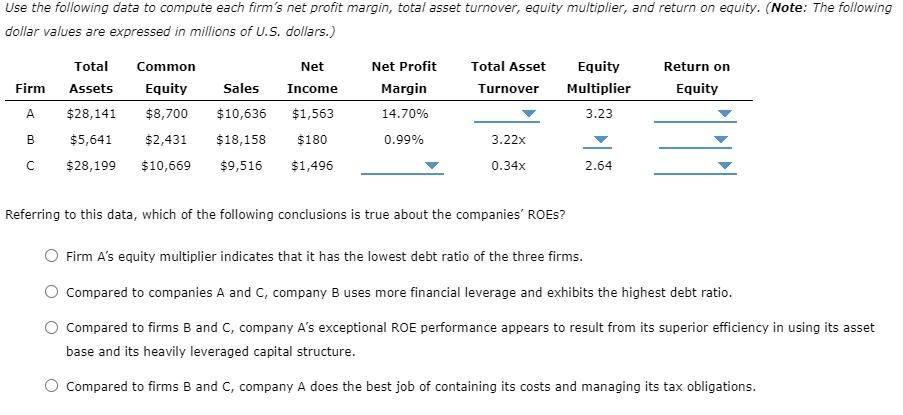

Use the following data to compute each firm's net profit margin, total asset turnover, equity multiplier, and return on equity. (Note: The following dollar

Use the following data to compute each firm's net profit margin, total asset turnover, equity multiplier, and return on equity. (Note: The following dollar values are expressed in millions of U.S. dollars.) Total Common Net Net Profit Total Asset Firm Assets A $28,141 B $5,641 Equity $8,700 $2,431 Sales Income Margin Turnover Equity Multiplier Return on Equity $10,636 $18,158 $1,563 14.70% 3.23 $180 0.99% 3.22x C $28,199 $10,669 $9,516 $1,496 0.34x 2.64 Referring to this data, which of the following conclusions is true about the companies' ROES? Firm A's equity multiplier indicates that it has the lowest debt ratio of the three firms. Compared to companies A and C, company B uses more financial leverage and exhibits the highest debt ratio. Compared to firms B and C, company A's exceptional ROE performance appears to result from its superior efficiency in using its asset base and its heavily leveraged capital structure. Compared to firms B and C, company A does the best job of containing its costs and managing its tax obligations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started