Question

Use the following given for the next 10 questions: 61. The net taxable compensation before personal exemptions would be: P891,000 P895,000 P792,000 P90,000 none of

Use the following given for the next 10 questions:

61. The net taxable compensation before personal exemptions would be:

P891,000

P895,000

P792,000

P90,000

none of the above-

62. The net income from profession before personal exemptions would be

P233,250

P250,000

P400,000

P0

None of the above

63. The net capital gains (loss) would be:

P75,750

P51,500-11

P50,000

P 0

None of the above

64. The total exemption would be

P0

P150,000

P125,000

P100,000

None of the above-

65. The net taxable income would be

P1,200,000

P2,015,250

P891,000

P800,000

None of the above-

66. Total deductible income tax credit would be

P80,000-

P60,000

P20,000

P0

None of the above

67. Income tax still due and payable per ITR.

P170,000

P250,000

P120,000

P130,000

None of the above-

68. The total final tax would be

P22,000

P25,000

P10,000

P12,000

None of the above-

69. The total nontaxable income and benefits would be

P195,380

P125,000

P90,000

P82,000

None of the above-

70. The difference of itemized deduction from OSD would be

P6,750

P160,000

P100,000

P10,000

None of the above

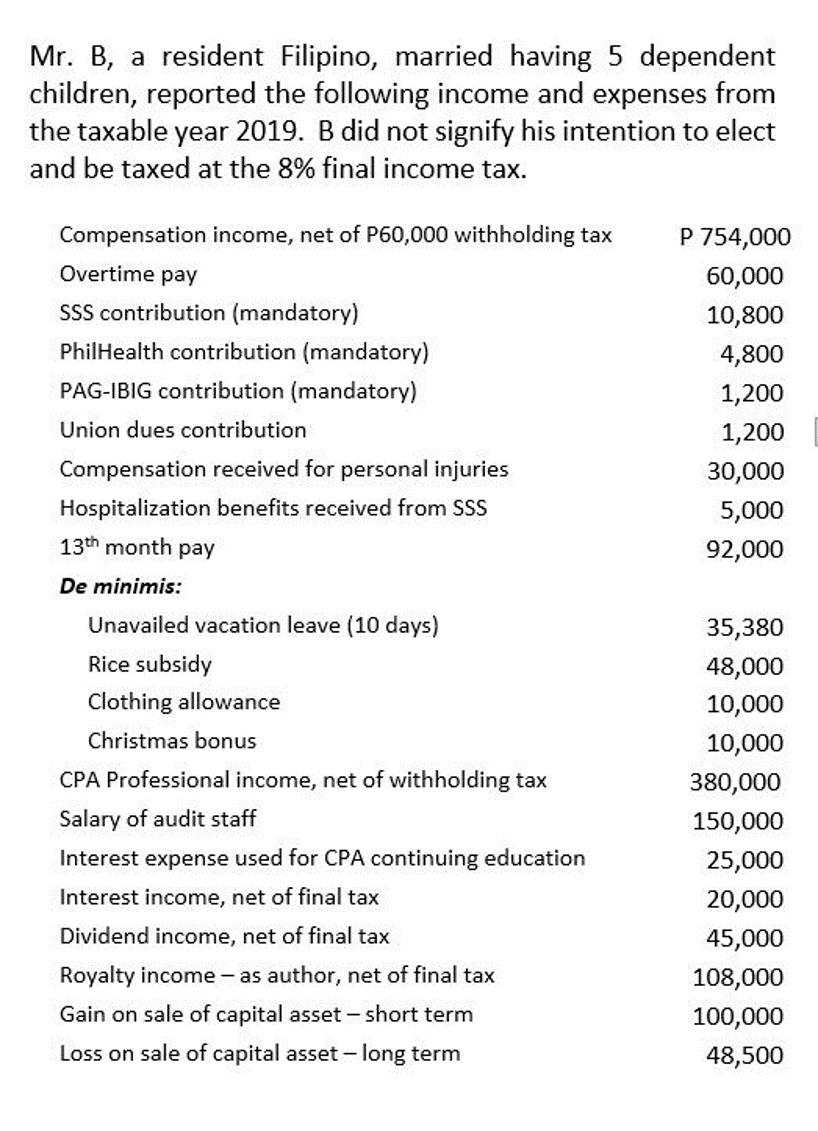

Mr. B, a resident Filipino, married having 5 dependent children, reported the following income and expenses from the taxable year 2019. B did not signify his intention to elect and be taxed at the 8% final income tax. Compensation income, net of P60,000 withholding tax P 754,000 Overtime pay 60,000 SSS contribution (mandatory) 10,800 PhilHealth contribution (mandatory) 4,800 PAG-IBIG contribution (mandatory) 1,200 Union dues contribution 1,200 Compensation received for personal injuries 30,000 Hospitalization benefits received from SSS 5,000 13th month pay 92,000 De minimis: Unavailed vacation leave (10 days) 35,380 Rice subsidy 48,000 Clothing allowance 10,000 Christmas bonus 10,000 CPA Professional income, net of withholding tax 380,000 Salary of audit staff 150,000 Interest expense used for CPA continuing education 25,000 Interest income, net of final tax 20,000 Dividend income, net of final tax 45,000 Royalty income - as author, net of final tax 108,000 Gain on sale of capital asset - short term 100,000 Loss on sale of capital asset - long term 48,500

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

61 814000 60000 2000 24000 4000 5000 909000 Compensation income gross of withholding tax 754000 6000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started