Answered step by step

Verified Expert Solution

Question

1 Approved Answer

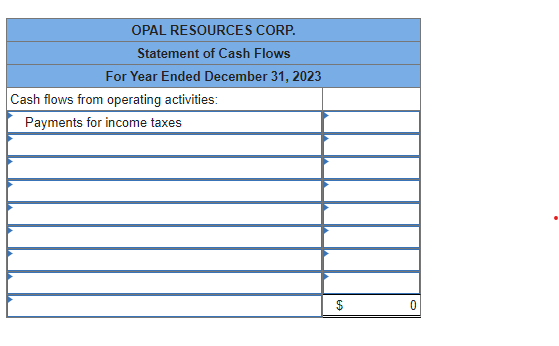

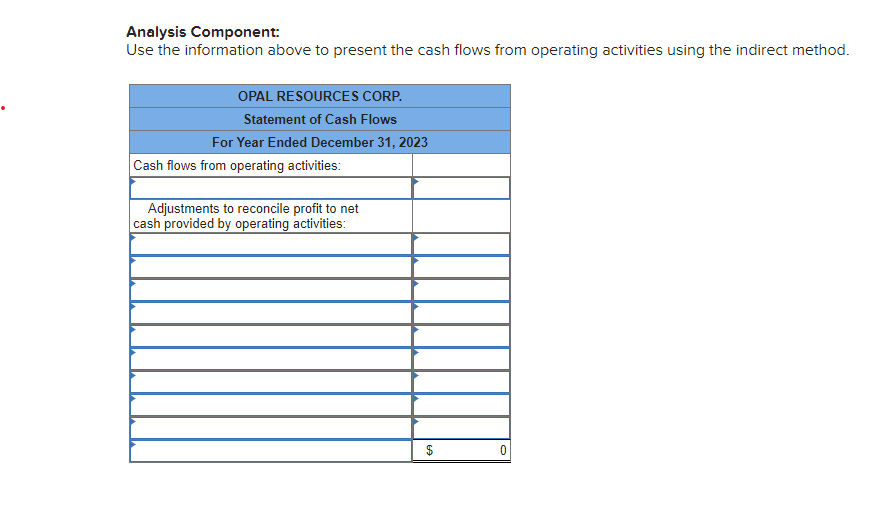

Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using

Use the following income statement and information about changes in non-cash current assets and current liabilities to present the cash flows from operating activities using the direct method: (List any deduction in cash and cash outflows as negative amounts.)

| Opal Resources Corp. | ||||||

| Income Statement | ||||||

| For Year Ended December 31, 2023 | ||||||

| Sales | $ | 486,000 | ||||

| Cost of goods sold | 236,400 | |||||

| Gross profit from sales | $ | 249,600 | ||||

| Operating expenses: | ||||||

| Salaries expense | $ | 67,476 | ||||

| Depreciation expense | 11,460 | |||||

| Rent expense | 9,700 | |||||

| Amortization expense, patents | 1,380 | |||||

| Utilities expense | 3,900 | |||||

| Total operating expenses | 93,916 | |||||

| Gain on sale of equipment | 1,860 | |||||

| Profit from operations | $ | 157,544 | ||||

| Income taxes | 2,000 | |||||

| Profit | $ | 155,544 | ||||

Changes in current asset and current liability accounts during the year were as follows:

| Accounts receivable | $ | 9,600 | increase | |||

| Merchandise inventory | 6,000 | increase | ||||

| Accounts payable | 2,400 | decrease | ||||

| Salaries payable | 400 | decrease | ||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started