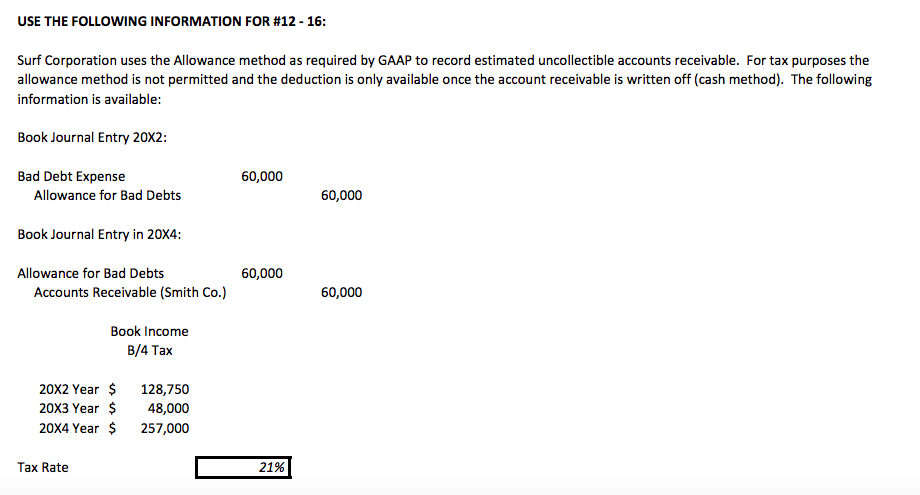

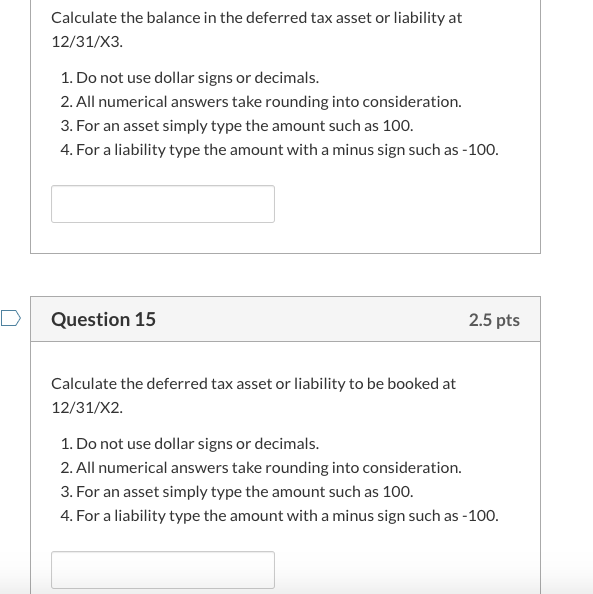

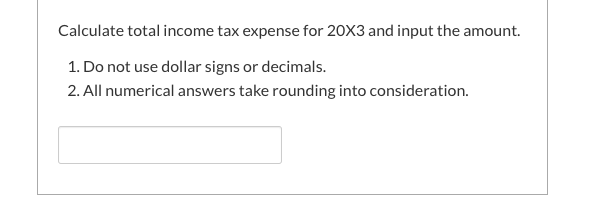

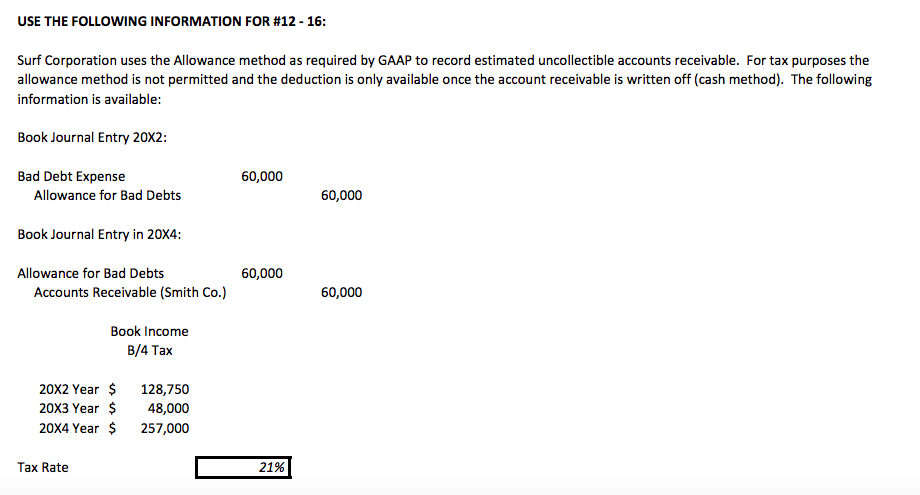

USE THE FOLLOWING INFORMATION FOR #12 - 16: Surf Corporation uses the Allowance method as required by GAAP to record estimated uncollectible accounts receivable. For tax purposes the allowance method is not permitted and the deduction is only available once the account receivable is written off (cash method). The following information is available: Book Journal Entry 20X2: 60,000 Bad Debt Expense Allowance for Bad Debts 60,000 Book Journal Entry in 20X4: 60,000 Allowance for Bad Debts Accounts Receivable (Smith Co.) 60,000 Book Income B/4 Tax 20x2 Year $ 20x3 Year $ 20X4 Year $ 128,750 48,000 257,000 Tax Rate 21% Calculate the balance in the deferred tax asset or liability at 12/31/X3. 1. Do not use dollar signs or decimals. 2. All numerical answers take rounding into consideration. 3. For an asset simply type the amount such as 100. 4. For a liability type the amount with a minus sign such as -100. Question 15 2.5 pts Calculate the deferred tax asset or liability to be booked at 12/31/X2. 1. Do not use dollar signs or decimals. 2. All numerical answers take rounding into consideration. 3. For an asset simply type the amount such as 100. 4. For a liability type the amount with a minus sign such as - 100. Calculate total income tax expense for 20x3 and input the amount. 1. Do not use dollar signs or decimals. 2. All numerical answers take rounding into consideration USE THE FOLLOWING INFORMATION FOR #12 - 16: Surf Corporation uses the Allowance method as required by GAAP to record estimated uncollectible accounts receivable. For tax purposes the allowance method is not permitted and the deduction is only available once the account receivable is written off (cash method). The following information is available: Book Journal Entry 20X2: 60,000 Bad Debt Expense Allowance for Bad Debts 60,000 Book Journal Entry in 20X4: 60,000 Allowance for Bad Debts Accounts Receivable (Smith Co.) 60,000 Book Income B/4 Tax 20x2 Year $ 20x3 Year $ 20X4 Year $ 128,750 48,000 257,000 Tax Rate 21% Calculate the balance in the deferred tax asset or liability at 12/31/X3. 1. Do not use dollar signs or decimals. 2. All numerical answers take rounding into consideration. 3. For an asset simply type the amount such as 100. 4. For a liability type the amount with a minus sign such as -100. Question 15 2.5 pts Calculate the deferred tax asset or liability to be booked at 12/31/X2. 1. Do not use dollar signs or decimals. 2. All numerical answers take rounding into consideration. 3. For an asset simply type the amount such as 100. 4. For a liability type the amount with a minus sign such as - 100. Calculate total income tax expense for 20x3 and input the amount. 1. Do not use dollar signs or decimals. 2. All numerical answers take rounding into consideration