Answered step by step

Verified Expert Solution

Question

1 Approved Answer

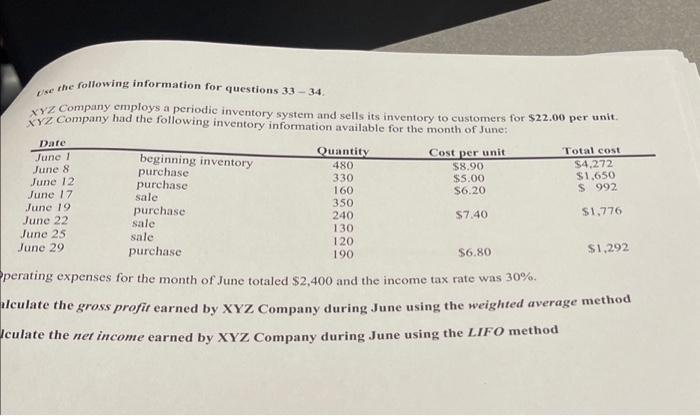

Use the following information for questions 33 - 34. XYZ Company employs a periodic inventory system and sells its inventory to customers for $22.00 per

Use the following information for questions 33 - 34. XYZ Company employs a periodic inventory system and sells its inventory to customers for $22.00 per unit. XYZ Company had the following inventory information available for the month of June: Date June 1 June 8 June 12 June 17 June 19 June 22 June 25 June 29 beginning inventory purchase purchase sale purchase sale sale purchase Quantity 480 330 160 350 240 130 120 190 Cost per unit $8.90 $5.00 $6.20 $7.40 $6.80 Total cost $4,272 $1,650 $ 992 $1,776 $1,292 Operating expenses for the month of June totaled $2,400 and the income tax rate was 30%. alculate the gross profit earned by XYZ Company during June using the weighted average method Iculate the net income earned by XYZ Company during June using the LIFO method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started