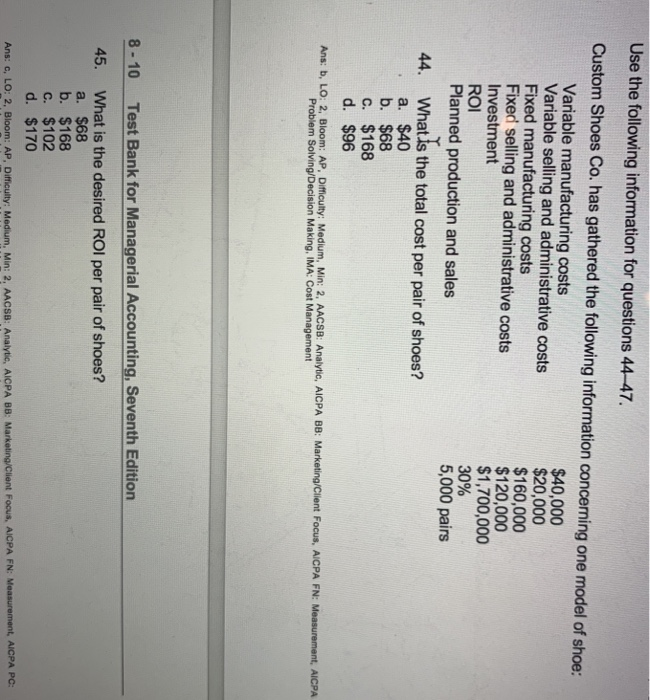

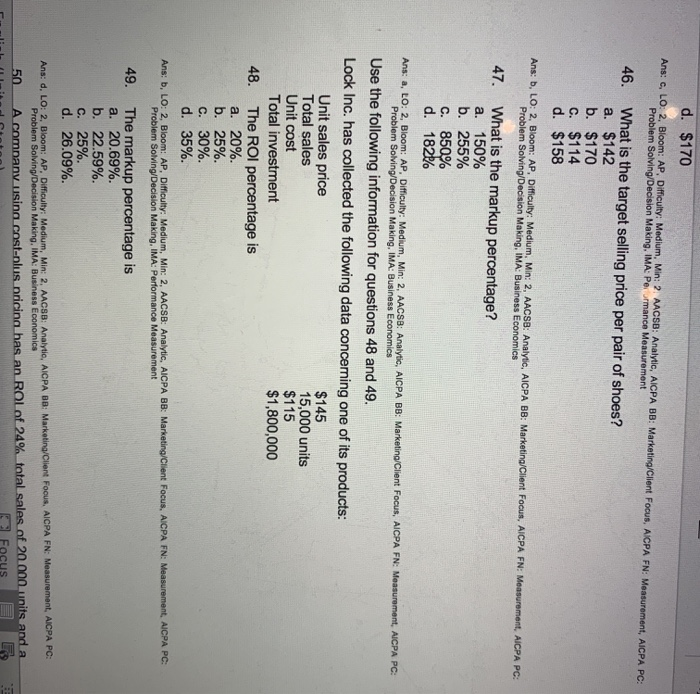

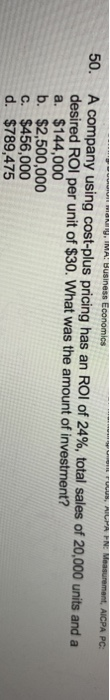

Use the following information for questions 44-47. Custom Shoes Co. has gathered the following information concerning one model of shoe: Variable manufacturing costs $40,000 Variable selling and administrative costs $20,000 Fixed manufacturing costs $160,000 Fixed selling and administrative costs $120,000 Investment $1,700,000 ROI 30% Planned production and sales 5,000 pairs 44. What is the total cost per pair of shoes? a. $40 b. $68 C. $168 d. $96 Ans: b, LO: 2, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA Problem Solving/Decision Making. IMA: Cost Management 8 - 10 Test Bank for Managerial Accounting, Seventh Edition 45. What is the desired ROI per pair of shoes? a. $68 b. $168 c. $102 d. $170 Ans: G, LO: 2, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC d. $170 Ans: c, LO: 2, Bloom: AP, Difficulty: Medium, Min: 2 MACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC: Problem Solving/Decision Making, IMA: Peormance Measurement 46. What is the target selling price per pair of shoes? a. $142 b. $170 c. $114 d. $158 Ans: b, LO: 2, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC Problem Solving/Decision Making, IMA: Business Economics 47. What is the markup percentage? a. 150% b. 255% C. 850% d. 182/ Ans: a, LO: 2, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC: Problem Solving/Decision Making. IMA: Business Economics Use the following information for questions 48 and 49. Lock Inc. has collected the following data concerning one of its products: Unit sales price $145 Total sales 15,000 units Unit cost $115 Total investment $1,800,000 48. The ROI percentage is a. 20%. b. 25% C. 30%. d. 35%. Ans: b, LO: 2, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC, Problem Solving/Decision Making, IMA: Performance Measurement 49. The markup percentage is a. 20.69% b. 22.59%. c. 25%. d. 26.09% Ans: d, LO: 2, Bloom: AP. Difficulty: Medium, Min: 2, AACSB: Analytio, AICPA BB: Marketing/Client Foous, AICPA FN: Measurement, AICPA PC: Problem Solving/Decision Making, IMA: Business Economics 50 Acompany using cost-plus pricing has an ROL of 24% total sales of 20.000 units and a Focus 3 9 50. "M , IMA: Uusiness Economics ALPA NE Measurement, AICPA PC: A company using cost-plus pricing has an ROI of 24%, total sales of 20,000 units and a desired ROI per unit of $30. What was the amount of investment? a. $144,000 b. $2,500,000 C. $456,000 d. $789,475