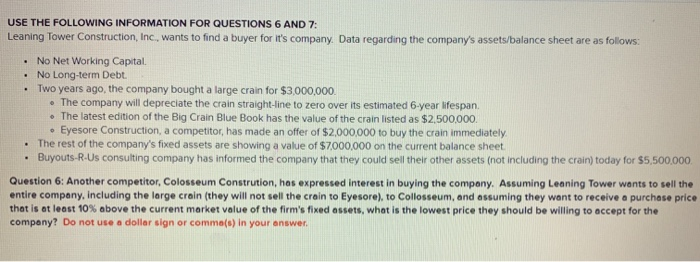

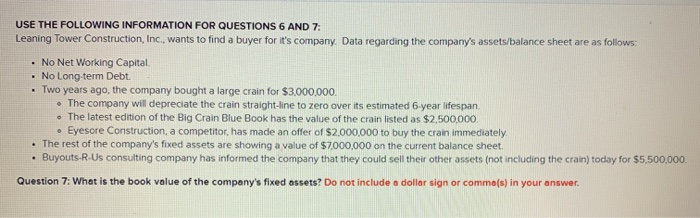

. USE THE FOLLOWING INFORMATION FOR QUESTIONS 6 AND 7: Leaning Tower Construction, Inc., wants to find a buyer for it's company. Data regarding the company's assets/balance sheet are as follows: No Net Working Capital No Long-term Debt Two years ago, the company bought a large crain for $3,000,000 The company will depreciate the crain straight-line to zero over its estimated 6-year lifespan. The latest edition of the Big Crain Blue Book has the value of the crain listed as $2,500,000 Eyesore Construction, a competitor, has made an offer of $2,000,000 to buy the crain immediately The rest of the company's fixed assets are showing a value of $7,000,000 on the current balance sheet Buyouts-R-Us consulting company has informed the company that they could sell their other assets (not including the crain) today for $5,500,000 Question 6: Another competitor, Colosseum Constrution, has expressed interest in buying the company. Assuming Leaning Tower wants to sell the entire company, including the large croin (they will not sell the crain to Eyesore), to Collosseum, and assuming they want to receive a purchase price that is at least 10% above the current market value of the firm's fixed assets, what is the lowest price they should be willing to accept for the company? Do not use a dollar sign or comma(e) in your answer . USE THE FOLLOWING INFORMATION FOR QUESTIONS 6 AND 7: Leaning Tower Construction, Inc., wants to find a buyer for it's company. Data regarding the company's assets/balance sheet are as follows: No Net Working Capital No Long-term Debt Two years ago, the company bought a large crain for $3.000.000. The company will depreciate the crain straight-line to zero over its estimated 6-year lifespan. The latest edition of the Big Crain Blue Book has the value of the crain listed as $2,500,000 Eyesore Construction, a competitor, has made an offer of $2,000,000 to buy the crain immediately The rest of the company's fixed assets are showing a value of $7,000,000 on the current balance sheet. Buyouts-R-Us consulting company has informed the company that they could sell their other assets (not including the crain) today for $5,500,000 Question 7: What is the book value of the company's fixed assets? Do not include a dollar sign or comma(s) in your