Answered step by step

Verified Expert Solution

Question

1 Approved Answer

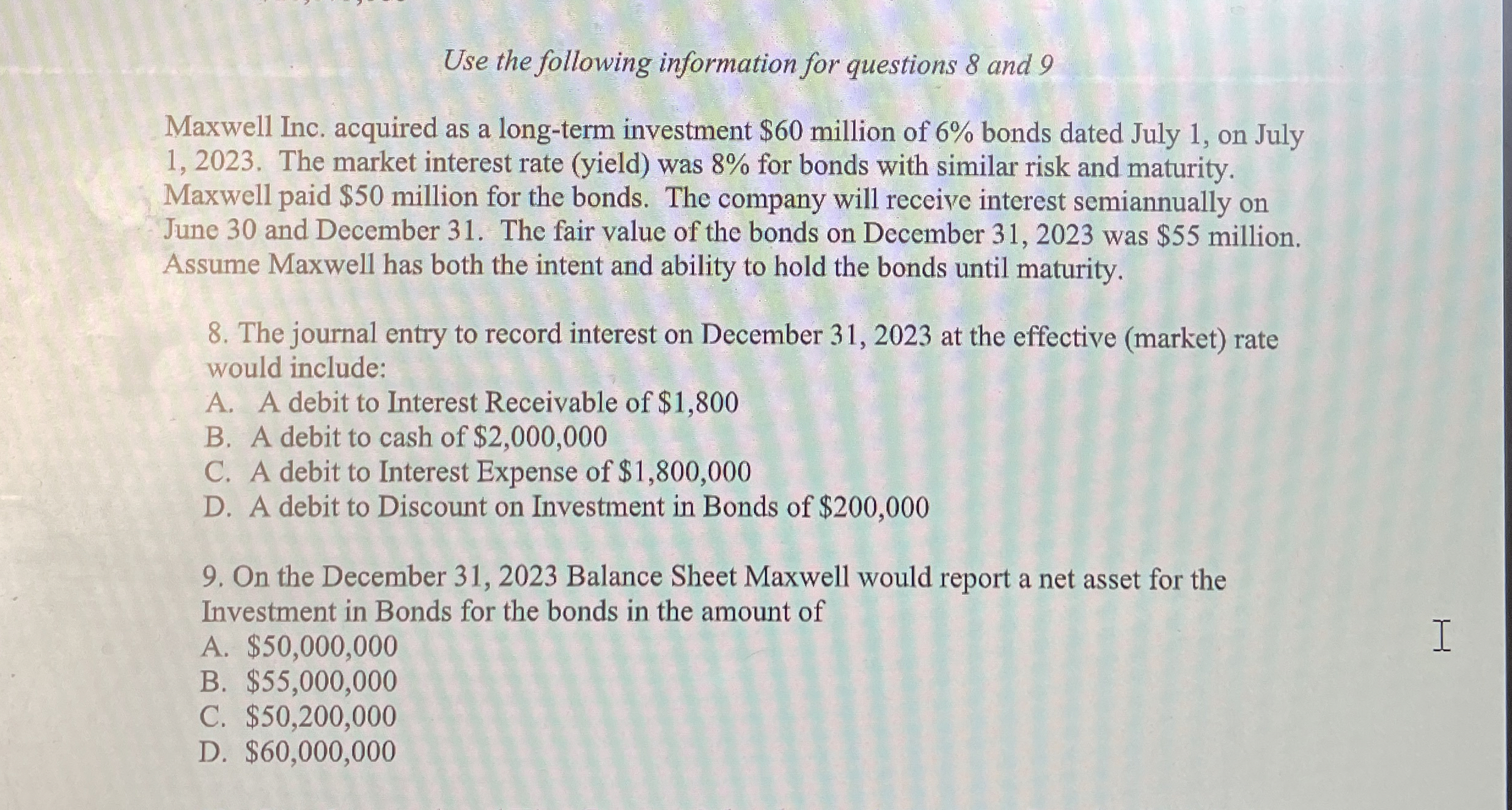

Use the following information for questions 8 and 9 Maxwell Inc. acquired as a long - term investment $ 6 0 million of 6 %

Use the following information for questions and

Maxwell Inc. acquired as a longterm investment $ million of bonds dated July on July

The market interest rate yield was for bonds with similar risk and maturity.

Maxwell paid $ million for the bonds. The company will receive interest semiannually on

June and December The fair value of the bonds on December was $ million.

Assume Maxwell has both the intent and ability to hold the bonds until maturity.

The journal entry to record interest on December at the effective market rate

would include:

A A debit to Interest Receivable of $

B A debit to cash of $

C A debit to Interest Expense of $

D A debit to Discount on Investment in Bonds of $

On the December Balance Sheet Maxwell would report a net asset for the

Investment in Bonds for the bonds in the amount of

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started