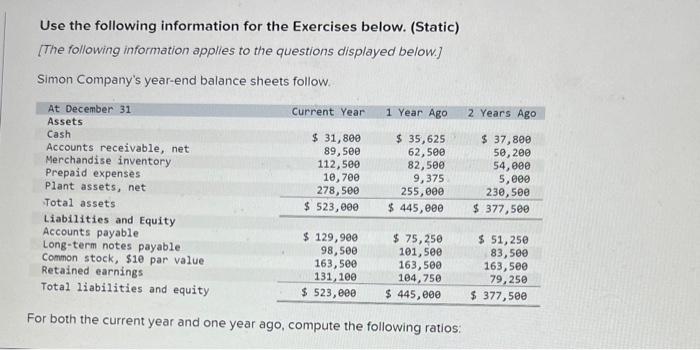

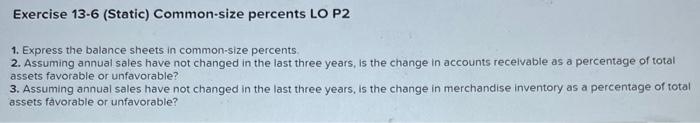

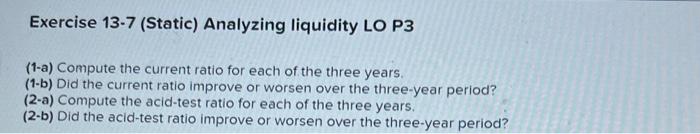

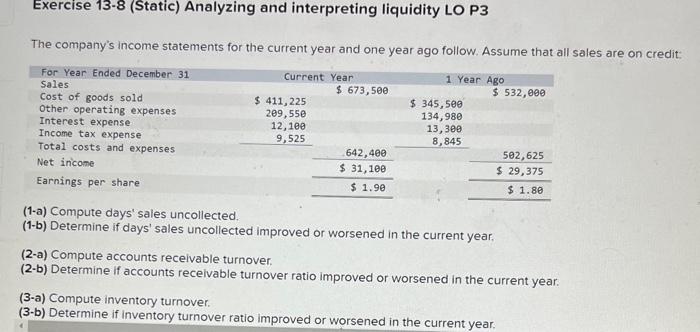

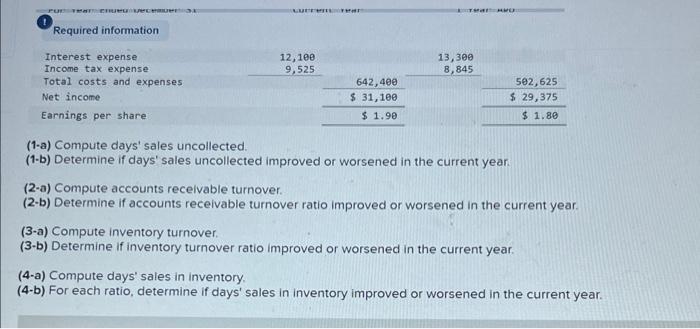

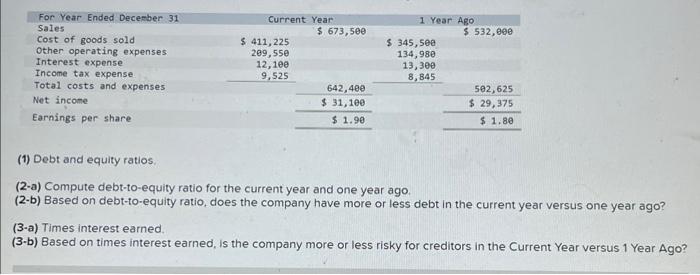

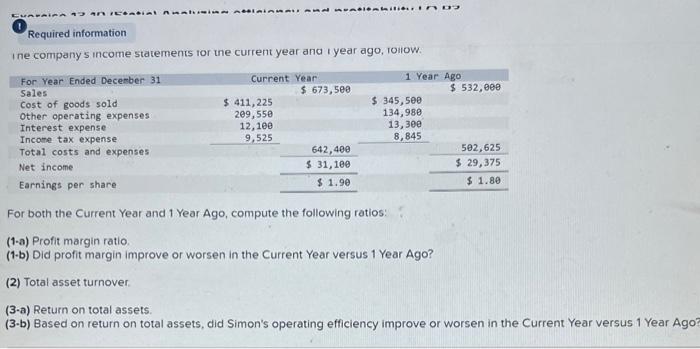

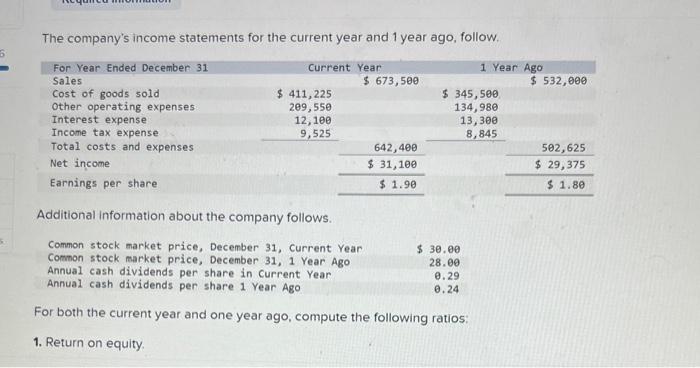

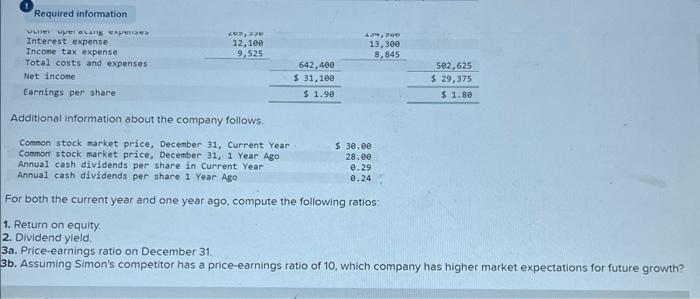

Use the following information for the Exercises below. (Static) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: Exercise 13-6 (Static) Common-size percents LO P2 1. Express the balance sheets in common-size percents 2. Assuming annual sales have not changed in the last three years, is the change in accounts recelvable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Exercise 137 (Static) Analyzing liquidity LO P3 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three-year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Exercise 13-8 (Static) Analyzing and interpreting liquidity LO P3 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: (1-a) Compute days' sales uncollected. (1-b) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts recelvable turnover. (2-b) Determine if accounts recelvable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-b) Determine if inventory turnover ratio improved or worsened in the current year. (1-a) Compute days' sales uncollected. (1-b) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts recelvable turnover. (2-b) Determine if accounts receivable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-b) Determine if inventory turnover ratio improved or worsened in the current year. (4-a) Compute days' sales in inventory. 4-b) For each ratio, determine if days' sales in inventory improved or worsened in the current year. (1) Debt and equity ratios. (2-a) Compute debt-to-equity ratio for the current year and one year ago. (2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? (3-a) Times interest earned. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? ine company s income statements tor the current year and i year ago, tollow. For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? (2) Total asset turnover. (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago: The company's income statements for the current year and 1 year ago, follow. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31 . b. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth? Use the following information for the Exercises below. (Static) [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: Exercise 13-6 (Static) Common-size percents LO P2 1. Express the balance sheets in common-size percents 2. Assuming annual sales have not changed in the last three years, is the change in accounts recelvable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Exercise 137 (Static) Analyzing liquidity LO P3 (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three-year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Exercise 13-8 (Static) Analyzing and interpreting liquidity LO P3 The company's income statements for the current year and one year ago follow. Assume that all sales are on credit: (1-a) Compute days' sales uncollected. (1-b) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts recelvable turnover. (2-b) Determine if accounts recelvable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-b) Determine if inventory turnover ratio improved or worsened in the current year. (1-a) Compute days' sales uncollected. (1-b) Determine if days' sales uncollected improved or worsened in the current year. (2-a) Compute accounts recelvable turnover. (2-b) Determine if accounts receivable turnover ratio improved or worsened in the current year. (3-a) Compute inventory turnover. (3-b) Determine if inventory turnover ratio improved or worsened in the current year. (4-a) Compute days' sales in inventory. 4-b) For each ratio, determine if days' sales in inventory improved or worsened in the current year. (1) Debt and equity ratios. (2-a) Compute debt-to-equity ratio for the current year and one year ago. (2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? (3-a) Times interest earned. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? ine company s income statements tor the current year and i year ago, tollow. For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? (2) Total asset turnover. (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Ago: The company's income statements for the current year and 1 year ago, follow. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yield. 3a. Price-earnings ratio on December 31 . b. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth