Question

Use the following information for the remaining questions: Assume it is currently October, and the S&P 500 is currently at a level of 1898.20, and

Use the following information for the remaining questions: Assume it is currently October, and the S&P 500 is currently at a level of 1898.20, and S&P 500 e-mini futures with December expiration are trading at a contract price of 1892.75 and have a contract size of 50.

Some values are provided with the previous question. Shares of IBM are currently trading at $168.55 (Beta=0.64). Over the previous month, IBM has fallen over 13%. An investor believes that this is a market overreaction, and that the price will correct by at least 7% before the end of the year. The investor plans to speculate by purchasing 10,000 shares. However, the investor is bearish with respect to the overall market, and wishes to hedge the systematic risk associated with the IBM investment.

a. Explain the steps the investor would take within the futures market to hedge the systematic risk of the position

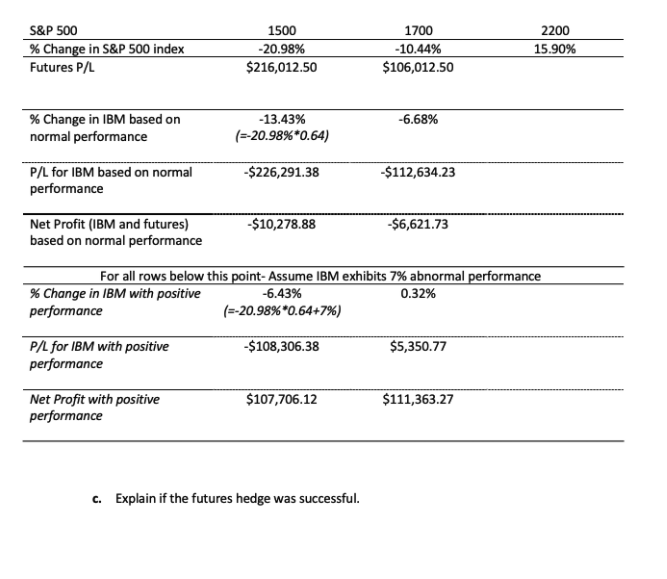

b. Complete the table below. Assume that if IBM exhibits abnormal performance that it will outperform relative to its beta by an extra 7%. If IBM exhibits normal performance its return will be based solely on its beta. For example, with positive performance and the S&P 500 at 1500, the return to IBM would be -13.43% without positive performance, or - 6.43% (=-13.43% + 7.00%) with positive performance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started