Question

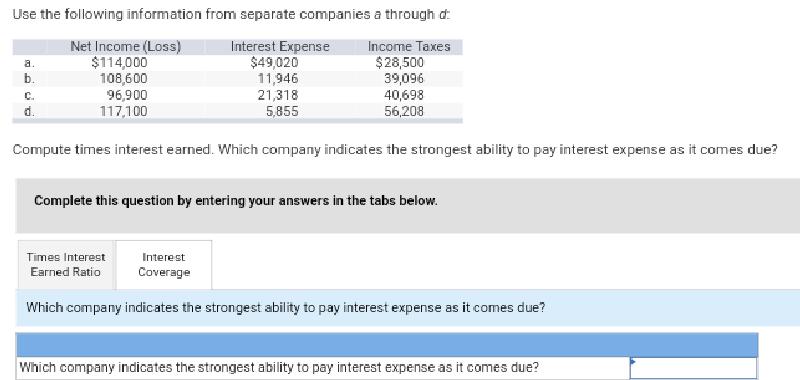

Use the following information from separate companies a through d: Net Income (Loss) $114,000 108,600 96,900 117,100 Income Taxes $28,500 39,096 40,698 56,208 Compute

Use the following information from separate companies a through d: Net Income (Loss) $114,000 108,600 96,900 117,100 Income Taxes $28,500 39,096 40,698 56,208 Compute times interest earned. Which company indicates the strongest ability to pay interest expense as it comes due? a. b. C. d. Interest Expense $49,020 11,946 21,318 5,855 Complete this question by entering your answers in the tabs below. Times Interest Earned Ratio Interest Coverage Which company indicates the strongest ability to pay interest expense as it comes due? Which company indicates the strongest ability to pay interest expense as it comes due?

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations Company a Net Income 114000 Inte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

20th Edition

1259157148, 78110874, 9780077616212, 978-1259157141, 77616219, 978-0078110870

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App