Answered step by step

Verified Expert Solution

Question

1 Approved Answer

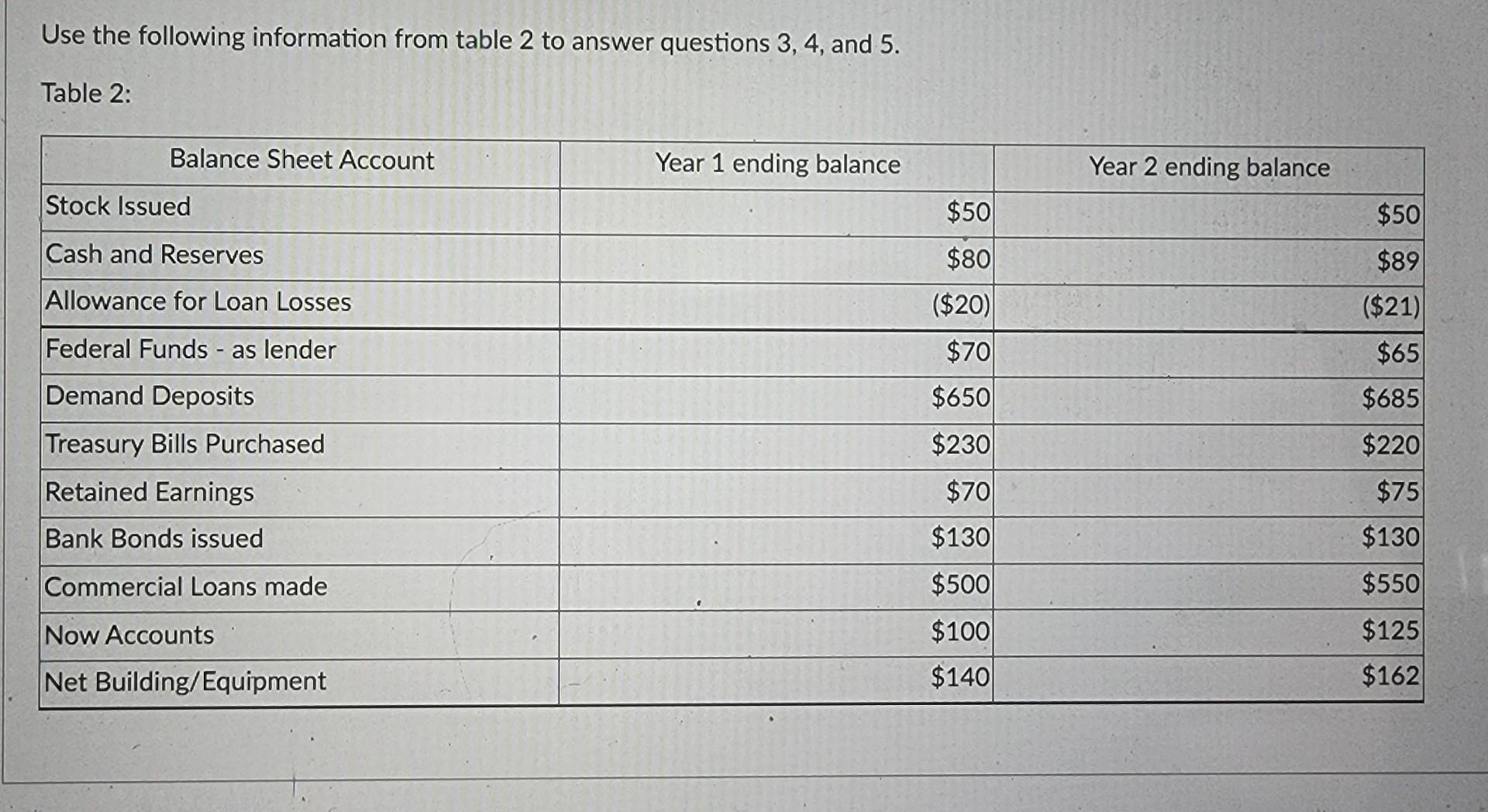

Use the following information from table 2 to answer questions 3, 4, and 5. Table 2: Balance Sheet Account Year 1 ending balance Year 2

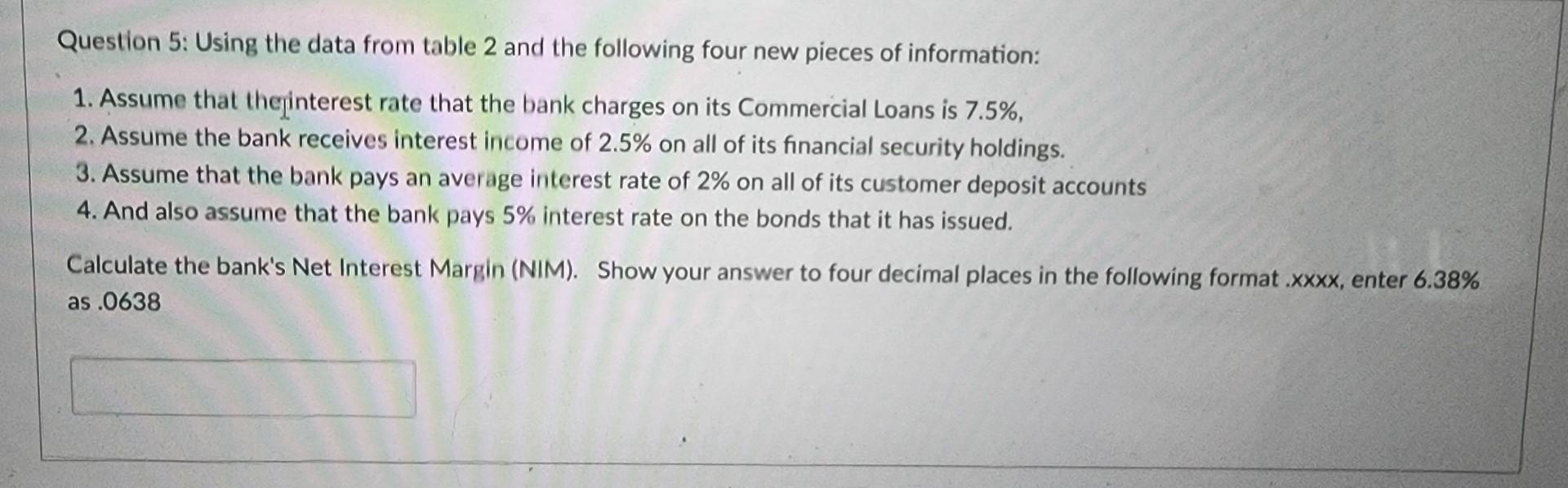

Use the following information from table 2 to answer questions 3, 4, and 5. Table 2: Balance Sheet Account Year 1 ending balance Year 2 ending balance Stock Issued $50 Cash and Reserves $80 Allowance for Loan Losses ($20) $70 $50 $89 ($21) $65 $685 Federal Funds - as lender $650 $230 $220 Demand Deposits Treasury Bills Purchased Retained Earnings Bank Bonds issued $75 $70 $130 $130 Commercial Loans made $500 $550 Now Accounts $125 $100 $140 Net Building/Equipment $162 Question 5: Using the data from table 2 and the following four new pieces of information: 1. Assume that the interest rate that the bank charges on its Commercial Loans is 7.5%, 2. Assume the bank receives interest income of 2.5% on all of its financial security holdings. 3. Assume that the bank pays an average interest rate of 2% on all of its customer deposit accounts 4. And also assume that the bank pays 5% interest rate on the bonds that it has issued. Calculate the bank's Net Interest Margin (NIM). Show your answer to four decimal places in the following format .xxxx, enter 6.38% as .0638

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started