Question

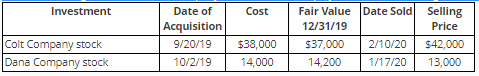

Use the following information on a company's investments in equity securities with no significant influence. The company's accounting year ends December 31.What amount is reported

Use the following information on a company's investments in equity securities with no significant influence. The company's accounting year ends December 31.What amount is reported for gain or loss on these securities in 2020 income?

Select one: A. No gain or loss B. $3,000 gain C. $3,800 gain D. $4,000 gain

A company purchases corporate bonds for $1,000,000 and categorizes them as AFS. At year-end, their market value is $750,000. $100,000 of the decline in value is attributed to a rise in market interest rates, and $150,000 of the decline is attributed to credit losses.

Which statement below is true concerning the entry to record the decline in value? Select one: A. The investment account, net of its allowance for losses, declines by $100,000. B. An impairment loss of $150,000 is reported in income. C. The investment account is directly reduced by $150,000. D. An impairment loss of $100,000 is reported in income.

Prival Company acquires 49.99% of the voting stock of Schaffer Company. From the viewpoint of readers of the financial statements, the most important factor Prival should consider when deciding whether to consolidate Schaffer in its financial statements is: Select one: A. Prival's percentage ownership of Schaffer's stock B. Whether consolidation will make it harder for Prival to borrow money C. Whether Prival follows IFRS or U.S. GAAP D. Whether Prival controls the performance of Schaffer

Which statement is true concerning IFRS goodwill impairment reporting?

Select one:

A. IFRS does not allow qualitative evaluation of goodwill impairment. B. IFRS does not require goodwill impairment recognition. C. IFRS allows goodwill impairment to be reported in other comprehensive income. D. IFRS allows goodwill impairment to adjust fair value reserves in equity.

An acquisition requires revaluation of a subsidiary's date-of-acquisition inventory from a book value of $5 million to fair value of $3 million. The subsidiary uses LIFO and inventory purchases exceed sales in every year following acquisition.

Which statement is true concerning the consolidation eliminating entries for this revaluation? Select one: A. Each year following acquisition, entry (R) reduces inventory and entry (O) increases cost of goods sold by $2 million. B. Each year following acquisition, entry (R) reduces inventory by $2 million, but entry (O) is not required. C. No entry (R) is required after the first year, but eliminating entry (O) reduces cost of goods sold by $2 million in the first year. D. No entries are required in any year.

Which statement is true concerning U.S. GAAP for the qualitative evaluation of goodwill? Select one: A. You don't have to quantitatively evaluate goodwill for impairment if it is more likely than not that the reporting unit's book value is less than its fair value. B. You don't have to quantitatively evaluate goodwill for impairment if it is more likely than not that the reporting unit's fair value is less than its book value. C. You don't have to quantitatively evaluate goodwill for impairment if the acquired subsidiary is expected to continue operating in the foreseeable future. D. The qualitative goodwill evaluation is based on general information on the economy, rather than specific information about the reporting unit's performance.

Investment Colt Company stock Dana Company stock Cost Fair Value Date Sold Selling Price Date of Acquisition 9/20/19 $38,000 10/2/19 14,000 12/31/19 $37,000 2/10/20 14,200 1/17/20 $42,000 13,000

Step by Step Solution

3.29 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started