Answered step by step

Verified Expert Solution

Question

1 Approved Answer

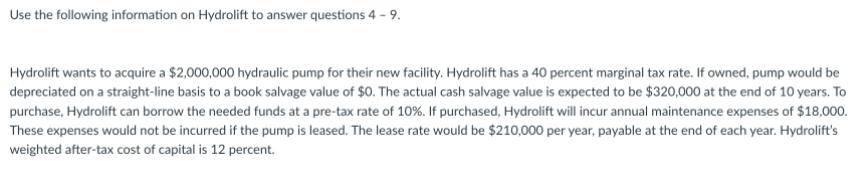

Use the following information on Hydrolift to answer questions 4 - 9. Hydrolift wants to acquire a $2,000,000 hydraulic pump for their new facility.

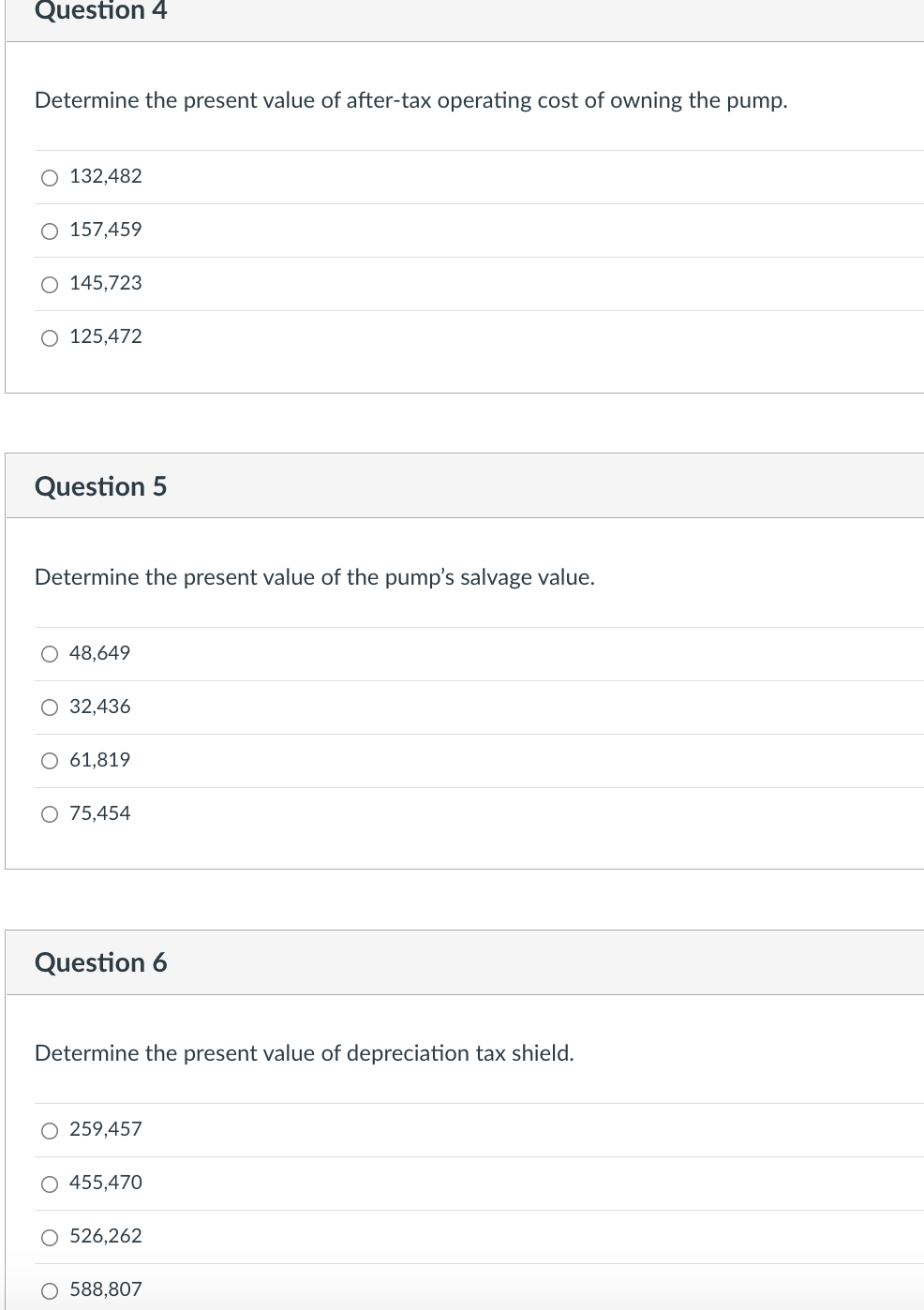

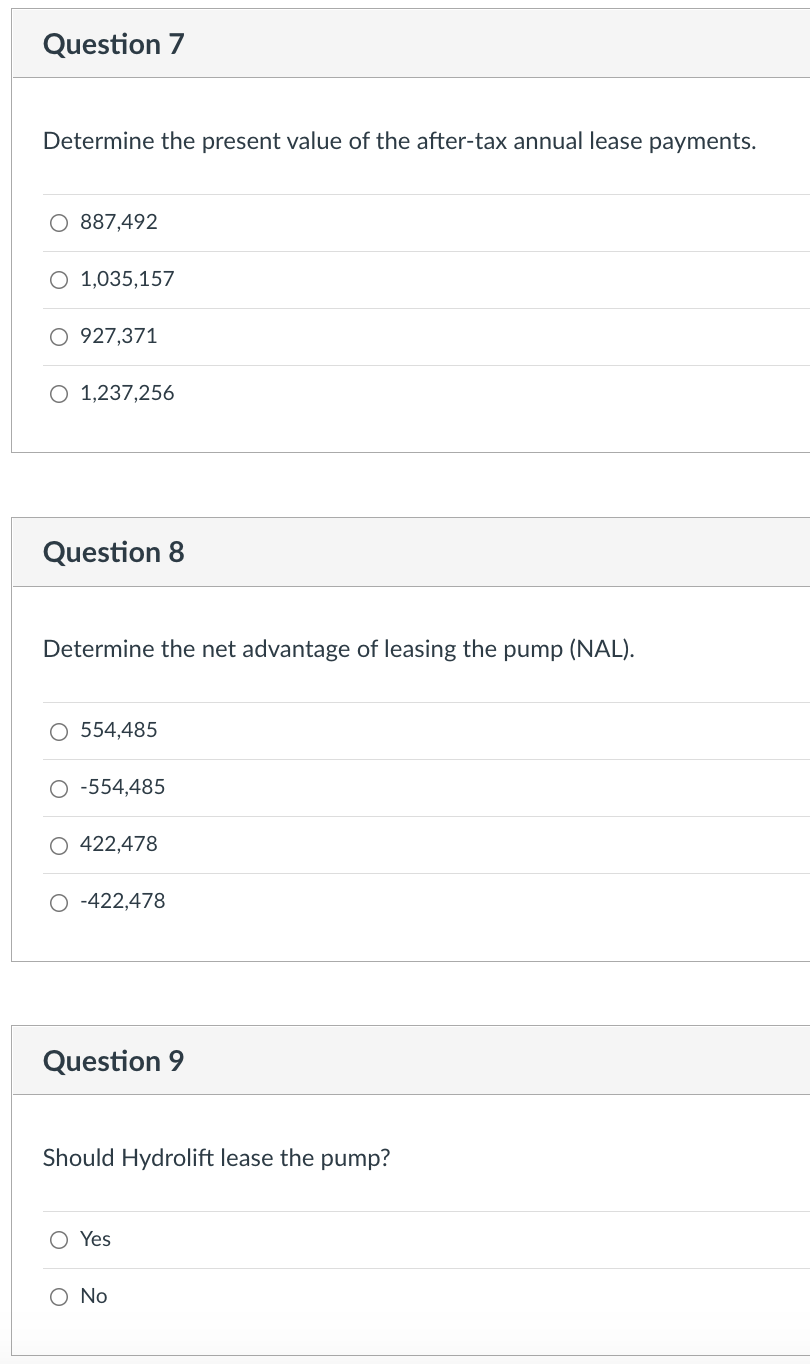

Use the following information on Hydrolift to answer questions 4 - 9. Hydrolift wants to acquire a $2,000,000 hydraulic pump for their new facility. Hydrolift has a 40 percent marginal tax rate. If owned, pump would be depreciated on a straight-line basis to a book salvage value of $0. The actual cash salvage value is expected to be $320,000 at the end of 10 years. To purchase, Hydrolift can borrow the needed funds at a pre-tax rate of 10%. If purchased, Hydrolift will incur annual maintenance expenses of $18,000. These expenses would not be incurred if the pump is leased. The lease rate would be $210,000 per year, payable at the end of each year. Hydrolift's weighted after-tax cost of capital is 12 percent. Question 4 Determine the present value of after-tax operating cost of owning the pump. O 132,482 O 157,459 145,723 O 125,472 Question 5 Determine the present value of the pump's salvage value. 48,649 O 32,436 O 61,819 O 75,454 Question 6 Determine the present value of depreciation tax shield. O 259,457 455,470 O 526,262 O 588,807 Question 7 Determine the present value of the after-tax annual lease payments. 887,492 O 1,035,157 927,371 O 1,237,256 Question 8 Determine the net advantage of leasing the pump (NAL). 554,485 -554,485 O 422,478 -422,478 Question 9 Should Hydrolift lease the pump? Yes O No

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started