Question

Use the following information to answer questions 1 through 10: You are trying to form portfolios based on the following information about Stocks A,B,C and

Use the following information to answer questions 1 through 10:

You are trying to form portfolios based on the following information about Stocks A,B,C and D

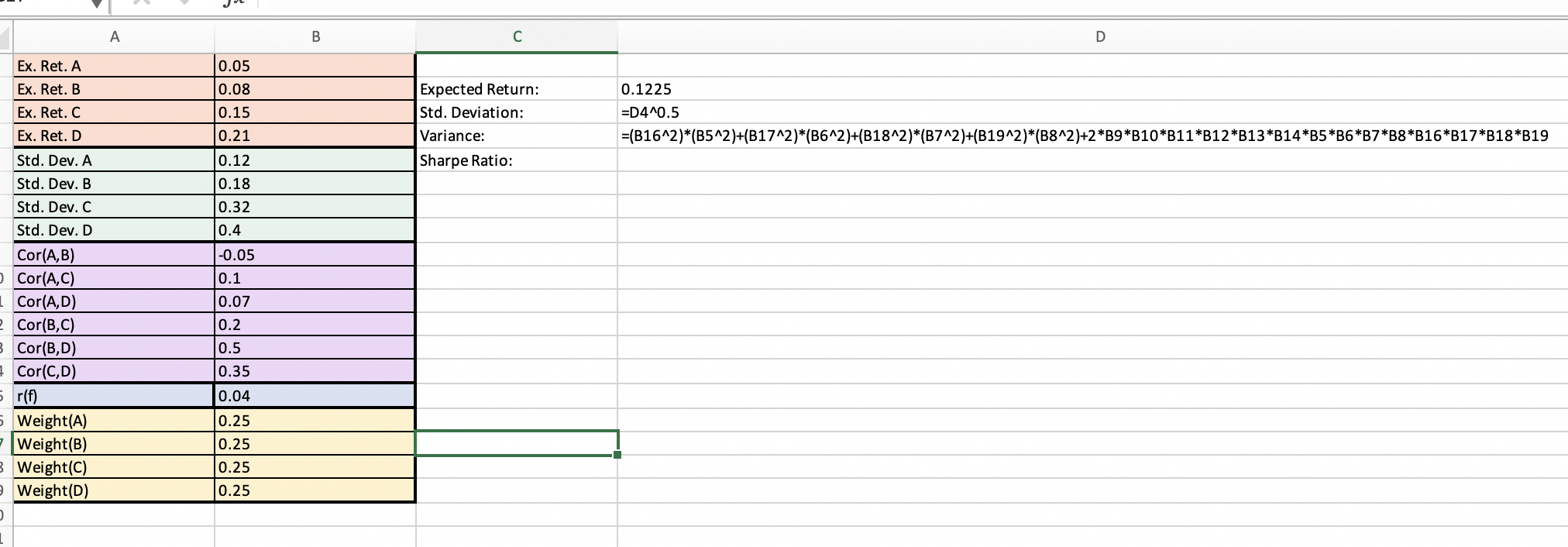

Expected Return of Stock A = 5%; Stock B = 8%; Stock C = 15%; Stock D = 21%

The Standard Deviation of Stock A = 12%; Stock B = 18%; Stock C = 32%; Stock D = 40%

The Correlation between A,B = - 0.05; A,C = 0.10, A,D = 0.07; B,C = 0.20; B,D = 0.50; C,D = 0.35

The Risk-Free Rate is 4.0%

Using Excel, do/answer the following:

Question 3, 4 and 5: Assume that you use a nave diversification approach and put 25% of your money equally into each stock. Compute the Expected Return, Standard Deviation and Sharpe Ratio of such a portfolio.

12.25

I NEED HELP WITH THE FORMULA FOR EXCEL TO FIND THE STANDARD DEVIATION. I am attaching my data with the formula I am using. I really just need to know what I'm doing wrong in my variance formula.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started