Answered step by step

Verified Expert Solution

Question

1 Approved Answer

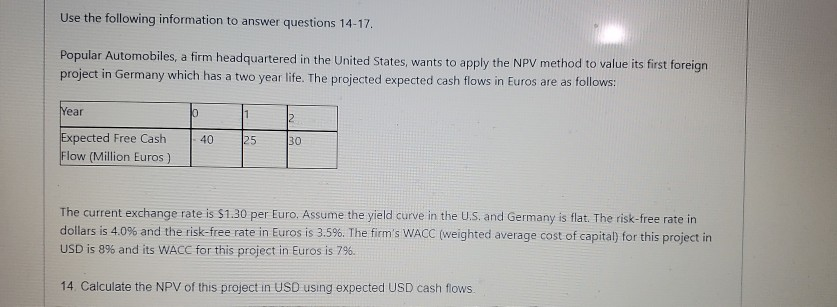

Use the following information to answer questions 14-17. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value

Use the following information to answer questions 14-17. Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value its first foreign project in Germany which has a two year life. The projected expected cash flows in Euros are as follows: Year 40 25 30 Expected Free Cash Flow (Million Euros) The current exchange rate is $1.30 per Euro, Assume the yield curve in the U.S. and Germany is flat. The risk-free rate in dollars is 4.0% and the risk-free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital) for this project in USD is 8% and its WACC for this project in Euros is 79. 14. Calculate the NPV of this project in USD using expected USD cash flows 15. Calculate the NPV of this project in USD using expected Euro cash flows. m USD using expected Euro cash flowe 16. What will be your recommendation based on the above analysis? 17. What will be your recommendation if the firm's WACC in USD was 7.7% instead and all the other information given above remained the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started