Answered step by step

Verified Expert Solution

Question

1 Approved Answer

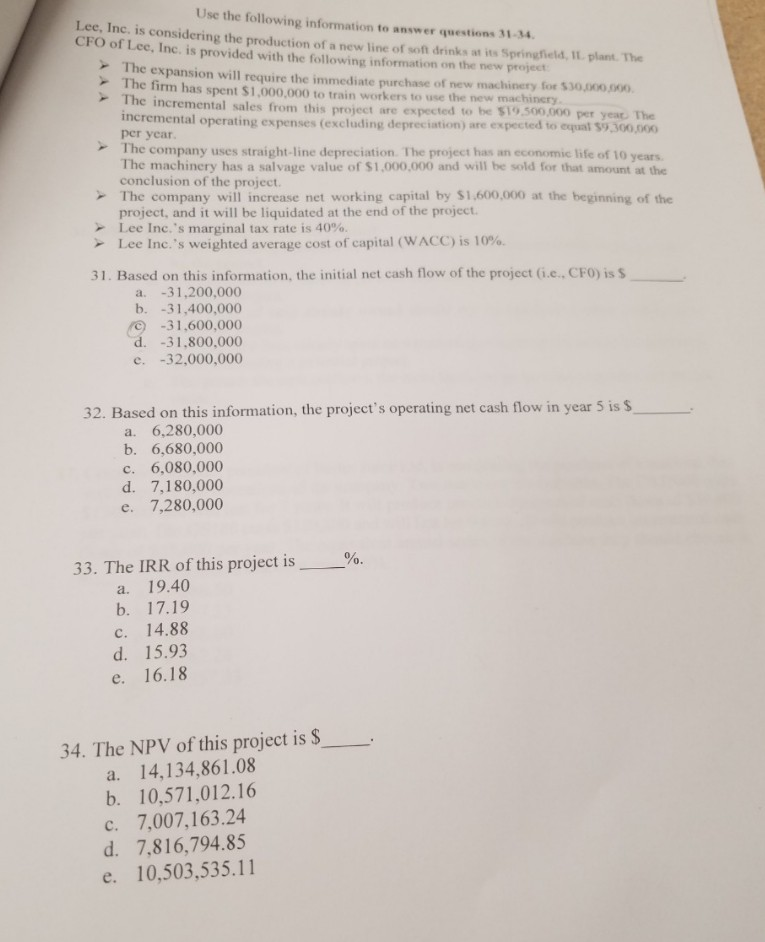

Use the following information to answer questions 3M L.ee, Inc. is considering the production of a new line of soft drinks as its Springfield, It.

Use the following information to answer questions 3M L.ee, Inc. is considering the production of a new line of soft drinks as its Springfield, It. plant The CFO of Lee, Inc. is provided with the following information on the new project The The firm has spent $1,000,000 to train workers to use the new machinery The incremental sales from this project are expected to be $19.50 expansion will require the immediate purchase of new machinery for $30,000,000 per year, The mental operating expenses (excluding depreciation) are expected to equal $9,300,000 per year The company uses straight-line depreciation. The project has an economic life of 10 years The machinery has a salvage value of $1,000,000 and will be sold for that amount at the conclusion of the project The company will increase net working capital by $1,600,000 at the beginning of the project, and it will be liquidated at the end of the project. Lee Inc.'s marginal tax rate is 40%. Lee Inc.'s weighted average cost of capital (WACC) is 10%. 31. Based on this information, the initial net cash flow of the project (i.e., CFO) is S a. -31,200,000 b. -31,400,000 -31,600,000 d. -31.800,000 e. -32,000,000 32. Based on this information, the project's operating net cash flow in year 5 is S a. 6,280,000 b. 6,680,000 c. 6,080,000 d. 7,180,000 e. 7,280,000 %. 33. The IRR of this project is a. 19.40 b. 17.19 c. 14.88 d. 15.93 e. 16.18 34. The NPV of this project is $ a. 14,134,861.08 b. 10,571,012.16 c. 7,007,163.24 d. 7,816,794.85 e. 10,503,535.11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started