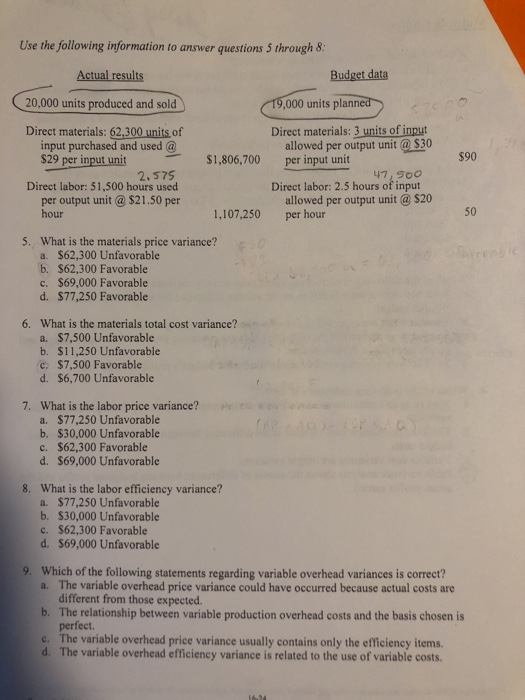

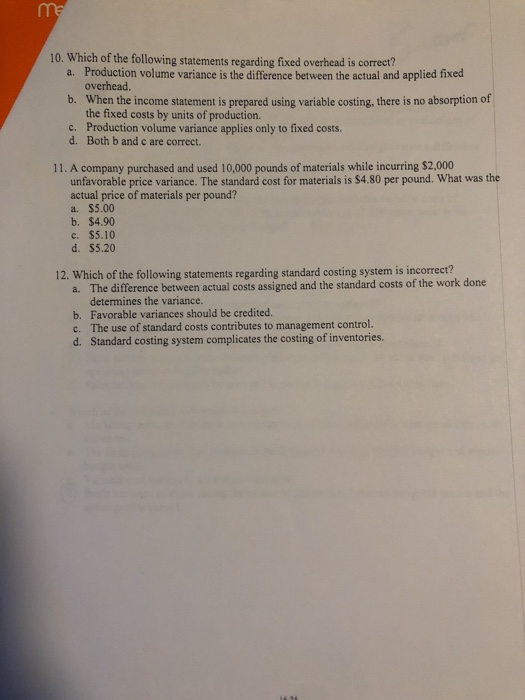

Use the following information to answer questions 5 through 8: Actual results Budget data 20,000 units produced and sold 19,000 units planned $1,806,700 $90 Direct materials: 62,300 units of input purchased and used @ $29 per input unit - 2.575 Direct labor: 51,500 hours used per output unit @ $21.50 per hour Direct materials: 3 units of input allowed per output unit @ $30 per input unit 47,500 Direct labor: 2.5 hours of input allowed per output unit @ $20 per hour 1,107,250 5. What is the materials price variance? a. $62,300 Unfavorable b. 562,300 Favorable c. $69,000 Favorable d. $77,250 Favorable 6. What is the materials total cost variance? a. $7,500 Unfavorable b. $11,250 Unfavorable c. $7,500 Favorable d. $6,700 Unfavorable Pr 7. What is the labor price variance? a. $77,250 Unfavorable b. $30,000 Unfavorable c. $62,300 Favorable d. $69,000 Unfavorable 8. What is the labor efficiency variance? a. $77,250 Unfavorable b. $30,000 Unfavorable c. $62,300 Favorable d. $69.000 Unfavorable 9. Which of the following statements regarding variable overhead variances is correct? a. The variable overhead price variance could have occurred because actual costs are different from those expected. b. The relationship between variable production overhead costs and the basis chosen is perfect c. The variable overhead price variance usually contains only the efficiency items. d. The variable overhead efficiency variance is related to the use of variable costs. me 10. Which of the following statements regarding fixed overhead is correct? a. Production volume variance is the difference between the actual and applied fixed overhead. b. When the income statement is prepared using variable costing, there is no absorption of the fixed costs by units of production. C. Production volume variance applies only to fixed costs. d. Both b and c are correct. 11. A company purchased and used 10,000 pounds of materials while incurring $2,000 unfavorable price variance. The standard cost for materials is $4.80 per pound. What was the actual price of materials per pound? a. $5.00 b. $4.90 c. $5.10 d. $5.20 12. Which of the following statements regarding standard costing system is incorrect? a. The difference between actual costs assigned and the standard costs of the work done determines the variance. b. Favorable variances should be credited. c. The use of standard costs contributes to management control. d. Standard costing system complicates the costing of inventories