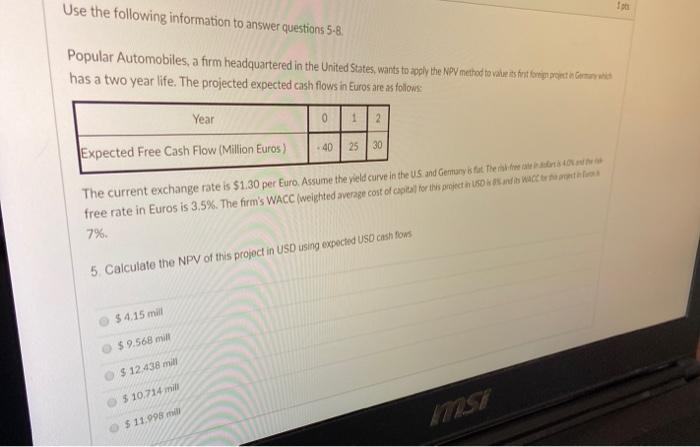

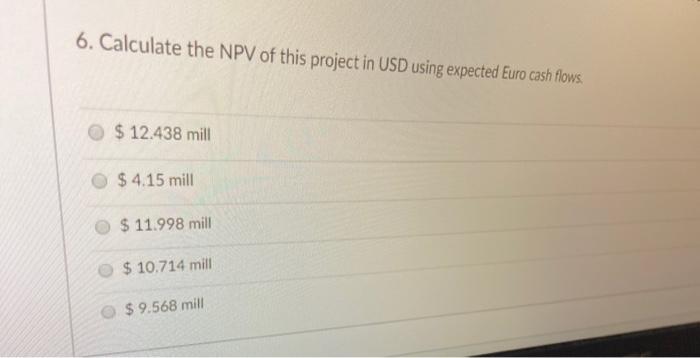

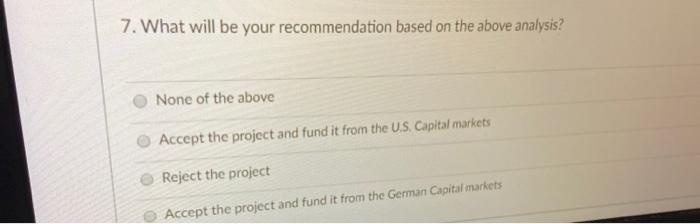

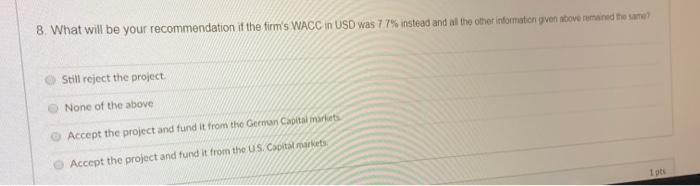

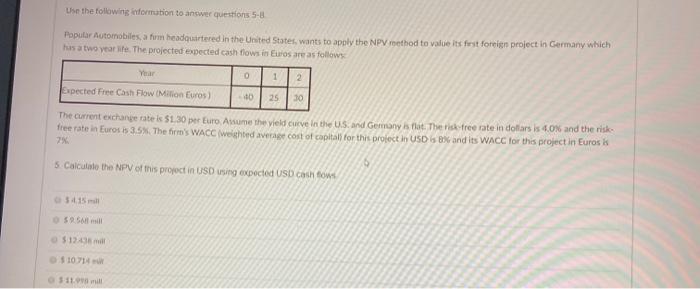

Use the following information to answer questions 5-8. 10 Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value as frit foenign project on Governani has a two year life. The projected expected cash flows in Euros are as follows: Year 0 1 Expected Free Cash Flow (Million Euros) - 40 25 30 The current exchange rate is $1.30 per Euro. Assume the yield curve in the US and Germany's fat The rol for cute in storia free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital for this project us and we were 7% 5. Calculate the NPV of this project in USD using expected USO Cash fows $4.15 mill $9.568 m $ 12.438 mill 5 10.714 mill $11.998 m 6. Calculate the NPV of this project in USD using expected Euro cash flows. $ 12.438 mill $ 4.15 mill $ 11.998 mill $ 10.714 mill $ 9.568 mill 7. What will be your recommendation based on the above analysis? None of the above Accept the project and fund it from the U.S. Capital markets Reject the project Accept the project and fund it from the German Capital markets 8. What will be your recommendation if the firm's WACC in USD was 77% instead and all the other information von above remained the same Still reject the project None of the above Accept the project and fund it from the German Capital markets Accept the project and fund it from the US. Capital markets I pts Use the following dormation to answer questions 5- Popular Automobiles, a firm headquartered in the United States, wants to apply the NPy method to value is fust foreign project in Germany which hus a two year it. The projected expected cash flows in Euros are as follows Year 0 1 2 Expected Free Cash Flow (Milion Euros) The current exchange rate is $130 per Euro Assume the yield curve in the US and Gemany flat. The rise free rate in dollars is 6.0% and the risk free rate in Eurosis 3.5%. The firm's WACC weighted average cost of capital for this project in USD is B and its WACC for this project in Euros 5 Calculate the NPV of this project in USD using expected USD cash cows 51:43 510714 Still Use the following information to answer questions 5-8. 10 Popular Automobiles, a firm headquartered in the United States, wants to apply the NPV method to value as frit foenign project on Governani has a two year life. The projected expected cash flows in Euros are as follows: Year 0 1 Expected Free Cash Flow (Million Euros) - 40 25 30 The current exchange rate is $1.30 per Euro. Assume the yield curve in the US and Germany's fat The rol for cute in storia free rate in Euros is 3.5%. The firm's WACC (weighted average cost of capital for this project us and we were 7% 5. Calculate the NPV of this project in USD using expected USO Cash fows $4.15 mill $9.568 m $ 12.438 mill 5 10.714 mill $11.998 m 6. Calculate the NPV of this project in USD using expected Euro cash flows. $ 12.438 mill $ 4.15 mill $ 11.998 mill $ 10.714 mill $ 9.568 mill 7. What will be your recommendation based on the above analysis? None of the above Accept the project and fund it from the U.S. Capital markets Reject the project Accept the project and fund it from the German Capital markets 8. What will be your recommendation if the firm's WACC in USD was 77% instead and all the other information von above remained the same Still reject the project None of the above Accept the project and fund it from the German Capital markets Accept the project and fund it from the US. Capital markets I pts Use the following dormation to answer questions 5- Popular Automobiles, a firm headquartered in the United States, wants to apply the NPy method to value is fust foreign project in Germany which hus a two year it. The projected expected cash flows in Euros are as follows Year 0 1 2 Expected Free Cash Flow (Milion Euros) The current exchange rate is $130 per Euro Assume the yield curve in the US and Gemany flat. The rise free rate in dollars is 6.0% and the risk free rate in Eurosis 3.5%. The firm's WACC weighted average cost of capital for this project in USD is B and its WACC for this project in Euros 5 Calculate the NPV of this project in USD using expected USD cash cows 51:43 510714 Still