Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information to answer Questions 7-13. You purchase 1,200 shares of AMZN at $141.60 per share on margin. You borrow $84,960 from your

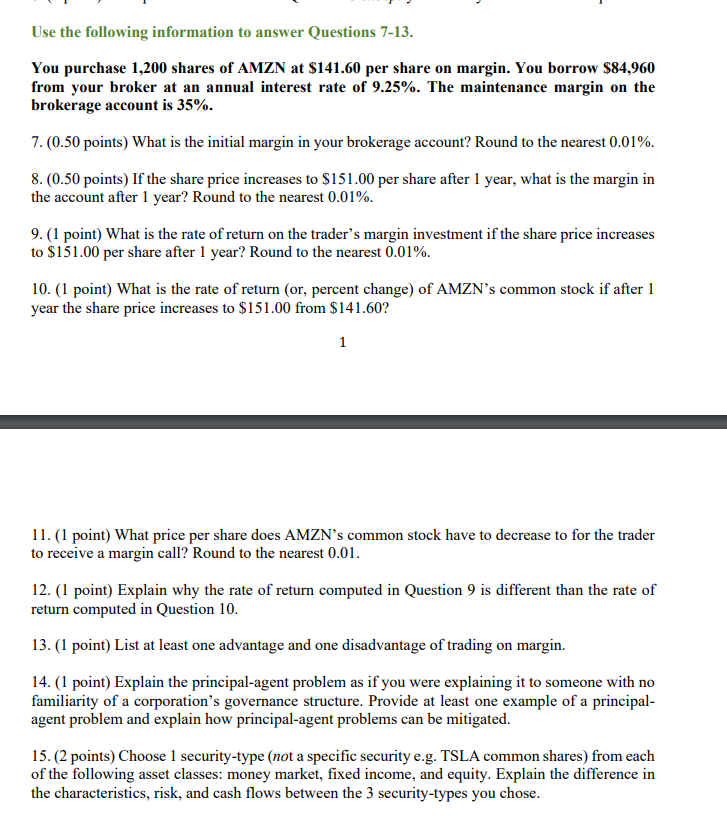

Use the following information to answer Questions 7-13. You purchase 1,200 shares of AMZN at $141.60 per share on margin. You borrow $84,960 from your broker at an annual interest rate of 9.25%. The maintenance margin on the brokerage account is 35%. 7. ( 0.50 points) What is the initial margin in your brokerage account? Round to the nearest 0.01%. 8. ( 0.50 points) If the share price increases to $151.00 per share after 1 year, what is the margin in the account after 1 year? Round to the nearest 0.01%. 9. (1 point) What is the rate of return on the trader's margin investment if the share price increases to $151.00 per share after 1 year? Round to the nearest 0.01%. 10. (1 point) What is the rate of return (or, percent change) of AMZN's common stock if after 1 year the share price increases to $151.00 from $141.60 ? 1 11. (1 point) What price per share does AMZN's common stock have to decrease to for the trader to receive a margin call? Round to the nearest 0.01 . 12. (1 point) Explain why the rate of return computed in Question 9 is different than the rate of return computed in Question 10. 13. (1 point) List at least one advantage and one disadvantage of trading on margin. 14. (1 point) Explain the principal-agent problem as if you were explaining it to someone with no familiarity of a corporation's governance structure. Provide at least one example of a principalagent problem and explain how principal-agent problems can be mitigated. 15. ( 2 points) Choose 1 security-type (not a specific security e.g. TSLA common shares) from each of the following asset classes: money market, fixed income, and equity. Explain the difference in the characteristics, risk, and cash flows between the 3 security-types you chose

Use the following information to answer Questions 7-13. You purchase 1,200 shares of AMZN at $141.60 per share on margin. You borrow $84,960 from your broker at an annual interest rate of 9.25%. The maintenance margin on the brokerage account is 35%. 7. ( 0.50 points) What is the initial margin in your brokerage account? Round to the nearest 0.01%. 8. ( 0.50 points) If the share price increases to $151.00 per share after 1 year, what is the margin in the account after 1 year? Round to the nearest 0.01%. 9. (1 point) What is the rate of return on the trader's margin investment if the share price increases to $151.00 per share after 1 year? Round to the nearest 0.01%. 10. (1 point) What is the rate of return (or, percent change) of AMZN's common stock if after 1 year the share price increases to $151.00 from $141.60 ? 1 11. (1 point) What price per share does AMZN's common stock have to decrease to for the trader to receive a margin call? Round to the nearest 0.01 . 12. (1 point) Explain why the rate of return computed in Question 9 is different than the rate of return computed in Question 10. 13. (1 point) List at least one advantage and one disadvantage of trading on margin. 14. (1 point) Explain the principal-agent problem as if you were explaining it to someone with no familiarity of a corporation's governance structure. Provide at least one example of a principalagent problem and explain how principal-agent problems can be mitigated. 15. ( 2 points) Choose 1 security-type (not a specific security e.g. TSLA common shares) from each of the following asset classes: money market, fixed income, and equity. Explain the difference in the characteristics, risk, and cash flows between the 3 security-types you chose Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started