Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information to answer the next several questions. The Company is looking to fund a new project with capital from both bondholders and

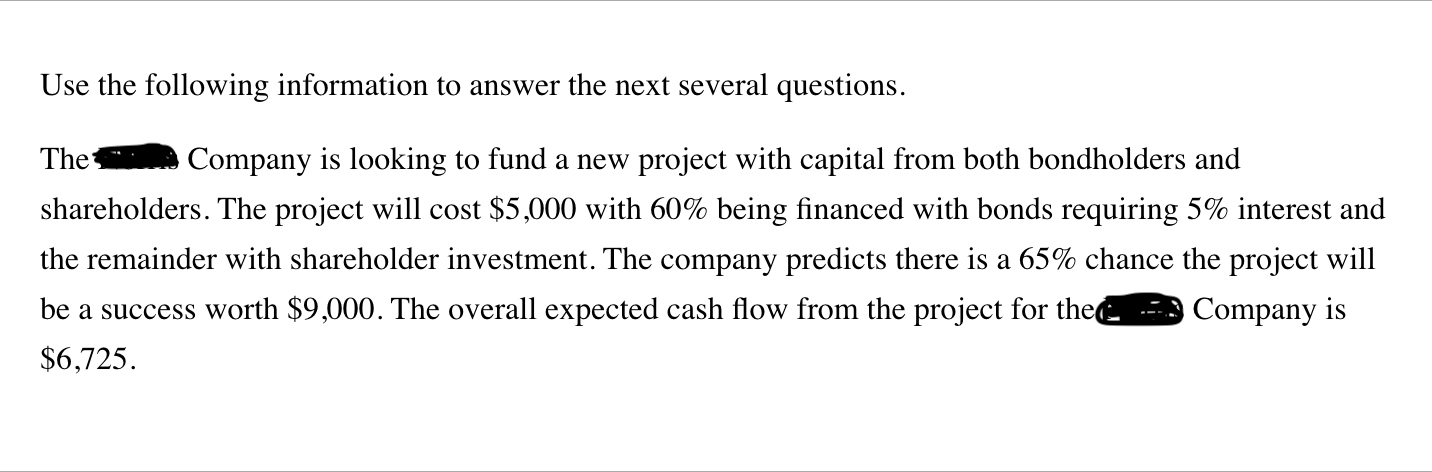

Use the following information to answer the next several questions.

The Company is looking to fund a new project with capital from both bondholders and shareholders. The project will cost $ with being financed with bonds requiring interest and the remainder with shareholder investment. The company predicts there is a chance the project will be a success worth $ The overall expected

What is the value of the project if it does not turn out to be a success?

What is the cash flow to shareholders if the project is a success?

What is the overall expected cash flow for bondholders?

What is the overall expected cash flow to shareholders?

What is the expected rate of return for bondholders? Answer in Percent form and round to decimal places.

What is the expected rate of return for shareholders? Answer in Percent form and round to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started