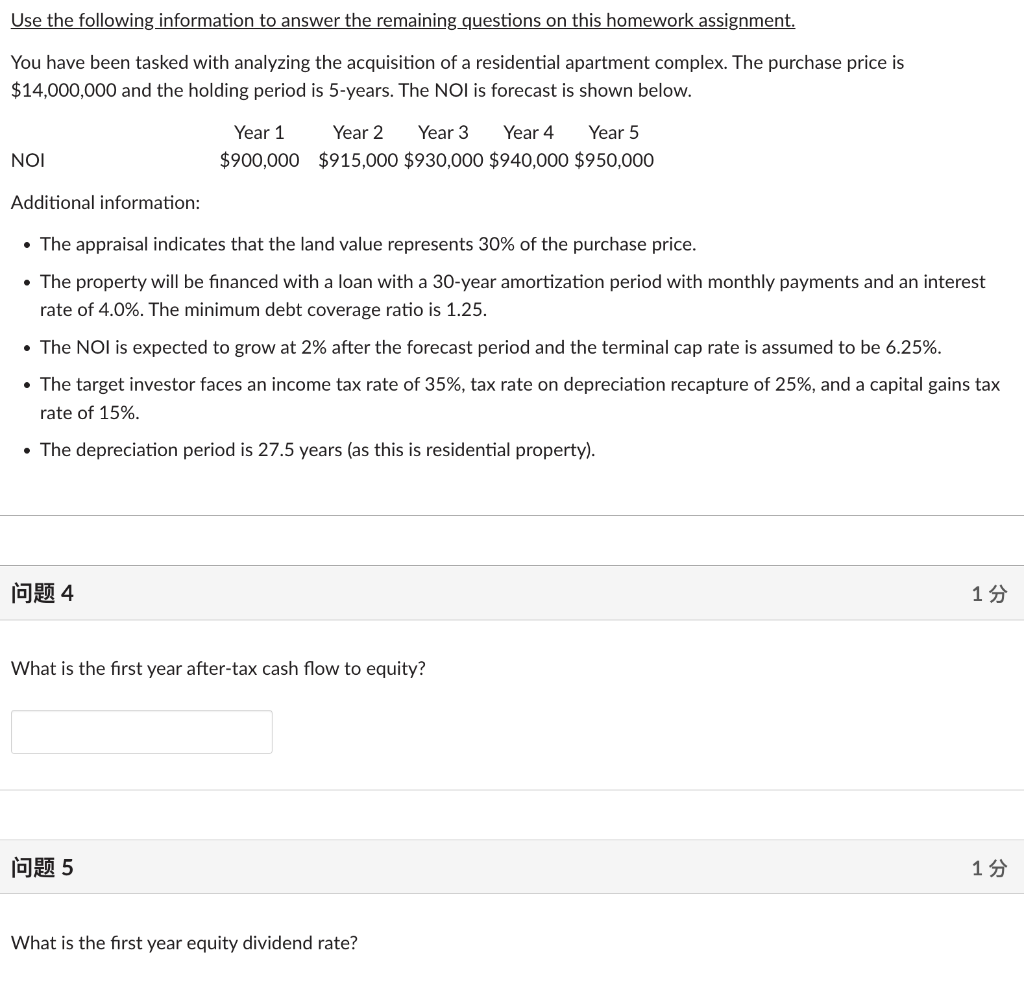

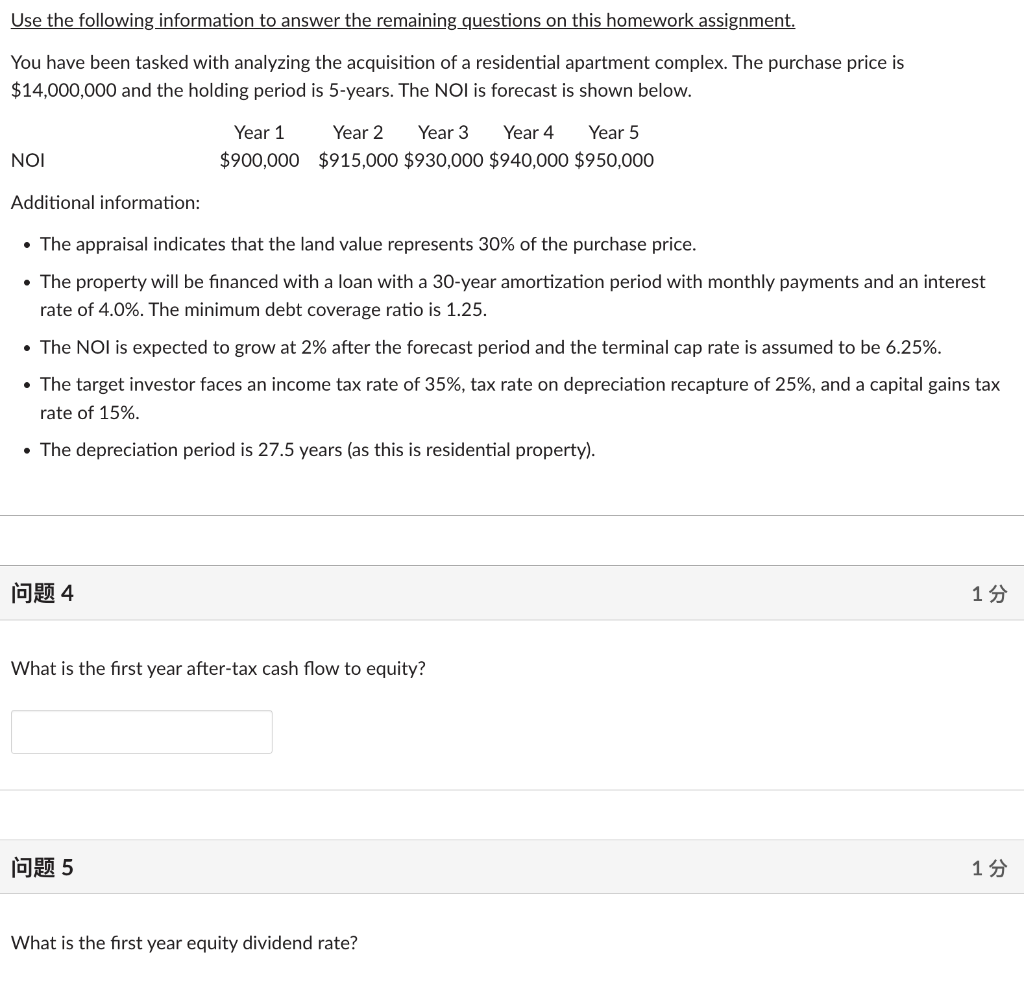

Use the following information to answer the remaining questions on this homework assignment. You have been tasked with analyzing the acquisition of a residential apartment complex. The purchase price is $14,000,000 and the holding period is 5-years. The NOI is forecast is shown below. NOI 4 Year 1 $900,000 Additional information: The appraisal indicates that the land value represents 30% of the purchase price. The property will be financed with a loan with a 30-year amortization period with monthly payments and an interest rate of 4.0%. The minimum debt coverage ratio is 1.25. The NOI is expected to grow at 2% after the forecast period and the terminal cap rate is assumed to be 6.25%. The target investor faces an income tax rate of 35%, tax rate on depreciation recapture of 25%, and a capital gains tax rate of 15%. The depreciation period is 27.5 years (as this is residential property). Year 2 Year 3 Year 4 Year 5 $915,000 $930,000 $940,000 $950,000 5 What is the first year after-tax cash flow to equity? What is the first year equity dividend rate? 15 15 Use the following information to answer the remaining questions on this homework assignment. You have been tasked with analyzing the acquisition of a residential apartment complex. The purchase price is $14,000,000 and the holding period is 5-years. The NOI is forecast is shown below. NOI 4 Year 1 $900,000 Additional information: The appraisal indicates that the land value represents 30% of the purchase price. The property will be financed with a loan with a 30-year amortization period with monthly payments and an interest rate of 4.0%. The minimum debt coverage ratio is 1.25. The NOI is expected to grow at 2% after the forecast period and the terminal cap rate is assumed to be 6.25%. The target investor faces an income tax rate of 35%, tax rate on depreciation recapture of 25%, and a capital gains tax rate of 15%. The depreciation period is 27.5 years (as this is residential property). Year 2 Year 3 Year 4 Year 5 $915,000 $930,000 $940,000 $950,000 5 What is the first year after-tax cash flow to equity? What is the first year equity dividend rate? 15 15