Answered step by step

Verified Expert Solution

Question

1 Approved Answer

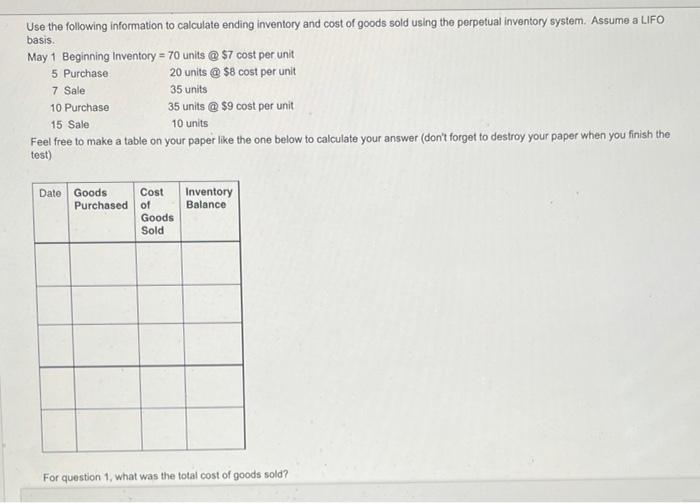

Use the following information to calculate ending inventory and cost of goods sold using the perpetual inventory system. Assume a LIFO basis. May 1

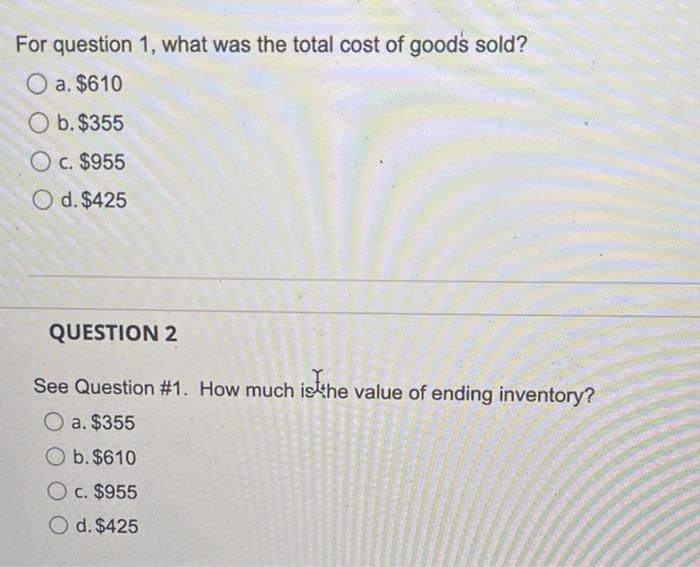

Use the following information to calculate ending inventory and cost of goods sold using the perpetual inventory system. Assume a LIFO basis. May 1 Beginning Inventory = 70 units @ $7 cost per unit 5 Purchase 20 units @ $8 cost per unit 35 units 7 Sale 10 Purchase 35 units @ $9 cost per unit 15 Sale 10 units Feel free to make a table on your paper like the one below to calculate your answer (don't forget to destroy your paper when you finish the test) Date Goods Cost Purchased of Goods Sold Inventory Balance For question 1, what was the total cost of goods sold? For question 1, what was the total cost of goods sold? a. $610 Ob. $355 O c. $955 O d. $425 QUESTION 2 See Question #1. How much is the value of ending inventory? is the a. $355 O b. $610 O c. $955 O d. $425

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Perpetual Inventory method is the system where inventory quantity and information ie sale and purcha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started