Answered step by step

Verified Expert Solution

Question

1 Approved Answer

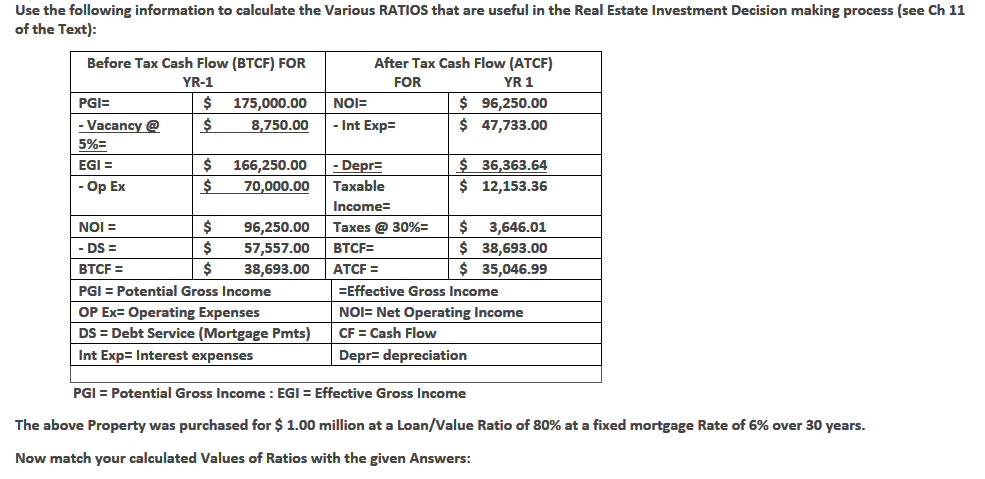

Use the following information to calculate the Various RATIOS that are useful in the Real Estate Investment Decision making process (see Ch 11 of the

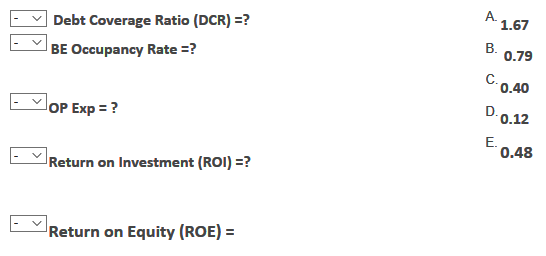

Use the following information to calculate the Various RATIOS that are useful in the Real Estate Investment Decision making process (see Ch 11 of the Text) Before Tax Cash Flow (BTCF) FOR After Tax Cash Flow (ATCF) YR-1 FOR YR 1 $ 96,250.00 $47,733.00 PGI $ 175,000.00 NOIE Vacancy @ 8,750.00Int Exp: 59? EGI = - Op Ex 166,250.00 'Depr= 70,000.00 Taxable $36,363.64 $ 12,153.36 Income- 96,250.00 | Taxes @ 30%: | $ 3,646.01 $ 38,693.00 $ 35,046.99 NOI -DS BTCF- PGI Potential Gross Income OP Ex Operating Expenses DS Debt Service (Mortgage Pmts) CF Int Exp Interest expenses $57,557.00 BTCF- $38,693.00 ATCF -Effective Gross Income NOIE Net Operating Income Cash Flow epr- depreciation PGI Potential Gross Income EGI- Effective Gross Income The above Property was purchased for $ 1.00 million at a Loan/Value Ratio of 80% at a fixed mortgage Rate of 6% over 30 years Now match your calculated Values of Ratios with the given Answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started