Answered step by step

Verified Expert Solution

Question

1 Approved Answer

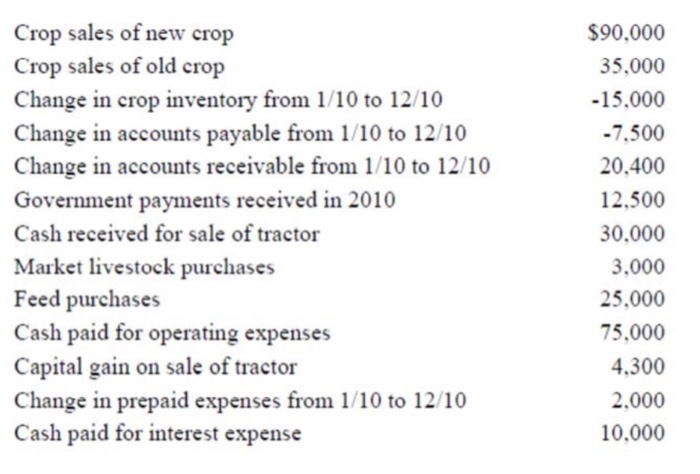

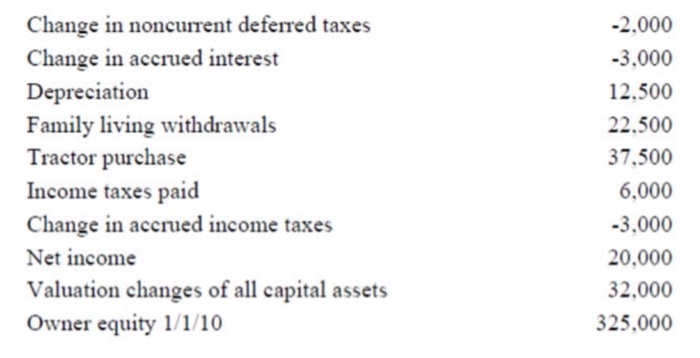

Use the following information to calculate value of farm production, total farm operating expenses, interest expense, net farm income from operations and owners equity. Use

Use the following information to calculate value of farm production, total farm operating expenses, interest expense, net farm income from operations and owners equity. Use the value of farm production format.

Crop sales of new crop Crop sales of old crop Change in crop inventory from 1/10 to 12/10 Change in accounts payable from 1/10 to 12/10 Change in accounts receivable from 1/10 to 12/10 Government payments received in 2010 Cash received for sale of tractor Market livestock purchases Feed purchases Cash paid for operating expenses Capital gain on sale of tractor Change in prepaid expenses from 1/10 to 12/10 Cash paid for interest expense 90,000 35,000 15.000 7.500 20.400 12.500 30.000 3,000 25.000 75,000 4,300 2,000 10,000 Change in noncurent deferred taxes Change in accrued interest Depreciation Family living withdrawals Tractor purchase Income taxes paid Change in accrued income taxes Net income Valuation changes of all capital assets Owner equity 1/1/10 -2.000 -3.000 12.500 22.500 37.500 6,000 3,000 20,000 32.000 325.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started