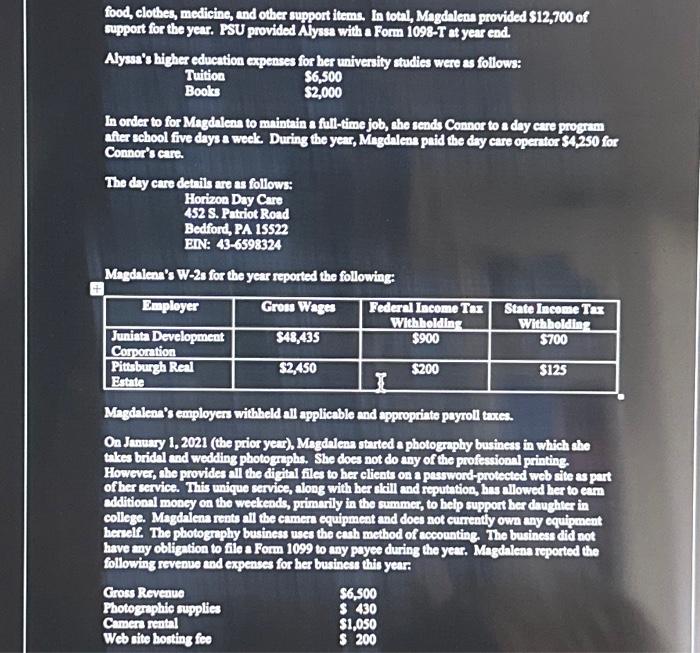

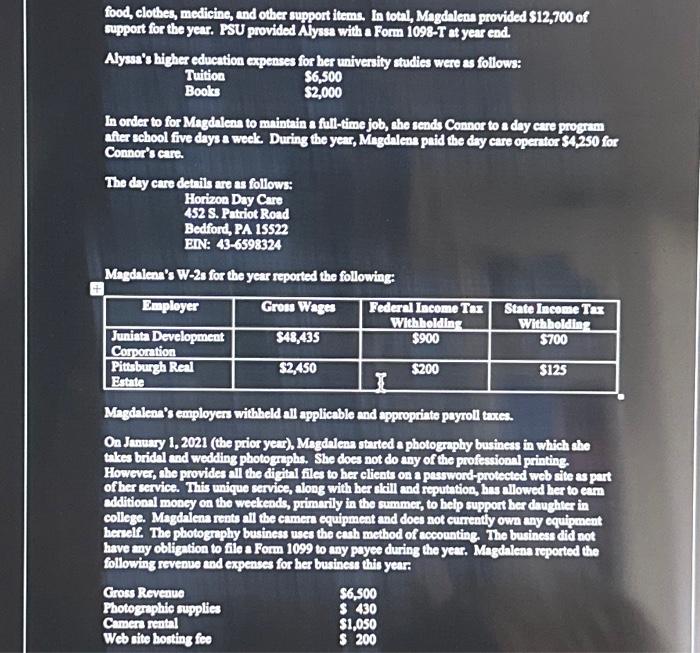

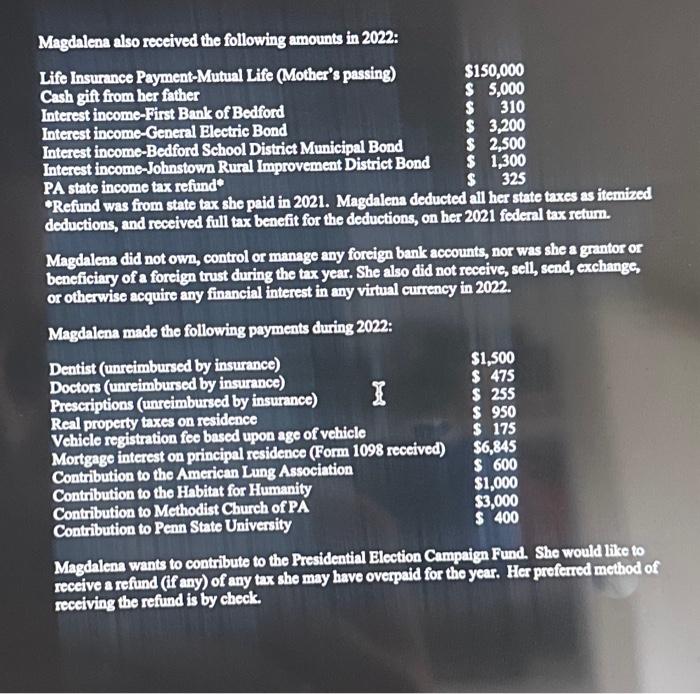

- Use the following information to complete Magdalens Schmitz's 2022 federal income tax retum. If any information is misging, use reasonable assumptions to fill in the gaps. - The forms, sehedules, and instructions cm be found at the IRS website. The instructions en be helpfill in completing the forms. Bectin: Magdalena Schmitz has undergone some major changes in her life recently. In 2021, at the age of 46, her husband, Roger, passed away. Magdalens has not remarnied as of the end of 2022. Magdnlens currently lives in Bedrord, Pennsylvania. She was living in Pitsburgh when her husband passed away but she moved back to her childhood home so she could get help from her family reising ber children. Magdalena was employed in Pittsburgh early in the year but left that job and relocated 100 miles away to pursue a new life end start her new job. Magdalena has three children (ages as of the end of the year): Alyssa (23), Tyler (16), and Connor (11). Magdalens would tike to determine her federal income tax under the filing status that is most edvantageous for her. Magdalena reported the following information: - Magdalena's social security number is 294-83-2845 - Alyss's social security number is 824-84-8456 - Tyler's social security number is 824-34-9584 - Connor's social security number is 824-56-2984 - Magdalena's matiling eddress is 623 S. Liberty Road Bedford, Pennsylvania 15522 Alysa is unmarried and a full-time greduate student at Pennsylvania State Univensity (PSU) (BiN 33-9876543). PSU's address is 1250 Happy Valley, State College, PA 16801. She received her bachelor's degree the yent her father passed away. This year represents her fifth year of full-time higher education schooling. Alyssa works part-time in State College to help with some of her living expenses. Alysa eamed 52,300 in gross income during the year and had her income tax returm prepared on campus by Volunteer Income Txx Assistance (VIT) voluntees. Magdalens provided support for Alysen including paying for rent, books, tuition, apport for the year. FSU provided Alysa with a Form 1098T at year ead. Alyss's hicher education expenses for her univenity ctudies were as follows: Tuition $6,500 Book $2,000 In order to for Magdalens to maintain a full-time job, che sends Connor to a doy care progen after school five days a week. During the yen, Migdnlens paid the doy care operator 54,250 for Connor's cate. The dy care detrils are as follow: Horizon Day Cre 452 S. Patriot Rond Bedrond, PA 15522 EiN: 436598324 Magdalear's W-2s for the year reported the following: Magdalens's employes witheld all applicable and appoprinto paysoll tuxes. thes brical end wedling photo erophs. She does not do any of the profescional printing. of her cervice. This unique servise, along with her ckill and reputation, hus cllowed her to ein colleze. Maghiens rents all the enmers equipment and does not currently ome eny cequipment have eny obligation to file a Form 1099 to any peyce during the yeur. Magthlene reported the following rovenue and expenses for ber business ohis year: Grose Roveaus Photeerphic auplies $6,500 s 430 $1,050 Magdalens wants to contribute to the Presidential Election Campaign Fund. She would tike to receive a refund (if any) of any tax she may have overpaid for the year. Her profered method of receiving the refind is by check