Answered step by step

Verified Expert Solution

Question

1 Approved Answer

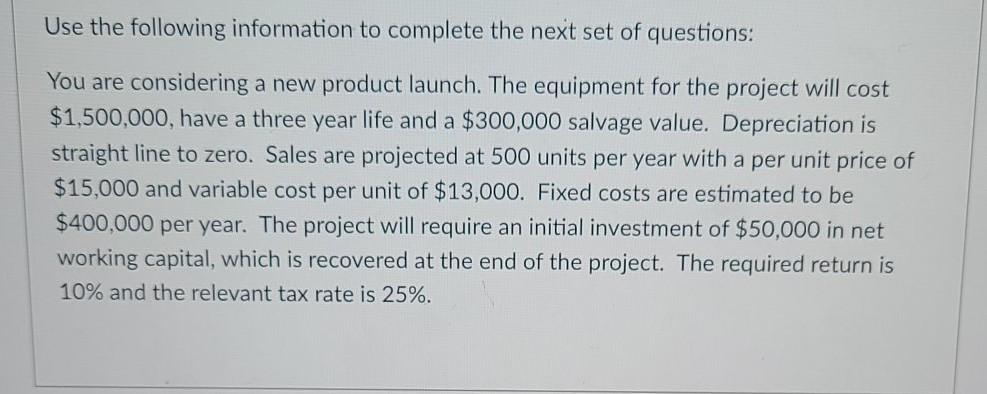

Use the following information to complete the next set of questions: You are considering a new product launch. The equipment for the project will cost

Use the following information to complete the next set of questions: You are considering a new product launch. The equipment for the project will cost $1,500,000, have a three year life and a $300,000 salvage value. Depreciation is straight line to zero. Sales are projected at 500 units per year with a per unit price of $15,000 and variable cost per unit of $13,000. Fixed costs are estimated to be $400,000 per year. The project will require an initial investment of $50,000 in net working capital, which is recovered at the end of the project. The required return is 10% and the relevant tax rate is 25%. Create a pro-forma income statement for the project. Upload work in the Exam #2 Work Dropbox. Compute the total project cash flow. 1 VTT 17.1 Compute the NPV of the project. Would you accept or reject the proposed project? Compute the IRR of the project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started