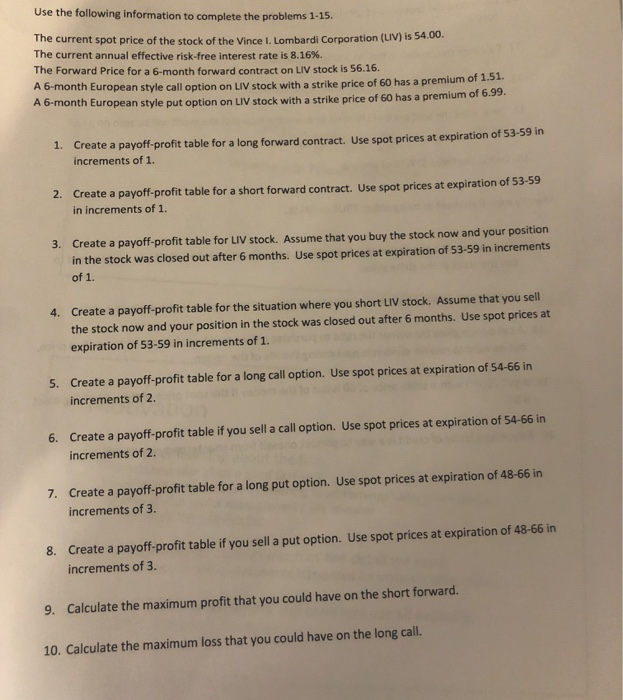

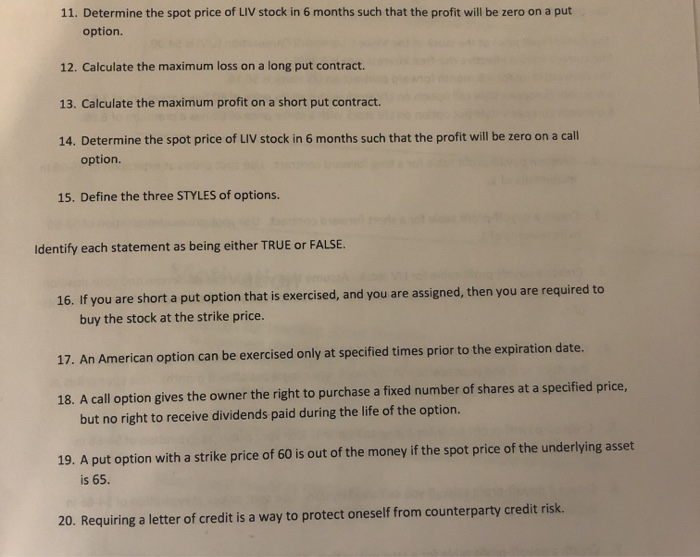

Use the following information to complete the problems 1.15. The current spot price of the stock of the Vince I Lombardi Corporation (LIV) is 54.00 The current annual effective risk-free interest rate is 8.16%. The Forward Price for a 6-month forward contract on LIV stock is 56.16. Ab-month European style call option on LIV stock with a strike price of 60 has a premium of 1.5 A 6-month European style put option on LIV stock with a strike price of 60 has a premium of 6.99. 1. Create a payoff-profit table for a long forward contract. Use spot prices at expiration of 53-59 in increments of 1. 2. Create a payoff-profit table for a short forward contract. Use spot prices at expiration of 53-59 in increments of 1. 3. Create a payoff-profit table for LIV stock. Assume that you buy the stock now and your position in the stock was closed out after 6 months. Use spot prices at expiration of 53-59 in increments of 1. 4. Create a payoff-profit table for the situation where you short LIV stock. Assume that you sell the stock now and your position in the stock was closed out after 6 months. Use spot prices at expiration of 53-59 in increments of 1. 5. Create a payoff-profit table for a long call option. Use spot prices at expiration of 54-66 in increments of 2. 6. Create a payoff-profit table if you sell a call option. Use spot prices at expiration of 54-66 in increments of 2 7. Create a payoff-profit table for a long put option. Use spot prices at expiration of 48-66 in increments of 3. 8. Create a payoff-profit table if you sell a put option. Use spot prices at expiration of 48-66 in increments of 3. 9. Calculate the maximum profit that you could have on the short forward. 10. Calculate the maximum loss that you could have on the long call. 11. Determine the spot price of LIV stock in 6 months such that the profit will be zero on a put option. 12. Calculate the maximum loss on a long put contract. 13. Calculate the maximum profit on a short put contract. 14. Determine the spot price of LIV stock in 6 months such that the profit will be zero on a call option. 15. Define the three STYLES of options. Identify each statement as being either TRUE or FALSE. 16. If you are short a put option that is exercised, and you are assigned, then you are required to buy the stock at the strike price. 17. An American option can be exercised only at specified times prior to the expiration date. 18. A call option gives the owner the right to purchase a fixed number of shares at a specified price, but no right to receive dividends paid during the life of the option. 19. A put option with a strike price of 60 is out of the money if the spot price of the underlying asset is 65. 20. Requiring a letter of credit is a way to protect oneself from counterparty credit risk