Answered step by step

Verified Expert Solution

Question

1 Approved Answer

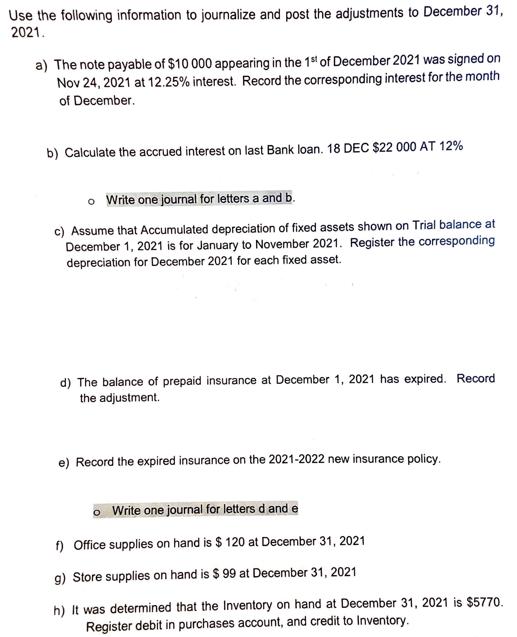

Use the following information to journalize and post the adjustments to December 31, 2021. a) The note payable of $10 000 appearing in the

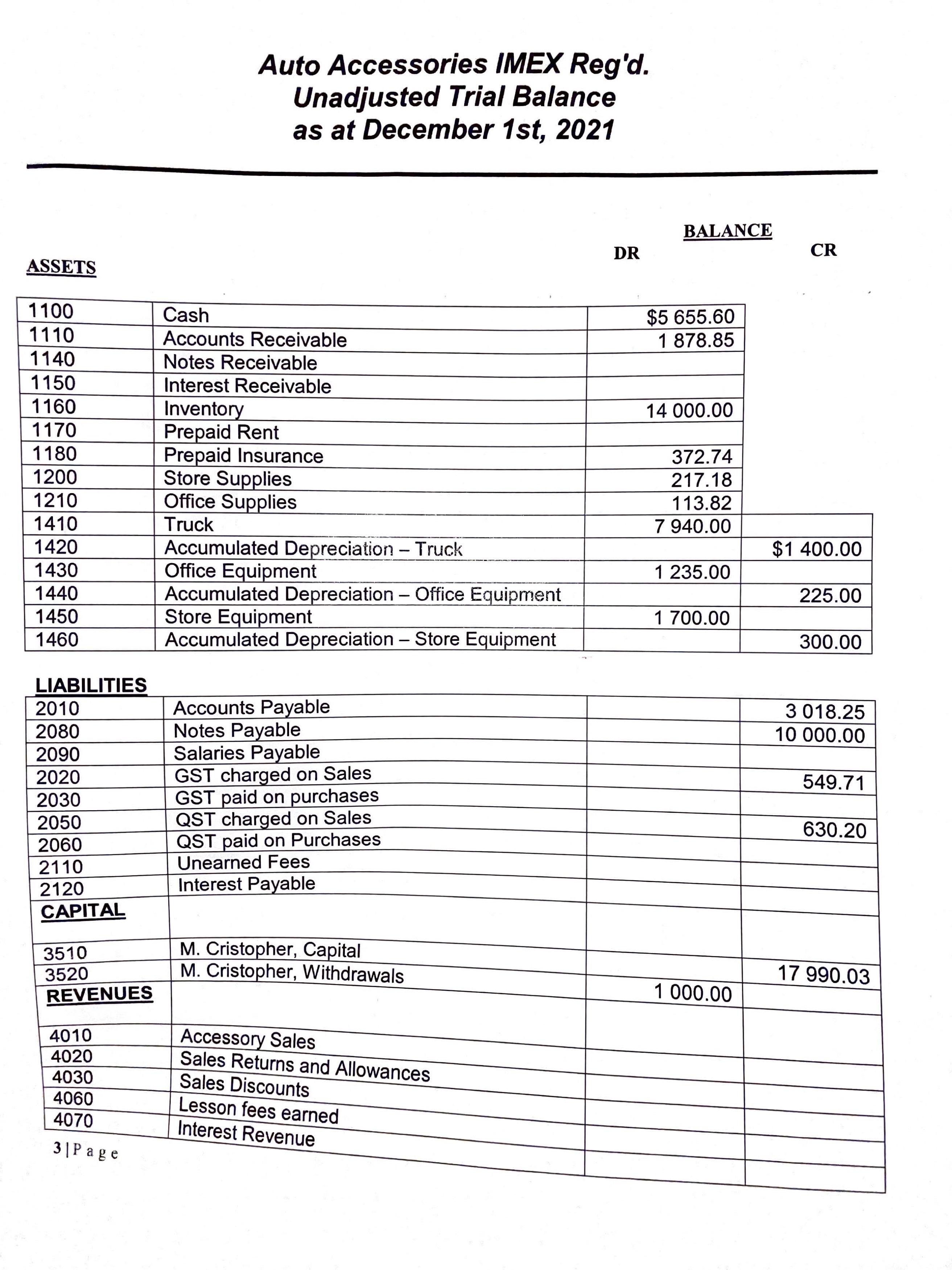

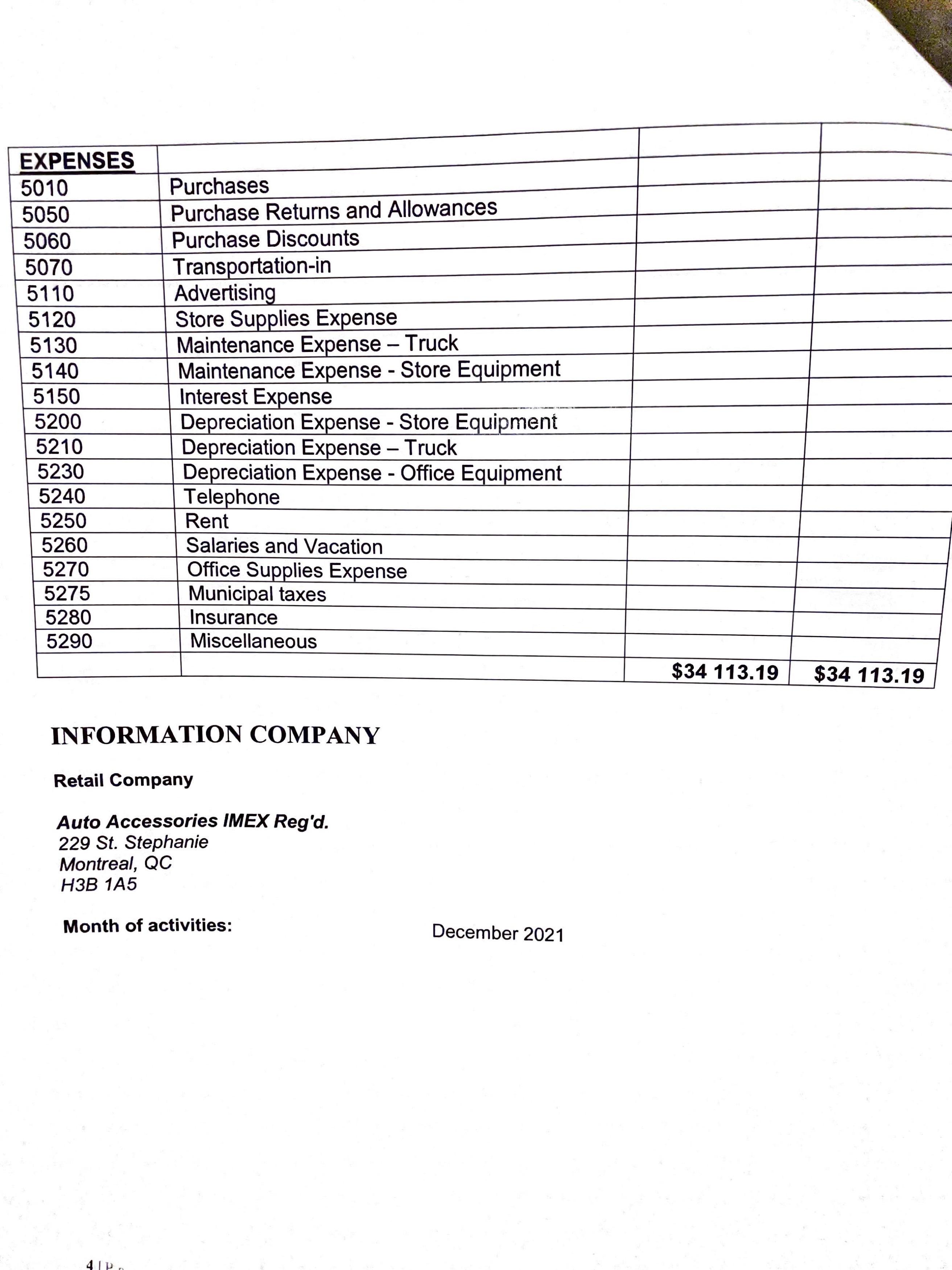

Use the following information to journalize and post the adjustments to December 31, 2021. a) The note payable of $10 000 appearing in the 1st of December 2021 was signed on Nov 24, 2021 at 12.25% interest. Record the corresponding interest for the month of December. b) Calculate the accrued interest on last Bank loan. 18 DEC $22 000 AT 12% o Write one journal for letters a and b. c) Assume that Accumulated depreciation of fixed assets shown on Trial balance at December 1, 2021 is for January to November 2021. Register the corresponding depreciation for December 2021 for each fixed asset. d) The balance of prepaid insurance at December 1, 2021 has expired. Record the adjustment. e) Record the expired insurance on the 2021-2022 new insurance policy. o Write one journal for letters d and e f) Office supplies on hand is $ 120 at December 31, 2021 g) Store supplies on hand is $ 99 at December 31, 2021 h) It was determined that the Inventory on hand at December 31, 2021 is $5770. Register debit in purchases account, and credit to Inventory. ASSETS 1100 1110 1140 1150 1160 1170 1180 1200 1210 1410 1420 1430 1440 1450 1460 LIABILITIES 2010 2080 2090 2020 2030 2050 2060 2110 2120 CAPITAL 3510 3520 REVENUES 4010 4020 4030 4060 4070 3|Page Auto Accessories IMEX Reg'd. Unadjusted Trial Balance as at December 1st, 2021 Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Rent Prepaid Insurance Store Supplies Office Supplies Truck Accumulated Depreciation - Truck Office Equipment Accumulated Depreciation - Office Equipment Store Equipment Accumulated Depreciation - Store Equipment Accounts Payable Notes Payable Salaries Payable GST charged on Sales GST paid on purchases QST charged on Sales QST paid on Purchases Unearned Fees Interest Payable M. Cristopher, Capital M. Cristopher, Withdrawals Accessory Sales Sales Returns and Allowances Sales Discounts Lesson fees earned Interest Revenue DR BALANCE $5 655.60 1 878.85 14 000.00 372.74 217.18 113.82 7 940.00 1 235.00 1 700.00 1 000.00 CR $1 400.00 225.00 300.00 3 018.25 10 000.00 549.71 630.20 17 990.03 EXPENSES 5010 5050 5060 5070 5110 5120 5130 5140 5150 5200 5210 5230 5240 5250 5260 5270 5275 5280 5290 Purchases Purchase Returns and Allowances Purchase Discounts Transportation-in Advertising Store Supplies Expense Maintenance Expense - Truck Maintenance Expense - Store Equipment Interest Expense Depreciation Expense - Store Equipment Depreciation Expense - Truck Depreciation Expense - Office Equipment Telephone 4P. Rent Salaries and Vacation Office Supplies Expense Municipal taxes Insurance Miscellaneous INFORMATION COMPANY Retail Company Auto Accessories IMEX Reg'd. 229 St. Stephanie Montreal, QC H3B 1A5 Month of activities: December 2021 $34 113.19 $34 113.19

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The question seems to be incomplete as its asking to Use the following information to journalize and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started