Answered step by step

Verified Expert Solution

Question

1 Approved Answer

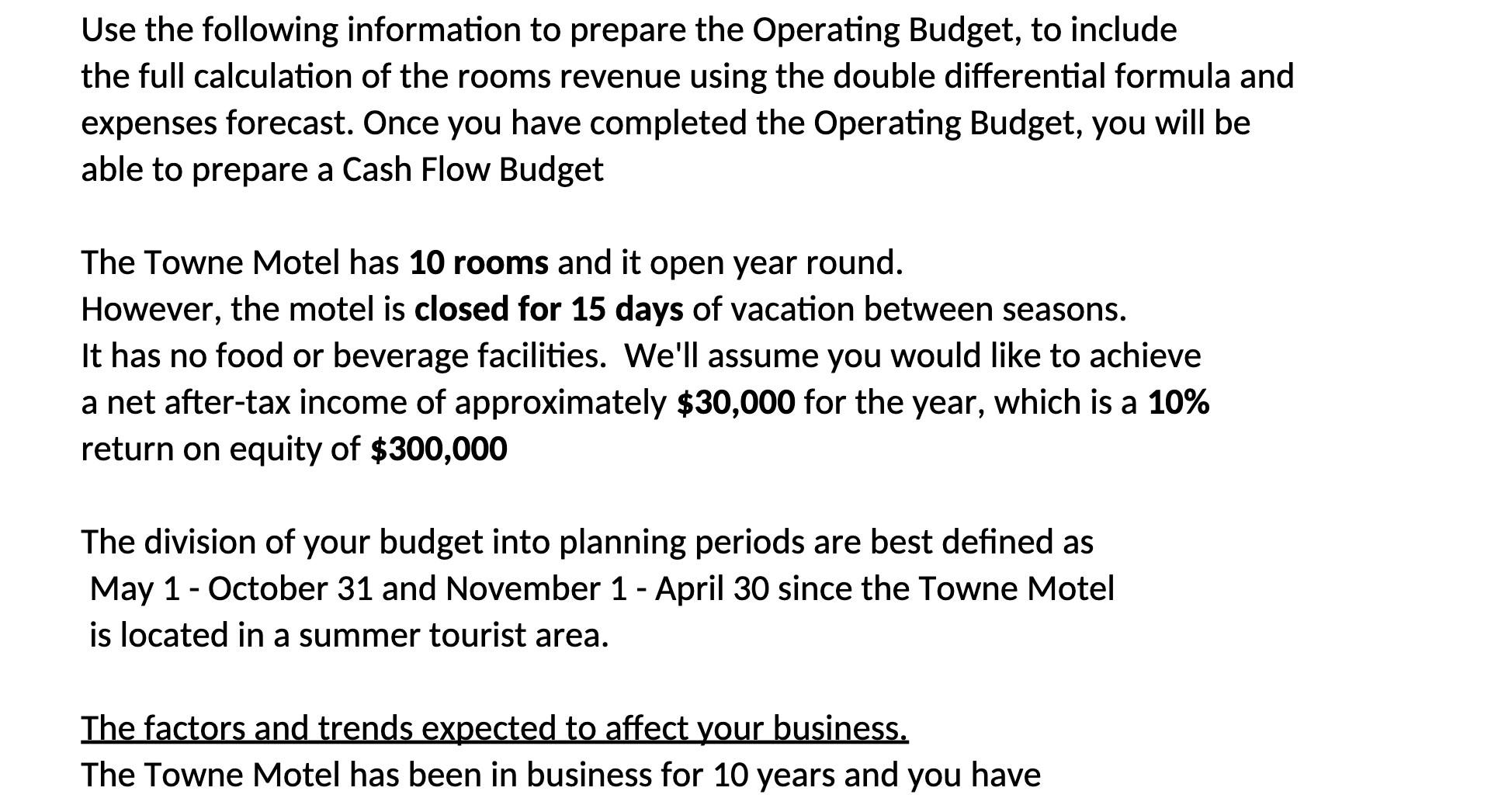

Use the following information to prepare the Operating Budget, to include the full calculation of the rooms revenue using the double differential formula and

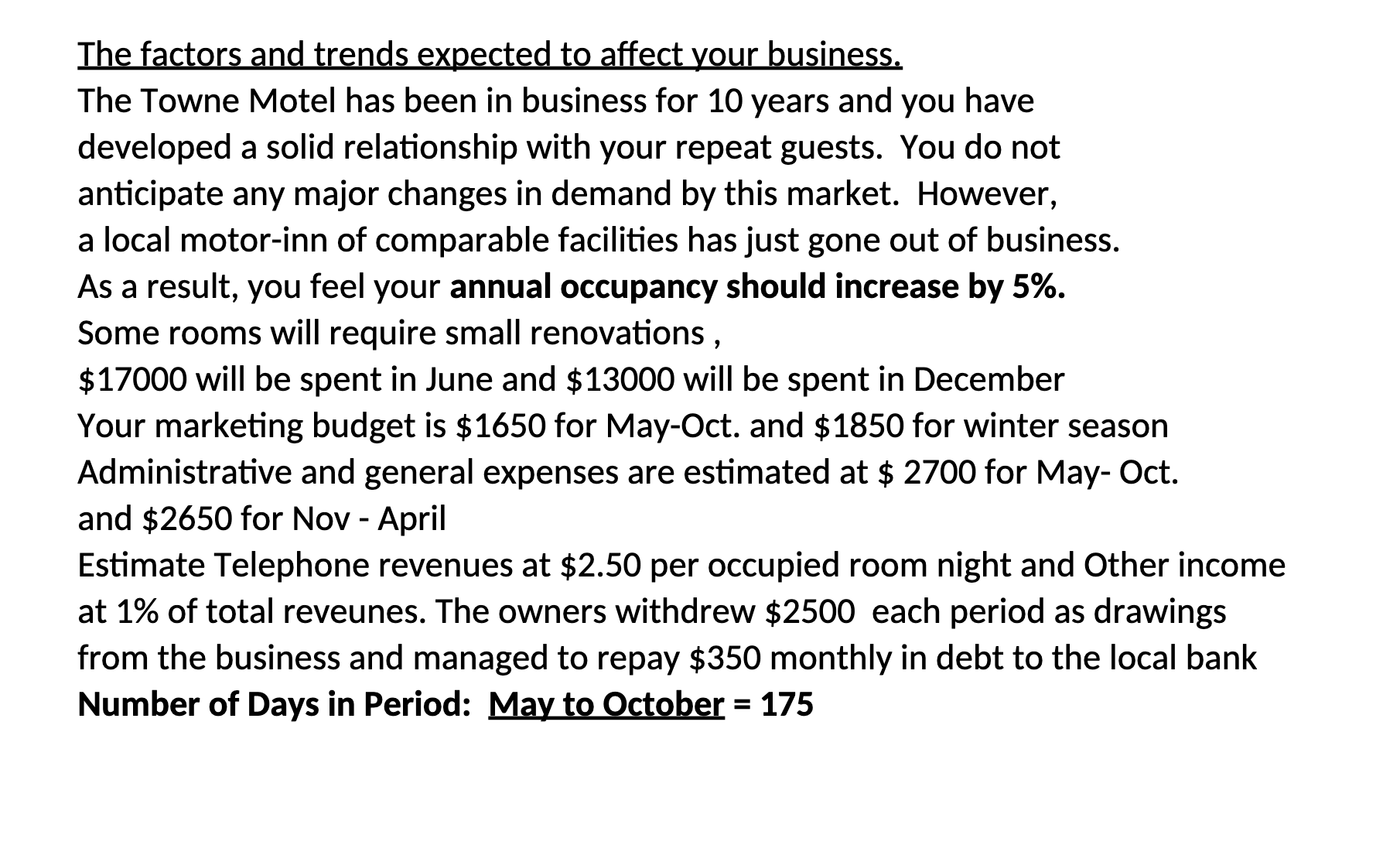

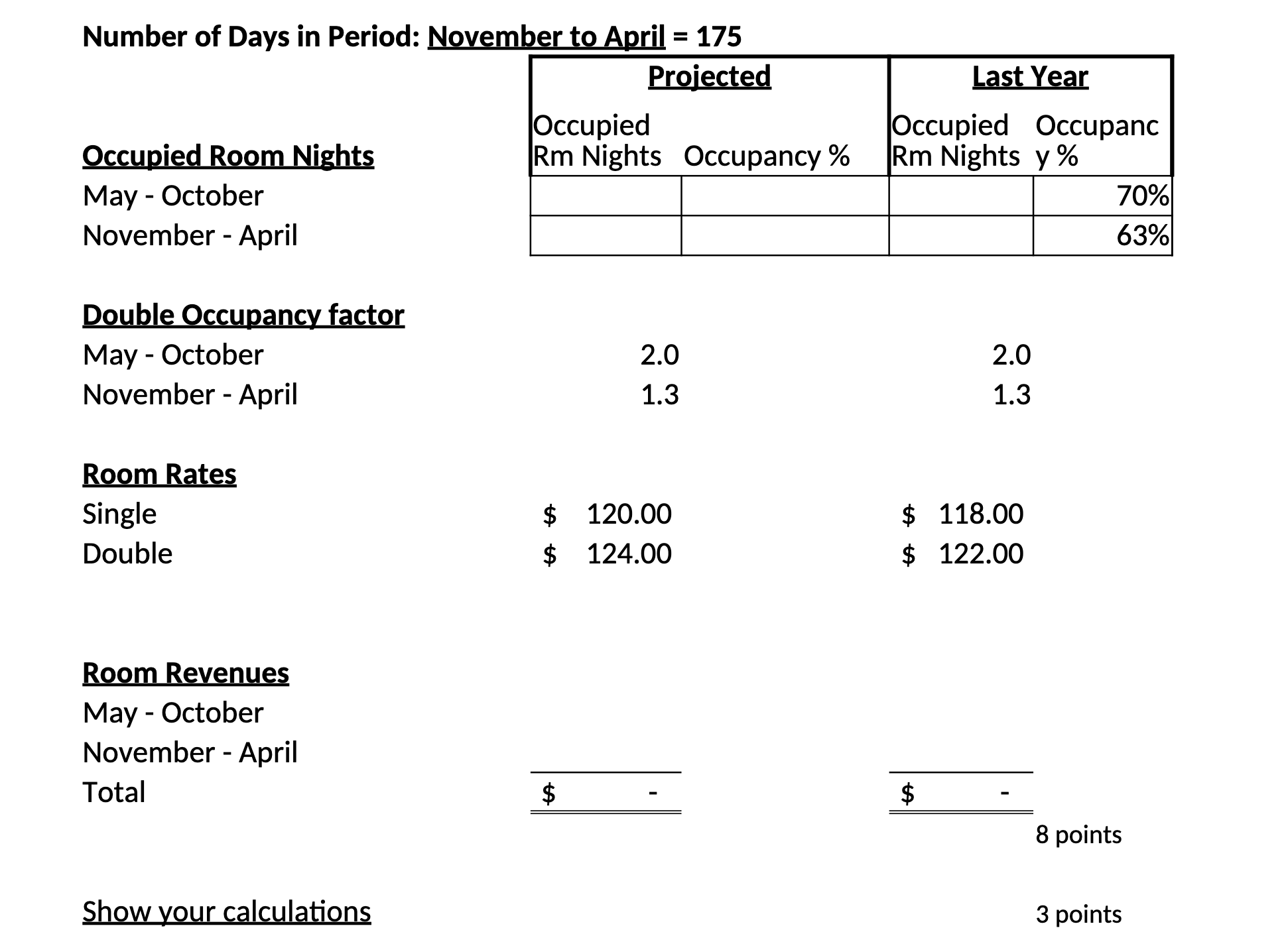

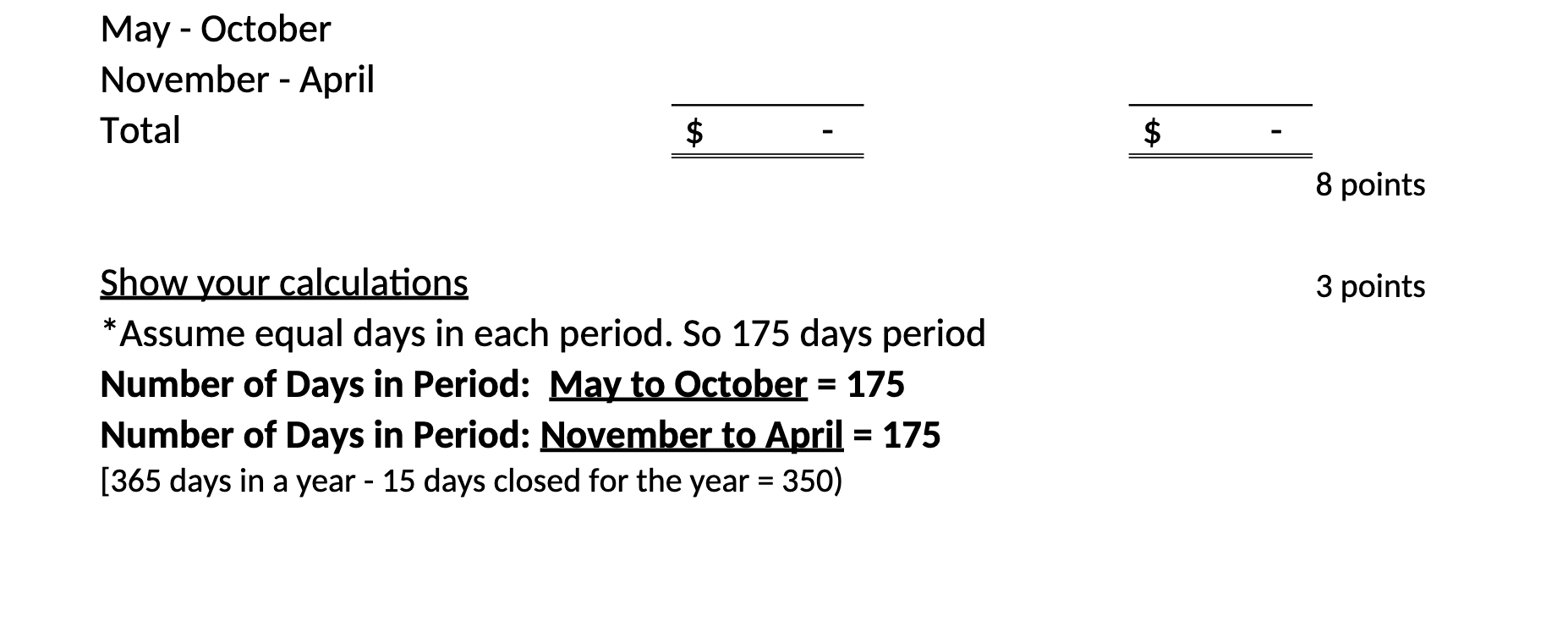

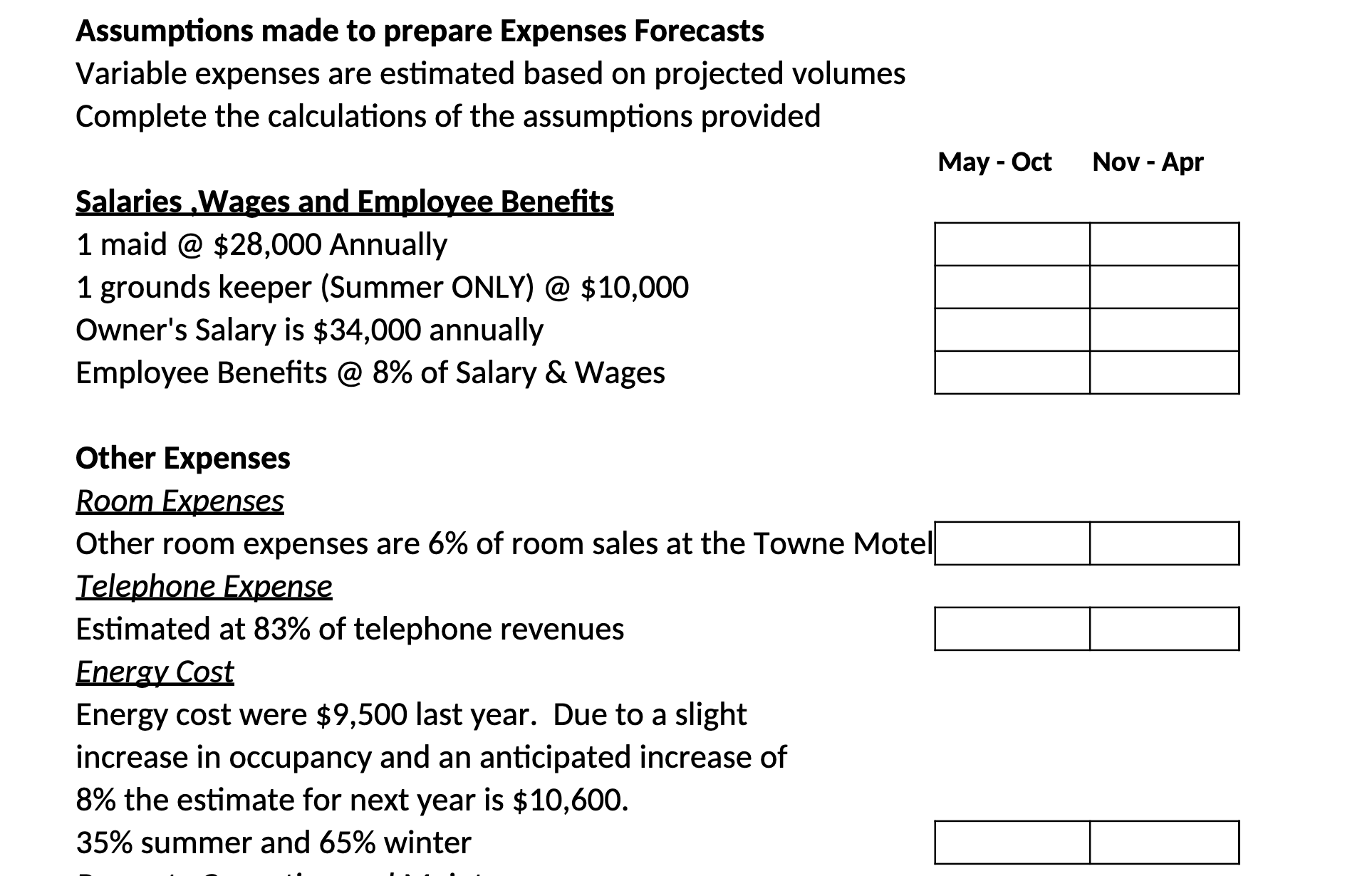

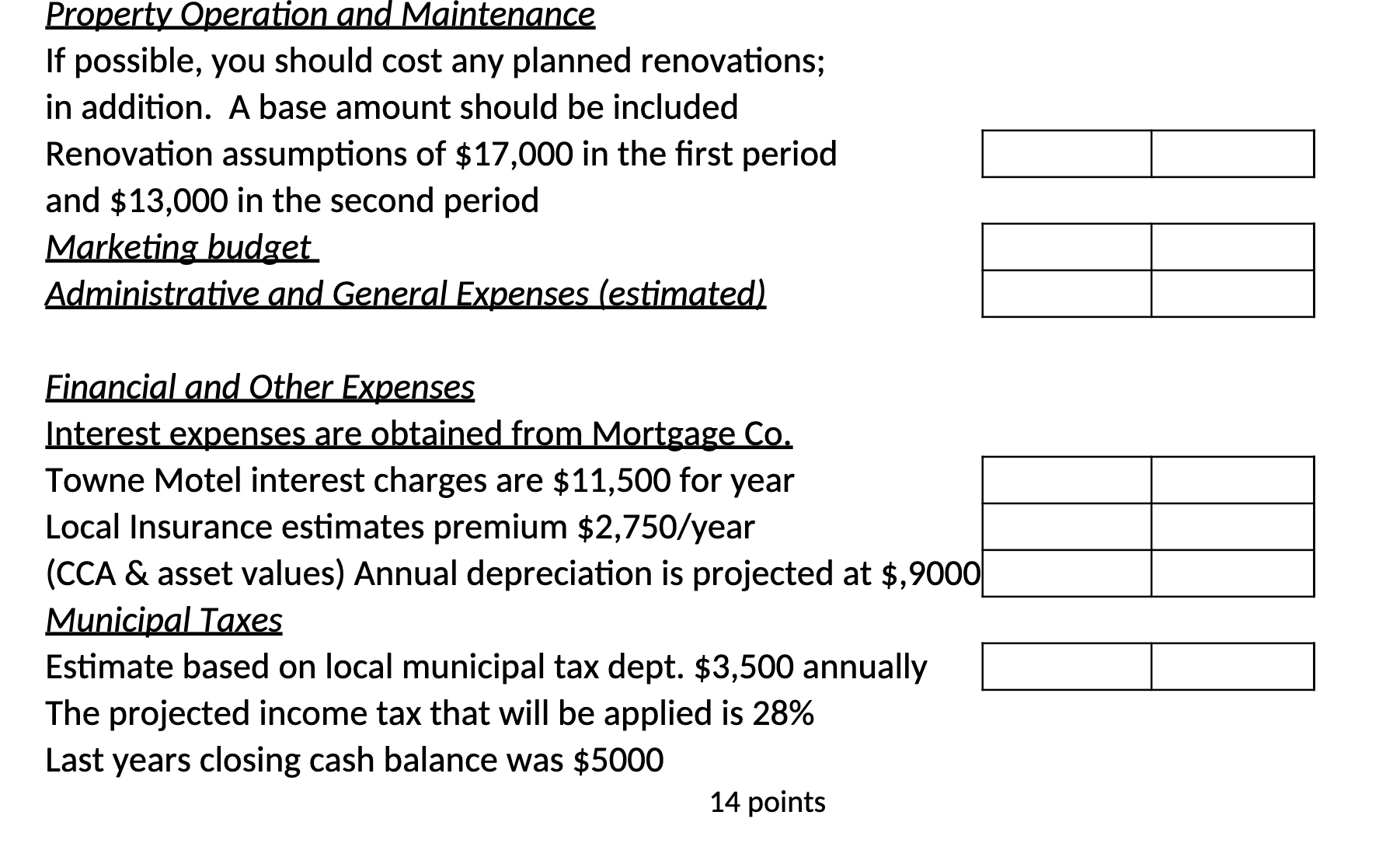

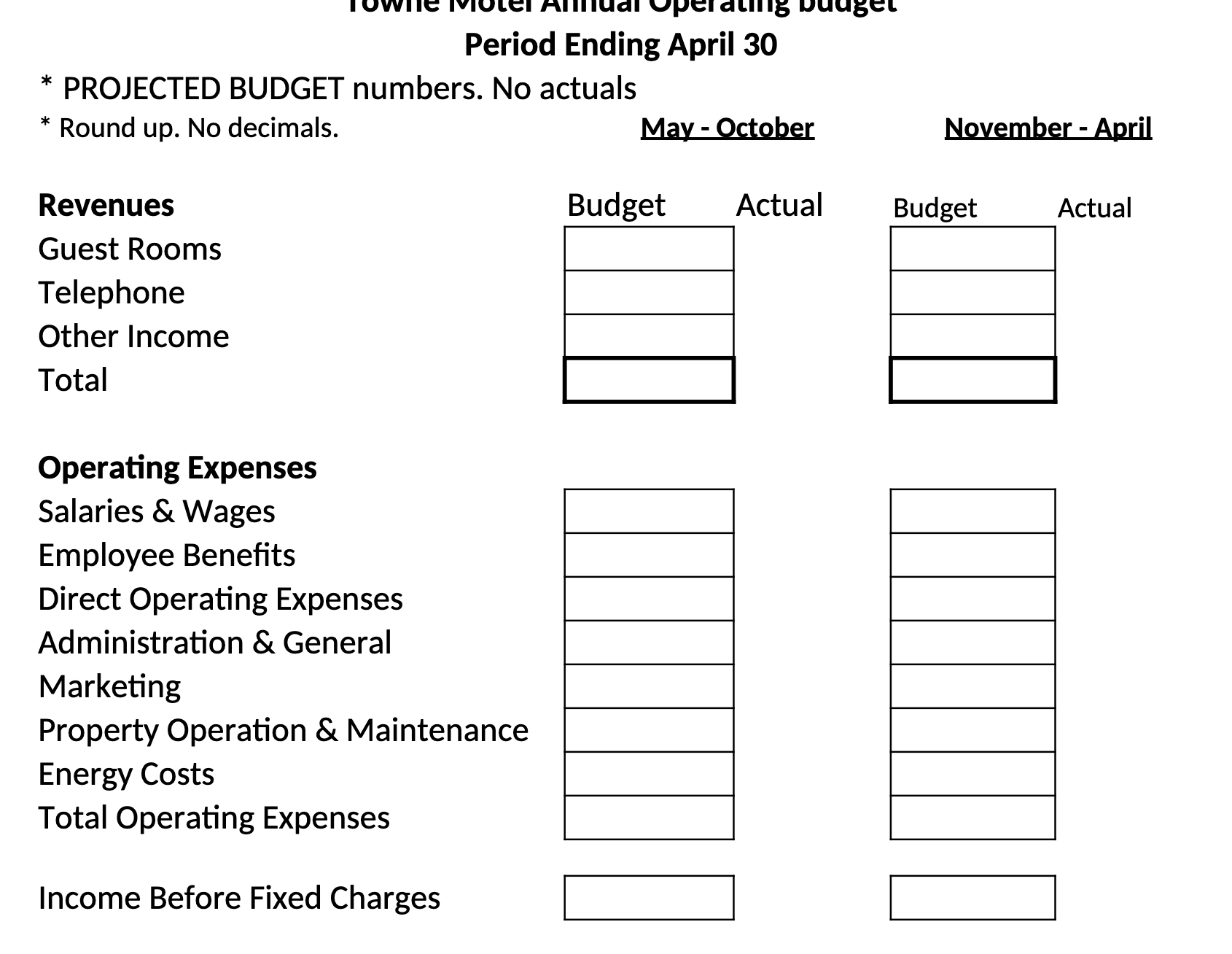

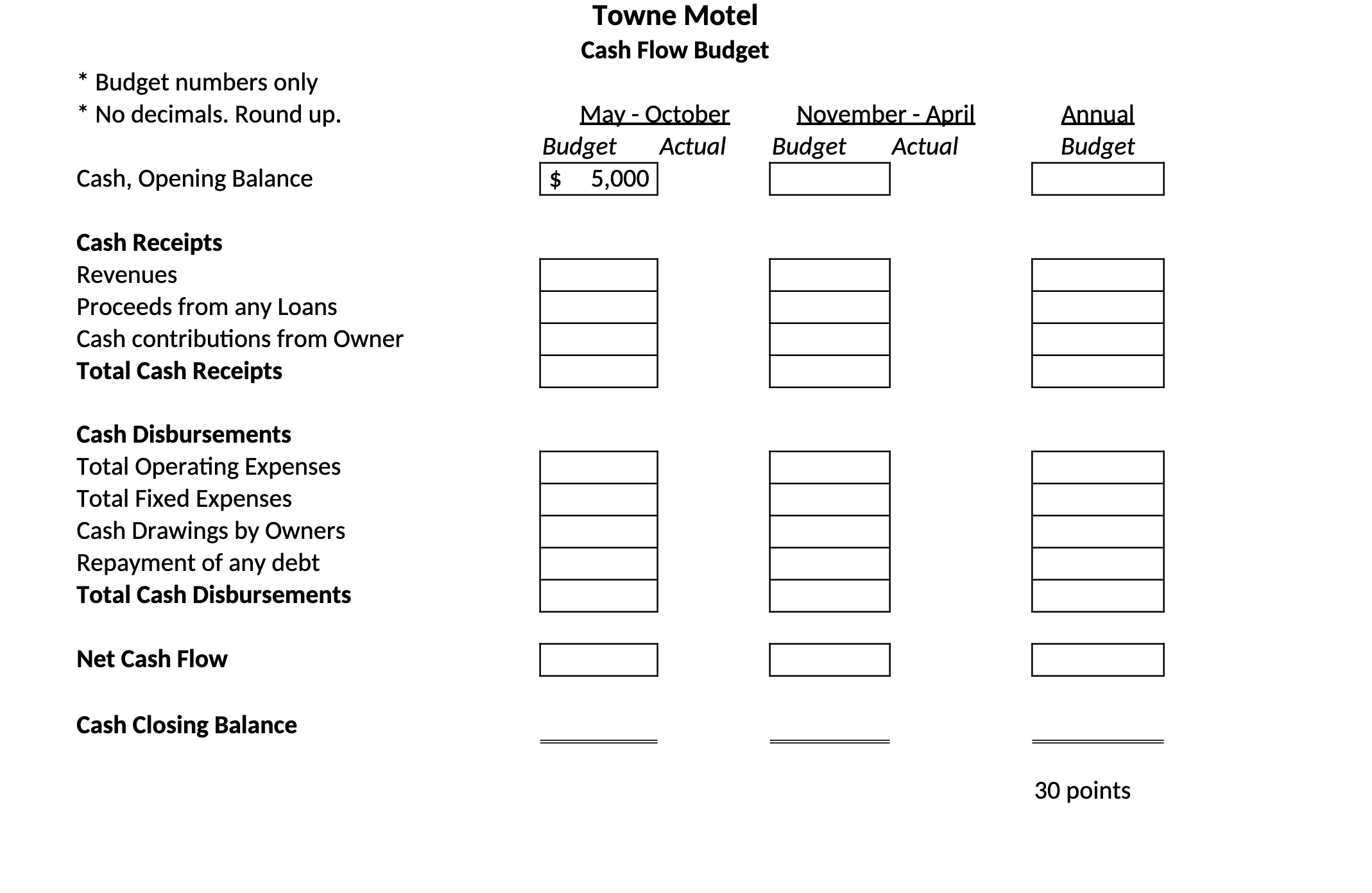

Use the following information to prepare the Operating Budget, to include the full calculation of the rooms revenue using the double differential formula and expenses forecast. Once you have completed the Operating Budget, you will be able to prepare a Cash Flow Budget The Towne Motel has 10 rooms and it open year round. However, the motel is closed for 15 days of vacation between seasons. It has no food or beverage facilities. We'll assume you would like to achieve a net after-tax income of approximately $30,000 for the year, which is a 10% return on equity of $300,000 The division of your budget into planning periods are best defined as May 1 - October 31 and November 1 - April 30 since the Towne Motel is located in a summer tourist area. The factors and trends expected to affect your business. The Towne Motel has been in business for 10 years and you have The factors and trends expected to affect your business. The Towne Motel has been in business for 10 years and you have developed a solid relationship with your repeat guests. You do not anticipate any major changes in demand by this market. However, a local motor-inn of comparable facilities has just gone out of business. As a result, you feel your annual occupancy should increase by 5%. Some rooms will require small renovations, $17000 will be spent in June and $13000 will be spent in December Your marketing budget is $1650 for May-Oct. and $1850 for winter season Administrative and general expenses are estimated at $ 2700 for May- Oct. and $2650 for Nov - April Estimate Telephone revenues at $2.50 per occupied room night and Other income at 1% of total reveunes. The owners withdrew $2500 each period as drawings from the business and managed to repay $350 monthly in debt to the local bank Number of Days in Period: May to October = 175 Number of Days in Period: November to April = 175 Occupied Room Nights May October - November - April Double Occupancy factor May October - November -April Occupied Projected Rm Nights Occupancy % Last Year Occupied Occupanc Rm Nights y % 2.0 2.0 1.3 1.3 225 70% 63% Room Rates Single Double Room Revenues May - October November - April Total Show your calculations $ 120.00 $ 118.00 $ 124.00 $ 122.00 $ $ LA 8 points 3 points May - October November - April Total $ Show your calculations *Assume equal days in each period. So 175 days period Number of Days in Period: May to October = 175 Number of Days in Period: November to April = 175 [365 days in a year - 15 days closed for the year = 350) $ +A 8 points 3 points Assumptions made to prepare Expenses Forecasts Variable expenses are estimated based on projected volumes Complete the calculations of the assumptions provided Salaries,Wages and Employee Benefits 1 maid @ $28,000 Annually 1 grounds keeper (Summer ONLY) @ $10,000 Owner's Salary is $34,000 annually Employee Benefits @ 8% of Salary & Wages Other Expenses Room Expenses Other room expenses are 6% of room sales at the Towne Motel Telephone Expense Estimated at 83% of telephone revenues Energy Cost Energy cost were $9,500 last year. Due to a slight increase in occupancy and an anticipated increase of 8% the estimate for next year is $10,600. 35% summer and 65% winter May - Oct Nov - Apr Property Operation and Maintenance If possible, you should cost any planned renovations; in addition. A base amount should be included Renovation assumptions of $17,000 in the first period and $13,000 in the second period Marketing budget Administrative and General Expenses (estimated) Financial and Other Expenses Interest expenses are obtained from Mortgage Co. Towne Motel interest charges are $11,500 for year Local Insurance estimates premium $2,750/year (CCA & asset values) Annual depreciation is projected at $,9000 Municipal Taxes Estimate based on local municipal tax dept. $3,500 annually The projected income tax that will be applied is 28% Last years closing cash balance was $5000 14 points Period Ending April 30 * PROJECTED BUDGET numbers. No actuals * Round up. No decimals. May - October November - April Budget Actual Budget Actual Revenues Guest Rooms Telephone Other Income Total Operating Expenses Salaries & Wages Employee Benefits Direct Operating Expenses Administration & General Marketing Property Operation & Maintenance Energy Costs Total Operating Expenses Income Before Fixed Charges * * Budget numbers only No decimals. Round up. Cash, Opening Balance Cash Receipts Revenues Proceeds from any Loans Cash contributions from Owner Total Cash Receipts Cash Disbursements Total Operating Expenses Total Fixed Expenses Cash Drawings by Owners Repayment of any debt Total Cash Disbursements Net Cash Flow Cash Closing Balance Towne Motel Cash Flow Budget May - October November - April Annual Budget Actual Budget Actual Budget $ 5,000 30 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started