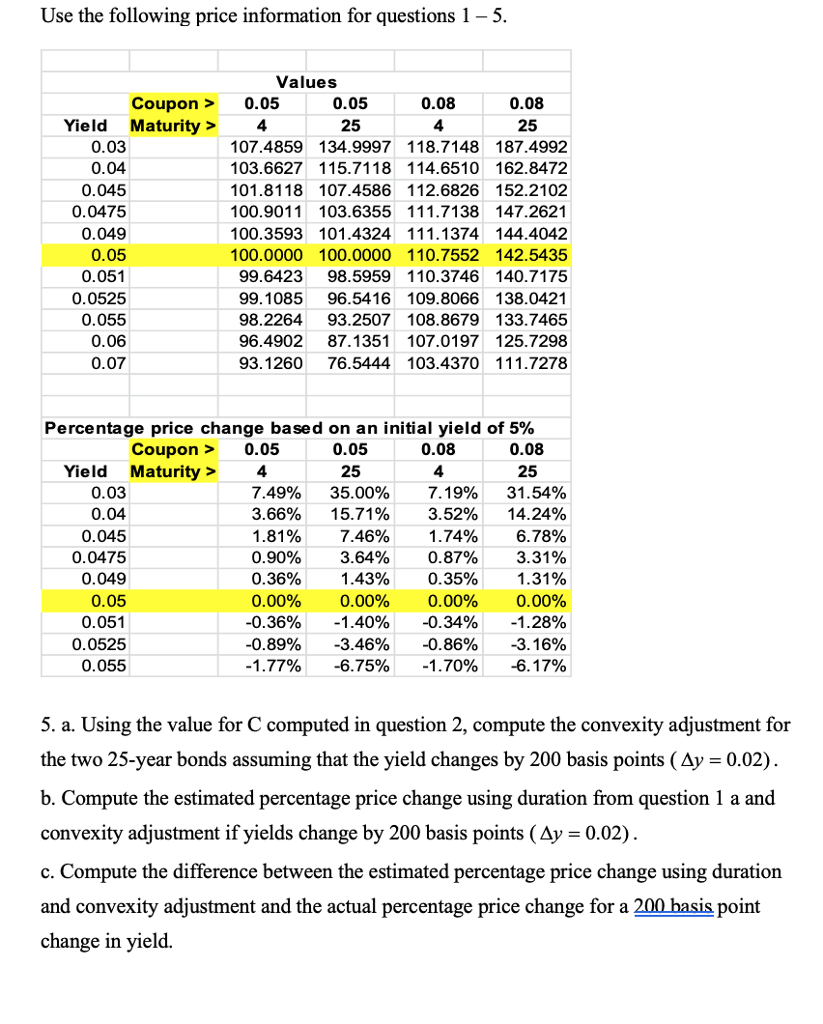

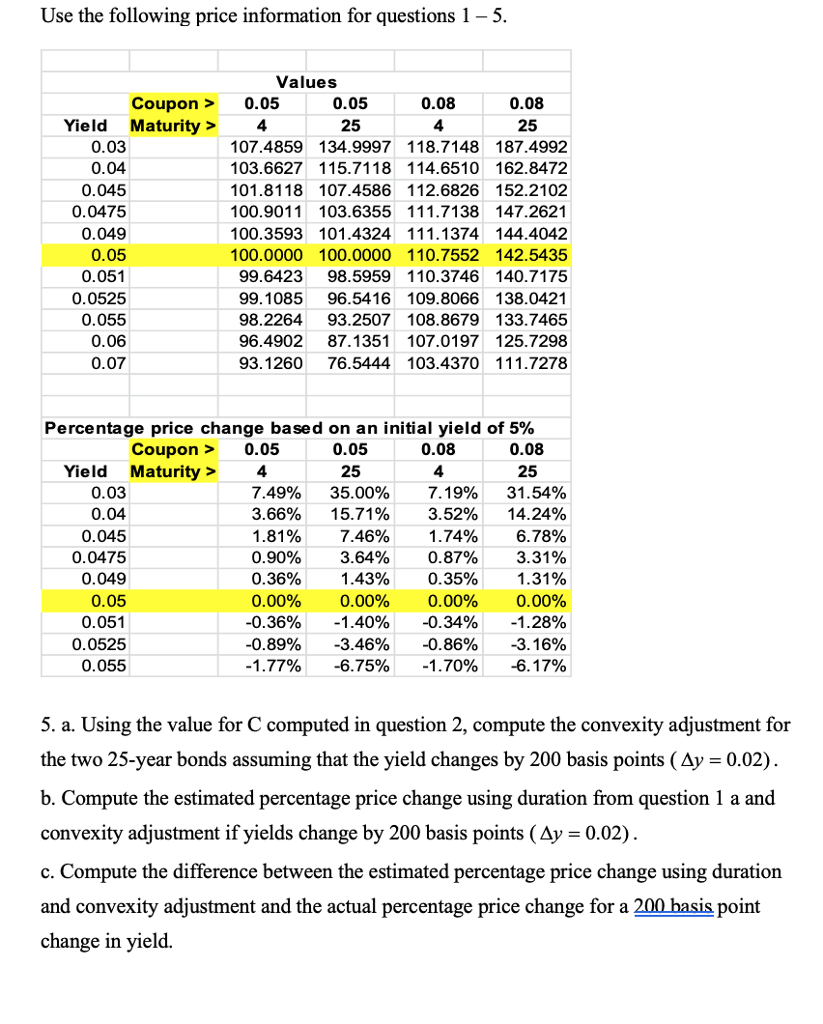

Use the following price information for questions 1-5 Values Coupon > 0.05 0.05 25 0.08 0.08 25 Yield Maturity>4 0.03 0.04 0.045 0.0475 0.049 0.05 0.051 0.0525 0.055 0.06 0.07 107.4859 134.9997 118.7148 187.4992 103.6627 115.7118114.6510 162.8472 101.8118 107.4586 112.6826 152.2102 100.9011 103.6355 111.7138 147.2621 100.3593 101.4324 111.1374 144.4042 100.0000 100.0000 110.7552 142.5435 99.6423 98.5959 110.3746 140.7175 99.1085 96.5416 109.8066 138.0421 98.2264 93.2507 108.8679 133.7465 96.4902 87.1351 107.0197125.7298 93.1260 76.5444 103.4370 111.7278 Percentage price change based on an initial yield of 5% Coupon>0.0!5 0.05 25 0.08 0.08 Yield Maturity>4 4 7.19% 3.52% 1.74% 0.87% 0.35% 0.00% -0.34% -0.86% -1.70% 25 0.03 0.04 0.045 0.0475 0.049 0.05 0.051 0.0525 0.055 7.49% 3.66% 1.81% 0.90% 036% 0.00% -0.36% -0.89% -1.77% 35.00% 15.71% 7.46% 3.64% 1.43% 0.00% -1.40% -3.46% -6.75% 31.54% 14.24% 6.78% 3.31% 1.31% 0.00% -1.28% -3.16% -6.17% 5. a. Using the value for C computed in question 2, compute the convexity adjustment for the two 25-year bonds assuming that the yield changes by 200 basis points (Ay 0.02) b. Compute the estimated percentage price change using duration from question 1 a and convexity adjustment if yields change by 200 basis points (Ay 0.02) c. Compute the difference between the estimated percentage price change using duration and convexity adjustment and the actual percentage price change for a 200 basis point change in yield. Use the following price information for questions 1-5 Values Coupon > 0.05 0.05 25 0.08 0.08 25 Yield Maturity>4 0.03 0.04 0.045 0.0475 0.049 0.05 0.051 0.0525 0.055 0.06 0.07 107.4859 134.9997 118.7148 187.4992 103.6627 115.7118114.6510 162.8472 101.8118 107.4586 112.6826 152.2102 100.9011 103.6355 111.7138 147.2621 100.3593 101.4324 111.1374 144.4042 100.0000 100.0000 110.7552 142.5435 99.6423 98.5959 110.3746 140.7175 99.1085 96.5416 109.8066 138.0421 98.2264 93.2507 108.8679 133.7465 96.4902 87.1351 107.0197125.7298 93.1260 76.5444 103.4370 111.7278 Percentage price change based on an initial yield of 5% Coupon>0.0!5 0.05 25 0.08 0.08 Yield Maturity>4 4 7.19% 3.52% 1.74% 0.87% 0.35% 0.00% -0.34% -0.86% -1.70% 25 0.03 0.04 0.045 0.0475 0.049 0.05 0.051 0.0525 0.055 7.49% 3.66% 1.81% 0.90% 036% 0.00% -0.36% -0.89% -1.77% 35.00% 15.71% 7.46% 3.64% 1.43% 0.00% -1.40% -3.46% -6.75% 31.54% 14.24% 6.78% 3.31% 1.31% 0.00% -1.28% -3.16% -6.17% 5. a. Using the value for C computed in question 2, compute the convexity adjustment for the two 25-year bonds assuming that the yield changes by 200 basis points (Ay 0.02) b. Compute the estimated percentage price change using duration from question 1 a and convexity adjustment if yields change by 200 basis points (Ay 0.02) c. Compute the difference between the estimated percentage price change using duration and convexity adjustment and the actual percentage price change for a 200 basis point change in yield