Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following scenario for Blanks #1-Blanks #6 Company YYZ is determining whether a piece of equipment is impaired. The equipment has a cost

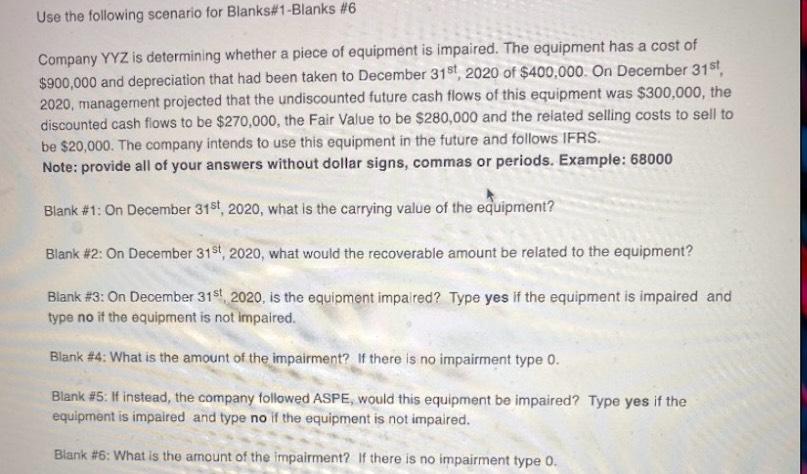

Use the following scenario for Blanks #1-Blanks #6 Company YYZ is determining whether a piece of equipment is impaired. The equipment has a cost of $900,000 and depreciation that had been taken to December 31st, 2020 of $400,000. On December 31st 2020, management projected that the undiscounted future cash flows of this equipment was $300,000, the discounted cash flows to be $270,000, the Fair Value to be $280,000 and the related selling costs to sell to be $20,000. The company intends to use this equipment in the future and follows IFRS. Note: provide all of your answers without dollar signs, commas or periods. Example: 68000 Blank #1: On December 31st, 2020, what is the carrying value of the equipment? Blank #2: On December 31st, 2020, what would the recoverable amount be related to the equipment? Blank #3: On December 31st, 2020, is the equipment impaired? Type yes if the equipment is impaired and type no if the equipment is not impaired. Blank #4: What is the amount of the impairment? If there is no impairment type 0. Blank #5: If instead, the company followed ASPE, would this equipment be impaired? Type yes if the equipment is impaired and type no if the equipment is not impaired. Blank #6: What is the amount of the impairment? If there is no impairment type 0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Blank 1 500000 Cost Accumulated Depreciation 900000 400000 Blank 2 There are two possible recoverabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started