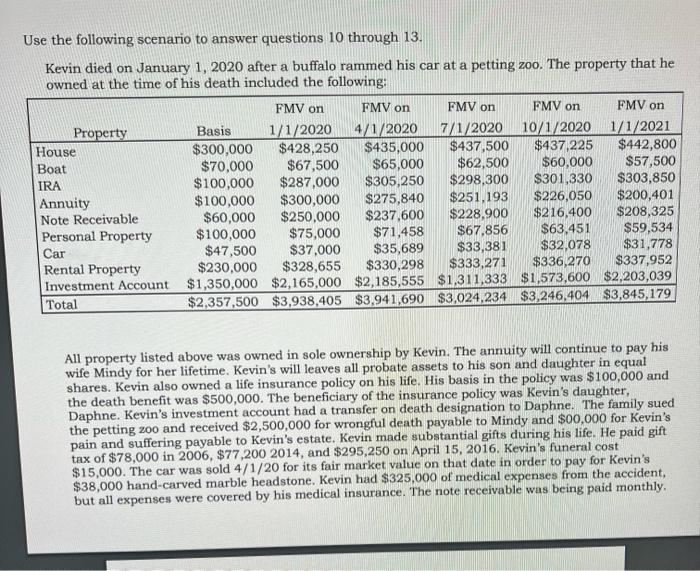

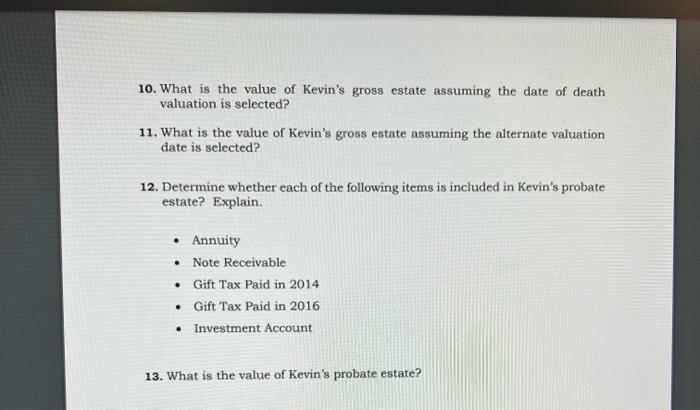

Use the following scenario to answer questions 10 through 13. Kevin died on January 1, 2020 after a buffalo rammed his car at a petting zoo. The property that he owned at the time of his death included the following: All property listed above was owned in sole ownership by Kevin. The annuity will continue to pay his wife Mindy for her lifetime. Kevin's will leaves all probate assets to his son and daughter in equal shares. Kevin also owned a life insurance policy on his life. His basis in the policy was $100,000 and the death benefit was $500,000. The beneficiary of the insurance policy was Kevin's daughter, Daphne. Kevin's investment account had a transfer on death designation to Daphne. The family sued the petting zoo and received $2,500,000 for wrongful death payable to Mindy and $00,000 for Kevin's pain and suffering payable to Kevin's estate. Kevin made substantial gifts during his life. He paid gift tax of $78,000 in 2006,$77,2002014, and $295,250 on April 15, 2016. Kevin's funeral cost $15,000. The car was sold 4/1/20 for its fair market value on that date in order to pay for Kevin's $38,000 hand-carved marble headstone. Kevin had $325,000 of medical expenses from the accident, but all expenses were covered by his medical insurance. The note receivable was being paid monthly. 10. What is the value of Kevin's gross estate assuming the date of death valuation is selected? 11. What is the value of Kevin's gross estate assuming the alternate valuation date is selected? 12. Determine whether each of the following items is included in Kevin's probate estate? Explain. - Annuity - Note Receivable - Gift Tax Paid in 2014 - Gift Tax Paid in 2016 - Investment Account 13. What is the value of Kevin's probate estate? Use the following scenario to answer questions 10 through 13. Kevin died on January 1, 2020 after a buffalo rammed his car at a petting zoo. The property that he owned at the time of his death included the following: All property listed above was owned in sole ownership by Kevin. The annuity will continue to pay his wife Mindy for her lifetime. Kevin's will leaves all probate assets to his son and daughter in equal shares. Kevin also owned a life insurance policy on his life. His basis in the policy was $100,000 and the death benefit was $500,000. The beneficiary of the insurance policy was Kevin's daughter, Daphne. Kevin's investment account had a transfer on death designation to Daphne. The family sued the petting zoo and received $2,500,000 for wrongful death payable to Mindy and $00,000 for Kevin's pain and suffering payable to Kevin's estate. Kevin made substantial gifts during his life. He paid gift tax of $78,000 in 2006,$77,2002014, and $295,250 on April 15, 2016. Kevin's funeral cost $15,000. The car was sold 4/1/20 for its fair market value on that date in order to pay for Kevin's $38,000 hand-carved marble headstone. Kevin had $325,000 of medical expenses from the accident, but all expenses were covered by his medical insurance. The note receivable was being paid monthly. 10. What is the value of Kevin's gross estate assuming the date of death valuation is selected? 11. What is the value of Kevin's gross estate assuming the alternate valuation date is selected? 12. Determine whether each of the following items is included in Kevin's probate estate? Explain. - Annuity - Note Receivable - Gift Tax Paid in 2014 - Gift Tax Paid in 2016 - Investment Account 13. What is the value of Kevin's probate estate