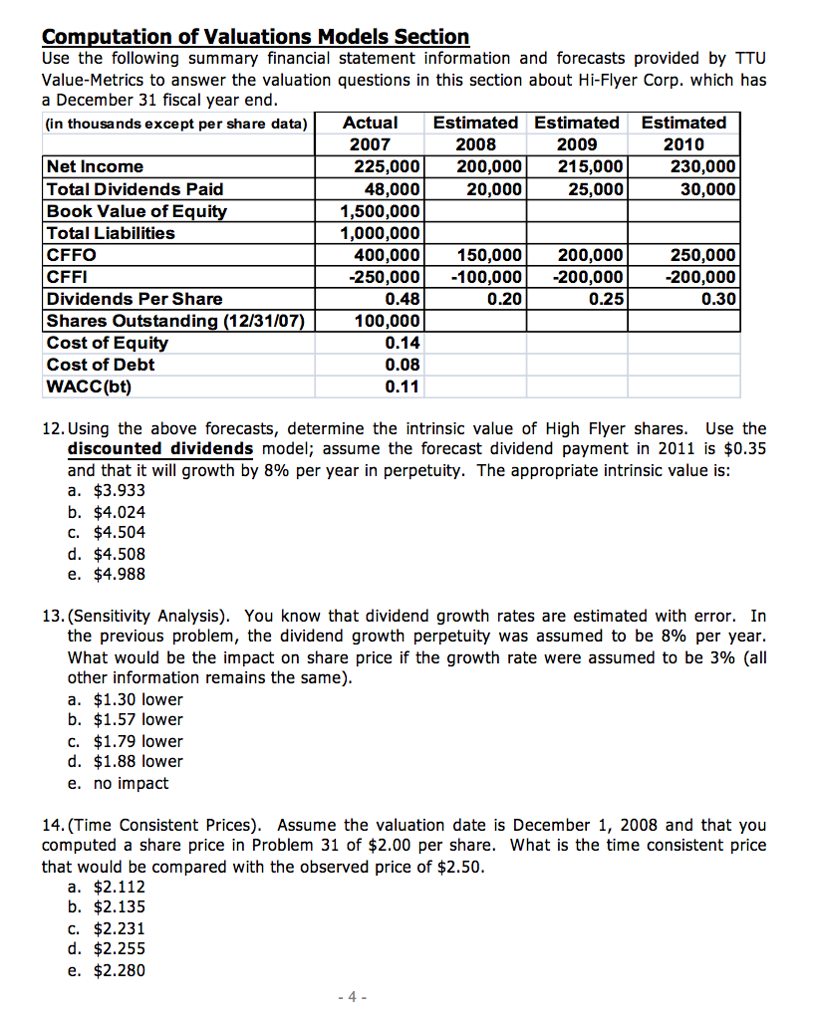

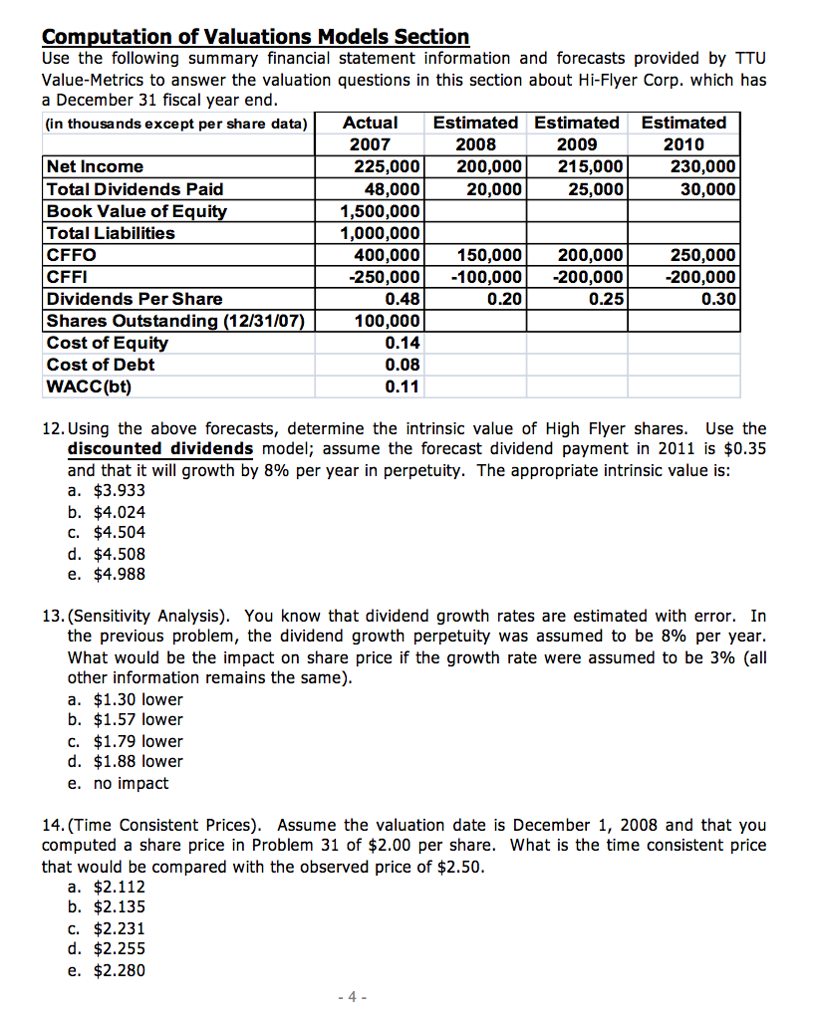

Use the following summary financial statement information and forecasts provided by TTU Value-Metrics to answer the valuation questions in this section about Hi-Flyer Corp. which has a December 31 fiscal year end. Using the above forecasts, determine the intrinsic value of High Flyer shares. Use the discounted dividends model; assume the forecast dividend payment in 2011 is $0.35 and that it will growth by 8% per year in perpetuity. The appropriate intrinsic value is: a. $3.933 b. $4.024 c. $4.504 d. $4.508 e. $4.988 (Sensitivity Analysis). You know that dividend growth rates are estimated with error. In the previous problem, the dividend growth perpetuity was assumed to be 8% per year. What would be the impact on share price if the growth rate were assumed to be 3% (all other information remains the same). a. $1.30 lower b. $1.57 lower c. $1.79 lower d. $1.88 lower e. no impact (Time Consistent Prices). Assume the valuation date is December 1, 2008 and that you computed a share price in Problem 31 of $2.00 per share. What is the time consistent price that would be compared with the observed price of $2.50. a. $2.112 b. $2.135 c. $2.231 d. $2.255 e. $2.280 Use the following summary financial statement information and forecasts provided by TTU Value-Metrics to answer the valuation questions in this section about Hi-Flyer Corp. which has a December 31 fiscal year end. Using the above forecasts, determine the intrinsic value of High Flyer shares. Use the discounted dividends model; assume the forecast dividend payment in 2011 is $0.35 and that it will growth by 8% per year in perpetuity. The appropriate intrinsic value is: a. $3.933 b. $4.024 c. $4.504 d. $4.508 e. $4.988 (Sensitivity Analysis). You know that dividend growth rates are estimated with error. In the previous problem, the dividend growth perpetuity was assumed to be 8% per year. What would be the impact on share price if the growth rate were assumed to be 3% (all other information remains the same). a. $1.30 lower b. $1.57 lower c. $1.79 lower d. $1.88 lower e. no impact (Time Consistent Prices). Assume the valuation date is December 1, 2008 and that you computed a share price in Problem 31 of $2.00 per share. What is the time consistent price that would be compared with the observed price of $2.50. a. $2.112 b. $2.135 c. $2.231 d. $2.255 e. $2.280