Question

Use the following table to calculate the minimum premium an insurance company should charge for a USD 5 million three-year term life insurance contract

| ||||||

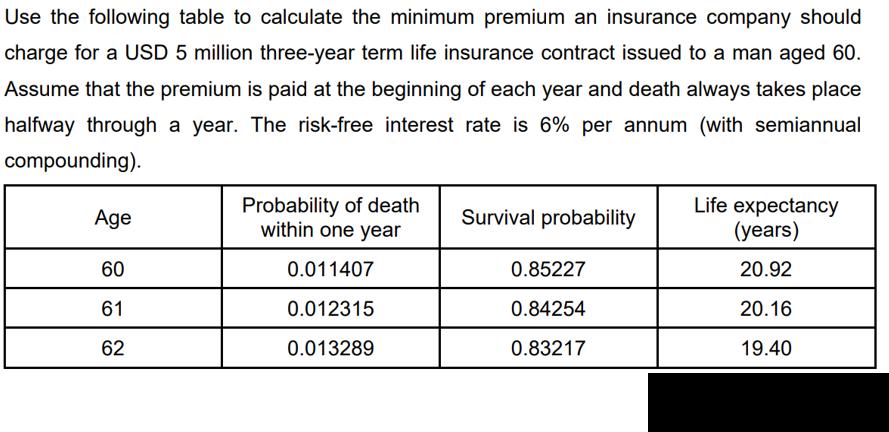

Use the following table to calculate the minimum premium an insurance company should charge for a USD 5 million three-year term life insurance contract issued to a man aged 60. Assume that the premium is paid at the beginning of each year and death always takes place halfway through a year. The risk-free interest rate is 6% per annum (with semiannual compounding). Age 60 61 62 Probability of death within one year 0.011407 0.012315 0.013289 Survival probability 0.85227 0.84254 0.83217 Life expectancy (years) 20.92 20.16 19.40

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Present Value of Death Benefit at Age 60 PV60 5000000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Risk Management and Financial Institutions

Authors: Hull John

4th edition

1118955943, 978-1118955949

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App