Answered step by step

Verified Expert Solution

Question

1 Approved Answer

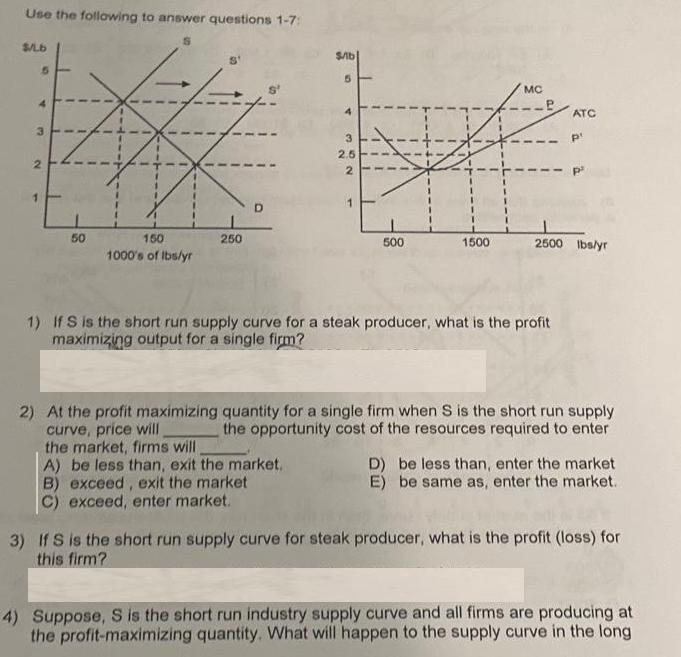

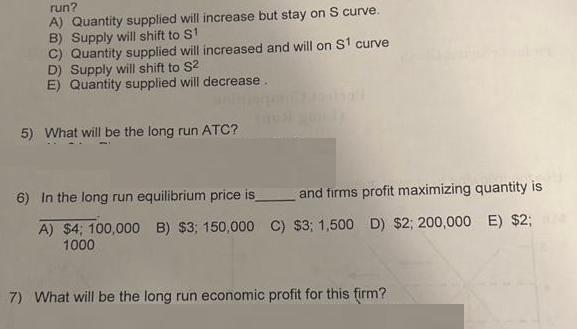

Use the following to answer questions 1-7: $/Lb 5 3 2 50 150 1000's of lbs/yr 11 250 $/b the market, firms will A)

Use the following to answer questions 1-7: $/Lb 5 3 2 50 150 1000's of lbs/yr 11 250 $/b the market, firms will A) be less than, exit the market. 5 Ch B) exceed, exit the market C) exceed, enter market. A 3 2.5 2 1 500 MC TVE 1500 1) If S is the short run supply curve for a steak producer, what is the profit maximizing output for a single firm? ATC p 2500 lbs/yr 2) At the profit maximizing quantity for a single firm when S is the short run supply curve, price will the opportunity cost of the resources required to enter D) be less than, enter the market E) be same as, enter the market. 3) If S is the short run supply curve for steak producer, what is the profit (loss) for this firm? 4) Suppose, S is the short run industry supply curve and all firms are producing at the profit-maximizing quantity. What will happen to the supply curve in the long run? A) Quantity supplied will increase but stay on S curve. B) Supply will shift to S1 C) Quantity supplied will increased and will on S1 curve D) Supply will shift to S E) Quantity supplied will decrease. 5) What will be the long run ATC? 6) In the long run equilibrium price is_ and firms profit maximizing quantity is A) $4; 100,000 B) $3; 150,000 C) $3; 1,500 D) $2; 200,000 E) $2; 1000 7) What will be the long run economic profit for this firm?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided images we have multiple questions related to shortrun and longrun supply and profit maximization in economics Lets address each question systematically 1 If S is the short run su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started