Answered step by step

Verified Expert Solution

Question

1 Approved Answer

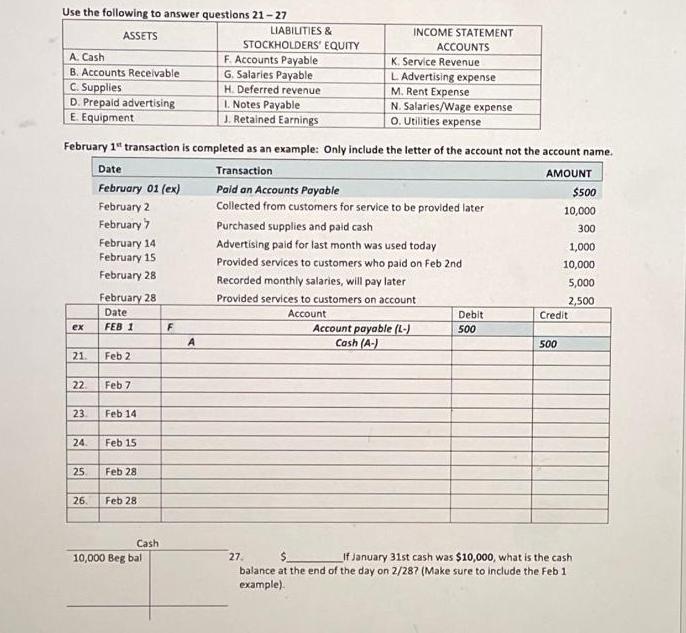

Use the following to answer questions 21-27 ASSETS A. Cash B. Accounts Receivable C. Supplies D. Prepaid advertising E. Equipment ex 21. 22 23

Use the following to answer questions 21-27 ASSETS A. Cash B. Accounts Receivable C. Supplies D. Prepaid advertising E. Equipment ex 21. 22 23 24. February 1st transaction is completed as an example: Only include the letter of the account not the account name. Date Transaction AMOUNT February 01 (ex) Paid an Accounts Payable February 2 Collected from customers for service to be provided later February 7 25 26. February 14 February 15 February 28 February 28 Date FEB 1 Feb 2 Feb 7 Feb 14 Feb 15 Feb 28 Feb 28: Cash 10,000 Beg bal F LIABILITIES & STOCKHOLDERS' EQUITY A F. Accounts Payable G. Salaries Payable H. Deferred revenue 1. Notes Payable J. Retained Earnings INCOME STATEMENT K. Service Revenue L. Advertising expense M. Rent Expense N. Salaries/Wage expense O. Utilities expense 27. ACCOUNTS Purchased supplies and paid cash Advertising paid for last month was used today Provided services to customers who paid on Feb 2nd Recorded monthly salaries, will pay later Provided services to customers on account Account Account payable (L-) Cash (A-) Debit 500 $500 10,000 300 500 1,000 10,000 5,000 2,500 Credit If January 31st cash was $10,000, what is the cash balance at the end of the day on 2/287 (Make sure to include the Feb 1 example).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Journal is a book in which all the transactions of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started