Answered step by step

Verified Expert Solution

Question

1 Approved Answer

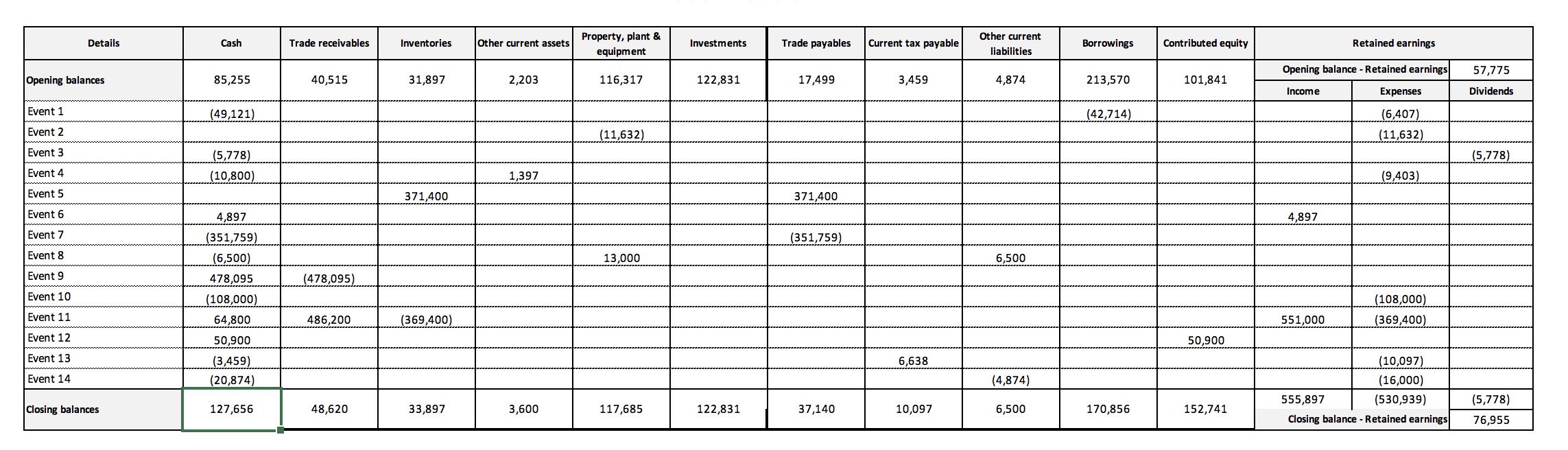

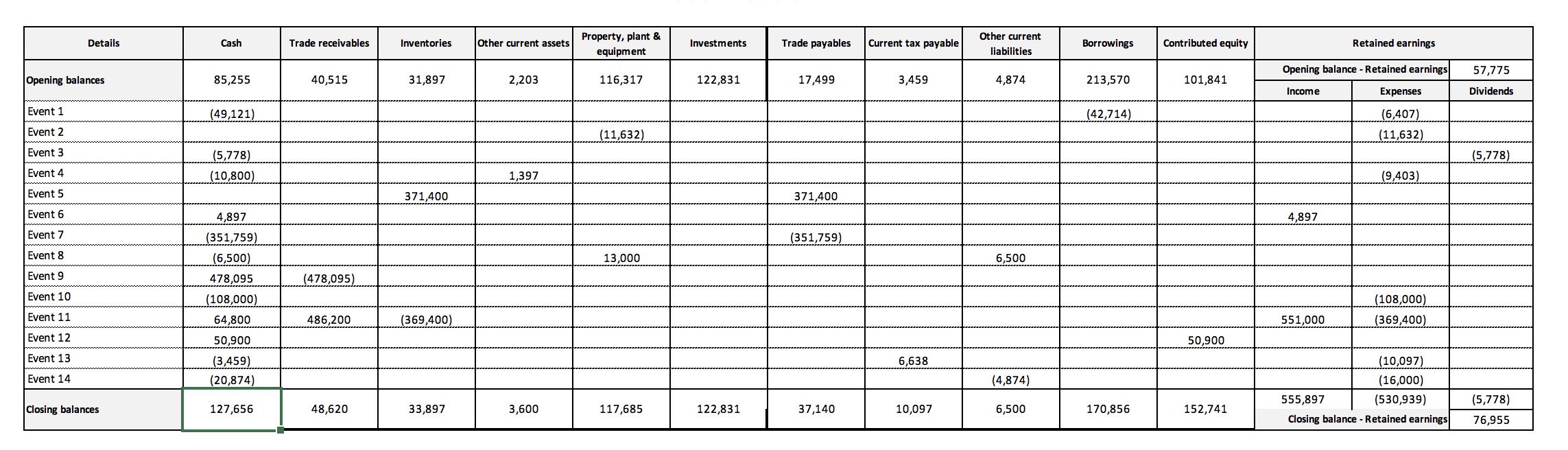

Use the following transaction worksheet to complete the table: Details Opening balances Event 1 Event 2 Event 3 Event 4 Event 5 Event 6 Event

Use the following transaction worksheet to complete the table:

Details Opening balances Event 1 Event 2 Event 3 Event 4 Event 5 Event 6 Event 7 Event 8 Event 9 Event 10 Event 11 Event 12 Event 13 Event 14 Closing balances Cash 85,255 (49,121) (5,778) (10,800) 4,897 (351,759) (6,500) 478,095 (108,000) 64,800 50,900 (3,459) (20,874) 127,656 Trade receivables 40,515 (478,095) 486,200 48,620 Inventories 31,897 371,400 (369,400) 33,897 Other current assets 2,203 1,397 3,600 Property, plant & equipment 116,317 (11,632) 13,000 117,685 Investments 122,831 122,831 Trade payables 17,499 371,400 (351,759) 37,140 Current tax payable 3,459 6,638 10,097 Other current liabilities 4,874 6,500 (4,874) 6,500 Borrowings 213,570 (42,714) 170,856 Contributed equity 101,841 50,900 152,741 Retained earnings Opening balance - Retained earnings Income Expenses (6,407) (11,632) (9,403) 4,897 (108,000) (369,400) 551,000 (10,097) (16,000) (530,939) 555,897 Closing balance - Retained earnings 57,775 Dividends (5,778) (5,778) 76,955

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

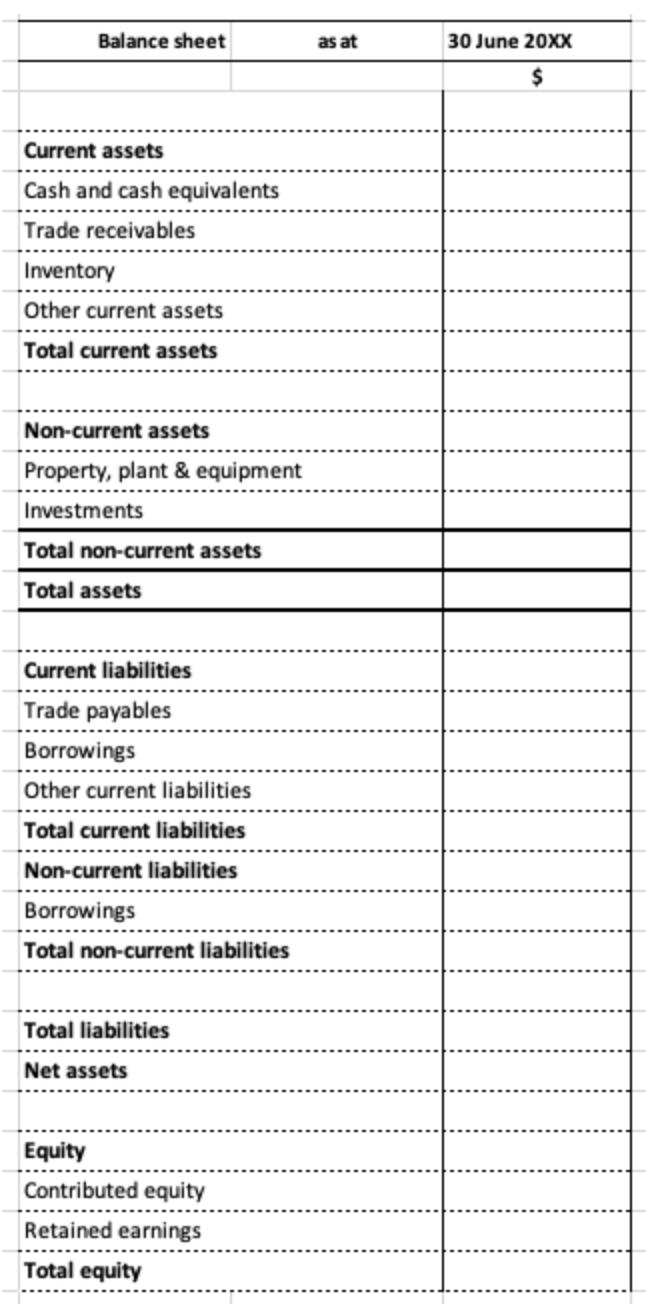

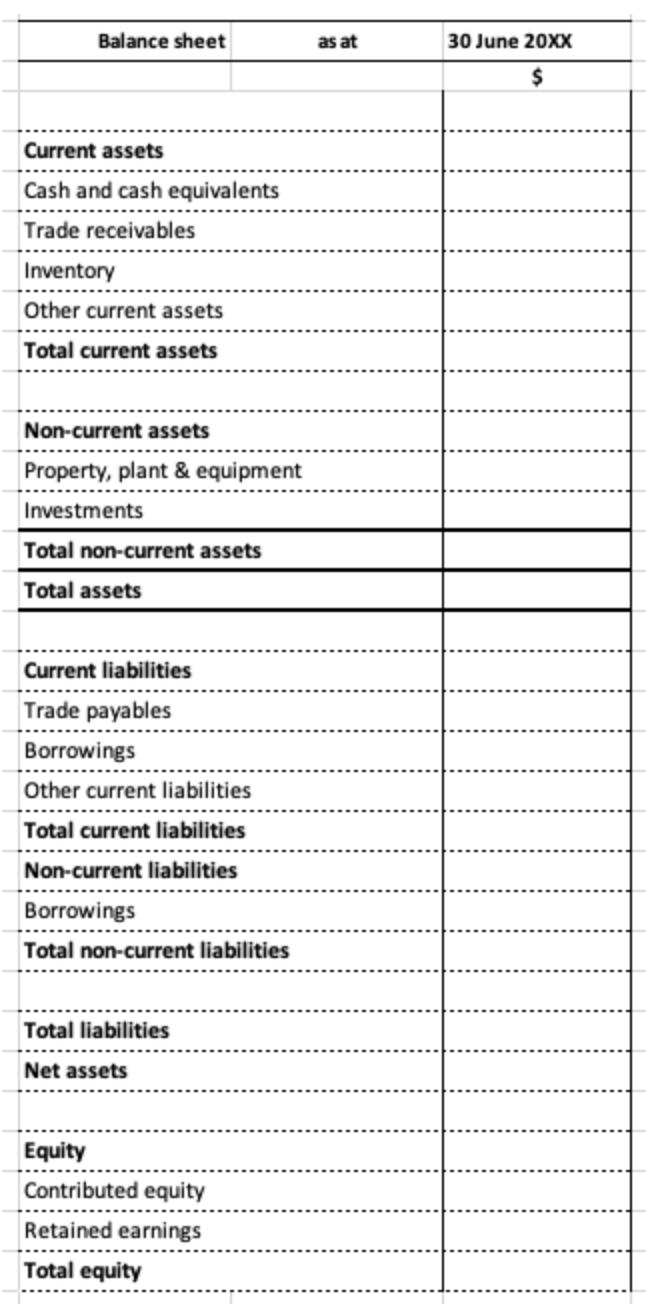

Answer Solution Balance Sheet Current Assets Cash Cash Equivalants Trade Receivables Invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started