Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following transactions to complete the second month of operations for Billy Bob's Daycare. Feb. Billy Bob began selling T-shirts to the kids

Use the following transactions to complete the second month of operations for Billy Bob's Daycare. Feb. Billy Bob began selling T-shirts to the kids and parents. Billy pays cash for 40 T- shirts at an introductory cost of $10/each. The T-shirts are being held for resale. Billy uses the perpetual method and uses the FIFO method to account for inventory. Purchased supplies on account for $410. Sold 30 T-Shirts at a price of $25/each receiving cash. Hint: Don't forget to record two journal entries to record revenue and cost of merchandise sold as perpetual method is used. Paid cash for the utility bill received at the end of January. Paid the employees cash of $2,000. *Do not forget that a portion of the amount of $2,000 was already recorded as a liability in January. 1 35 9 11 14 Provided the service for the daycare services owed from January 21st. Hint: Unearned daycare fees was recorded in January for services owed. Reduce the liability and increase revenues as service has been provided. 14 Collected cash from 27 of the parents and 4 parents agreed to pay in the future for daycare services provided for a total of 31 kids at $300/kid from February 1st through today. Billy Bob had 40 more T-shirts made in exchange for cash. The cost of the T- shirts increased to $13/each. The T-shirts are to be held for resale. Purchased groceries on account for $720 (recorded as food expense). 14 15 16 Sold 25 T-shirts at a price of $25/each receiving cash. Hint: Don't forget to record two journal entries to record revenue and cost of merchandise sold as perpetual method is used.

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

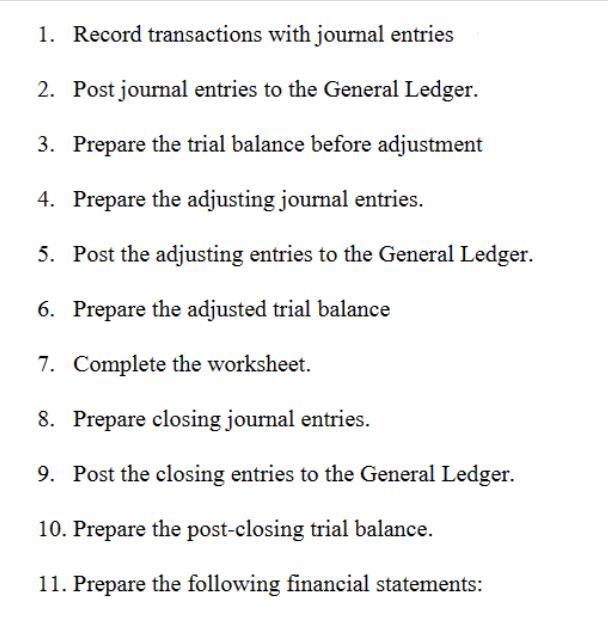

Task 1 Record transactions with journal entries Here are the journal entries for the transactions Fe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started