Answered step by step

Verified Expert Solution

Question

1 Approved Answer

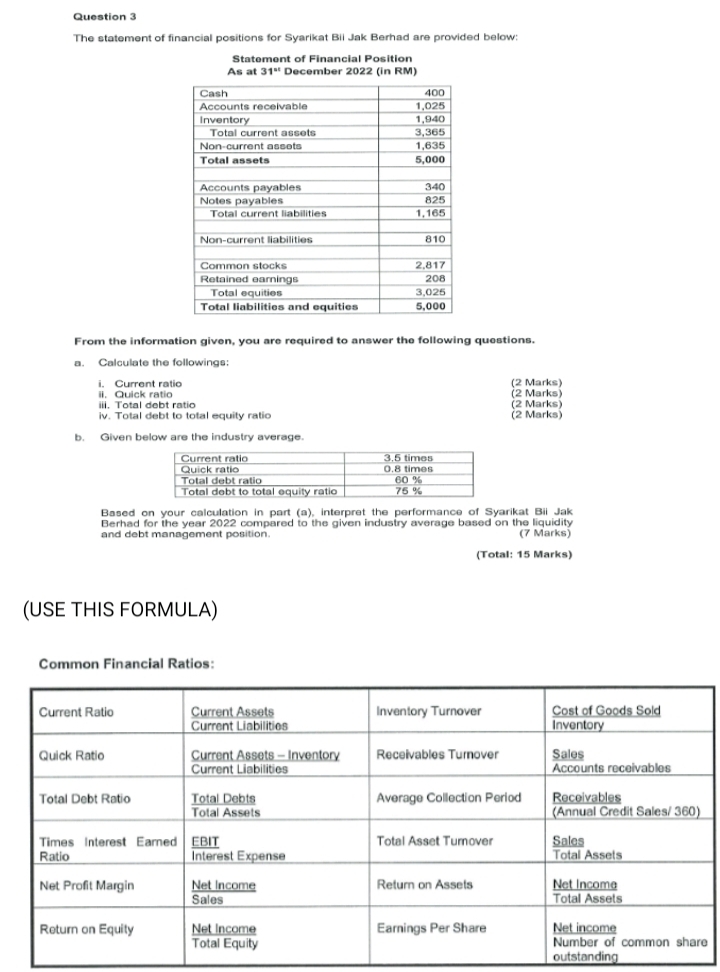

Use the formula given. Question 3 The statement of financial positions for Syarikat Bil Jak Berhad are provided below: Statement of Financial Position As at

Use the formula given.

Question 3 The statement of financial positions for Syarikat Bil Jak Berhad are provided below: Statement of Financial Position As at 31" December 2022 (in RM) Cash 400 Accounts receivable 1,025 Inventory Total current assets 1,940 3,365 1,635 5,000 Non-current assets Total assets Accounts payables 340 Notes payables 825 Total current liabilities 1,165 Non-current liabilities 810 Common stocks Retained earnings 2,817 208 3,025 Total equities Total liabilities and equities 5,000 From the information given, you are required to answer the following questions. Calculate the followings: a. i. Current ratio ii. Quick ratio iii. Total debt ratio iv. Total debt to total equity ratio b. Given below are the industry average. Current ratio Quick ratio Total debt ratio Total debt to total equity ratio 3.5 times 0.8 times 60% 75% (2 Marks) (2 Marks) (2 Marks) (2 Marks) Based on your calculation in part (a), interpret the performance of Syarikat Bii Jak Berhad for the year 2022 compared to the given industry average based on the liquidity and debt management position. (7 Marks) (Total: 15 Marks) (USE THIS FORMULA) Common Financial Ratios: Current Ratio Current Assets Current Liabilities Quick Ratio Total Debt Ratio Total Assets Times Interest Earned EBIT Total Asset Turnover Ratio Interest Expense Current Assets Inventory Current Liabilities Total Debts Inventory Turnover Cost of Goods Sold Inventory Receivables Turnover Average Collection Period Sales Accounts receivables Receivables (Annual Credit Sales/360) Sales Total Assets Net Profit Margin Net Income Sales Return on Assets Net Income Total Assets Return on Equity Net Income Earnings Per Share Total Equity Net income Number of common share outstanding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started