Answered step by step

Verified Expert Solution

Question

1 Approved Answer

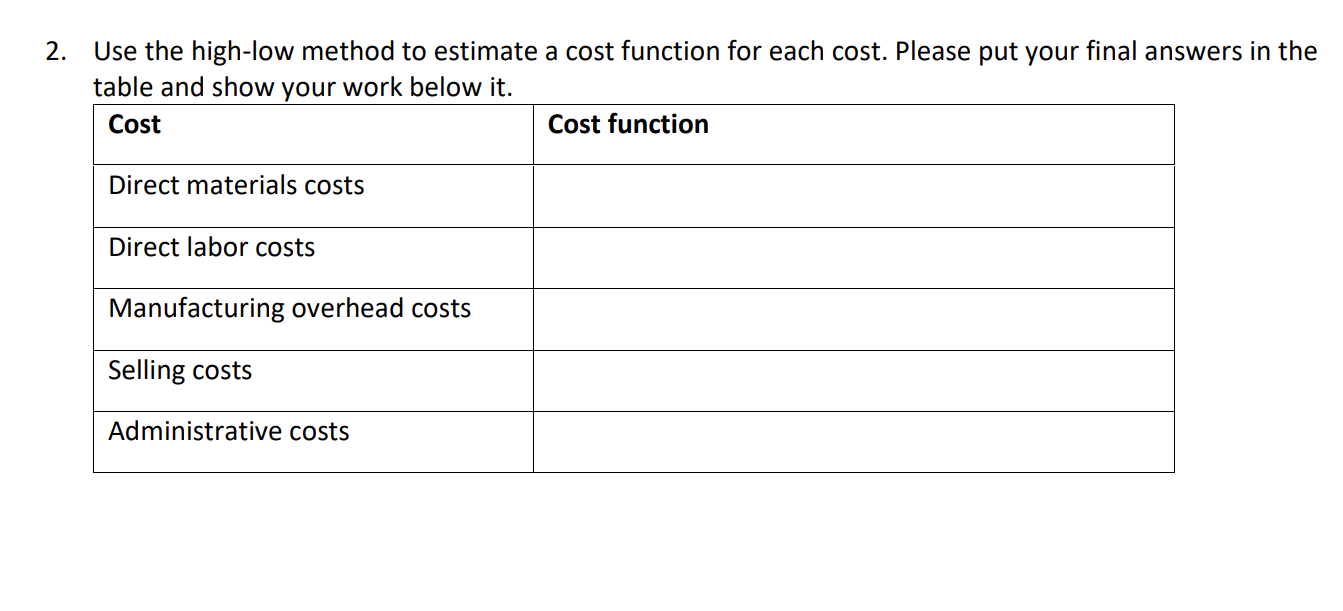

Use the high-low method to estimate a cost function for each cost. Please put your final answers in the table and show your work below

Use the high-low method to estimate a cost function for each cost.

Use the high-low method to estimate a cost function for each cost.

Please put your final answers in the table and show your work below it.

Cost Cost function

Direct materials costs

Direct labor costs

Manufacturing overhead costs

Selling costs

Administrative costs

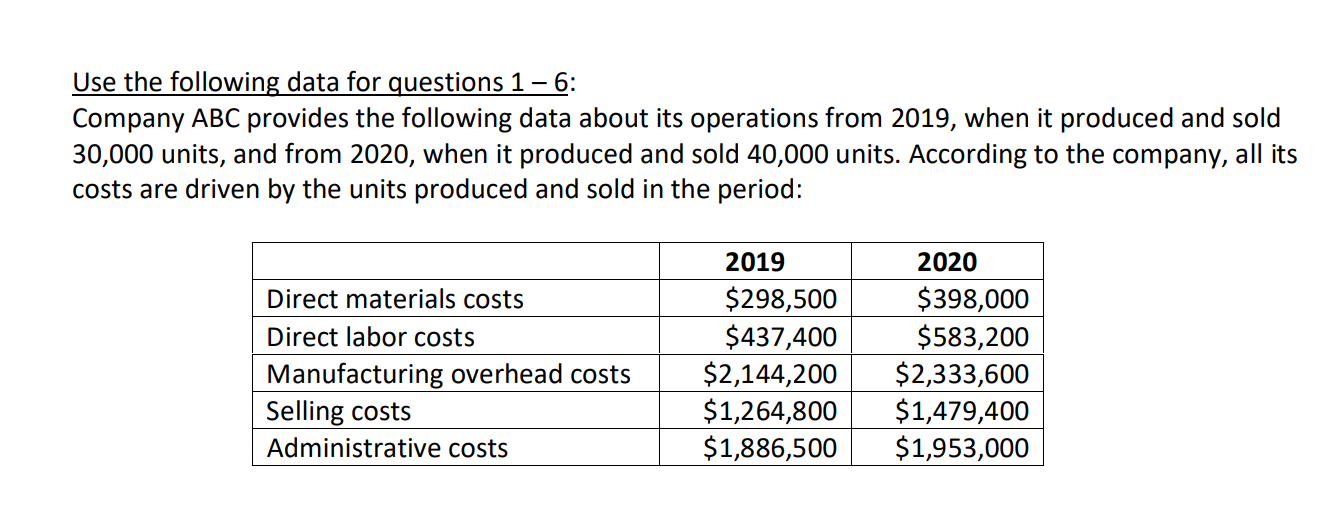

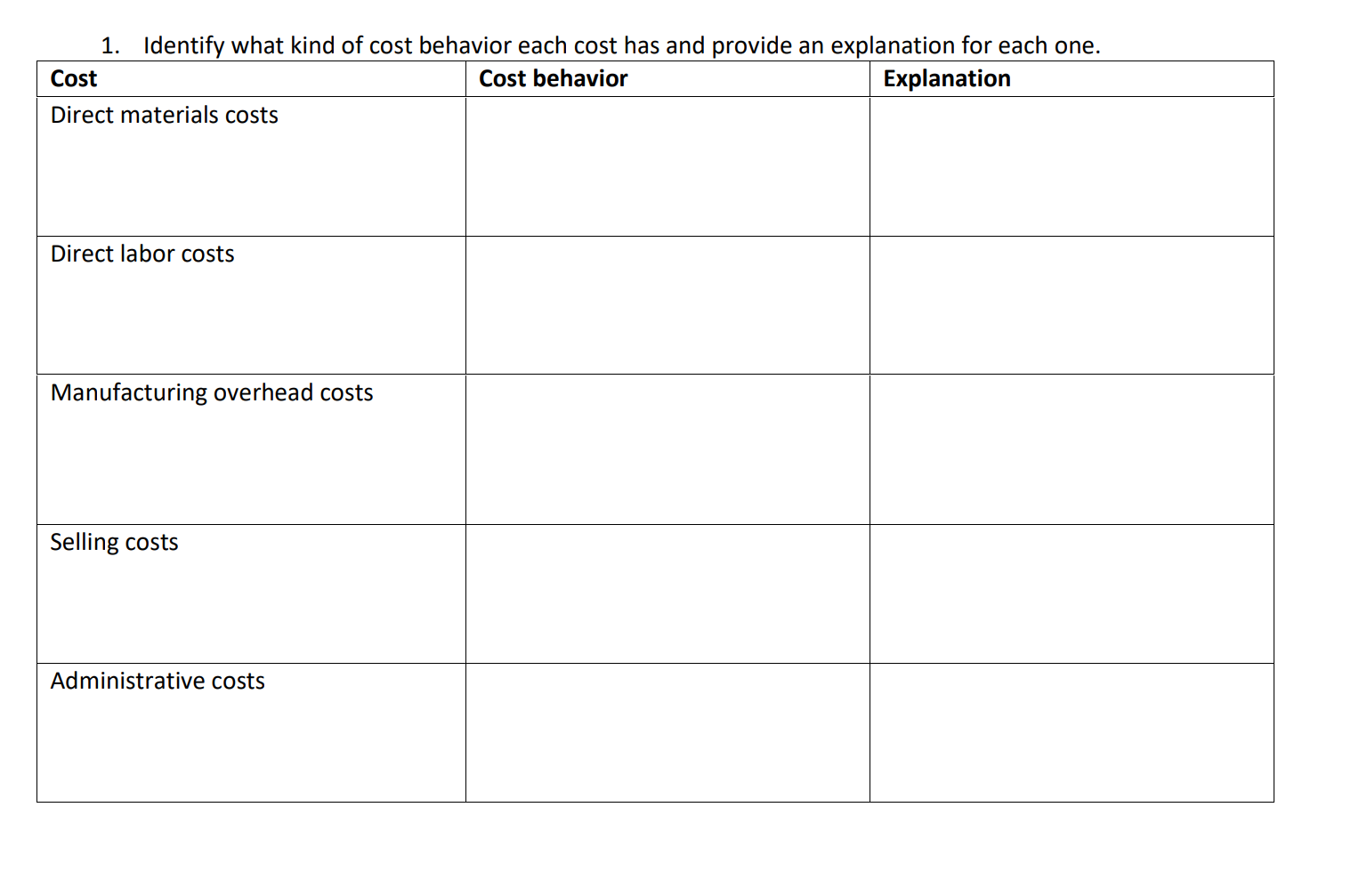

Use the following data for questions 1 6: Company ABC provides the following data about its operations from 2019, when it produced and sold 30,000 units, and from 2020, when it produced and sold 40,000 units. According to the company, all its costs are driven by the units produced and sold in the period: Direct materials costs Direct labor costs Manufacturing overhead costs Selling costs Administrative costs 2019 $298,500 $437,400 $2,144,200 $1,264,800 $1,886,500 2020 $398,000 $583,200 $2,333,600 $1,479,400 $1,953,000 1. Identify what kind of cost behavior each cost has and provide an explanation for each one. Cost Cost behavior Explanation Direct materials costs Direct labor costs Manufacturing overhead costs Selling costs Administrative costs 2. Use the high-low method to estimate a cost function for each cost. Please put your final answers in the table and show your work below it. Cost Cost function Direct materials costs Direct labor costs Manufacturing overhead costs Selling costs Administrative costsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started