Question

Use the income statements on the Absorption Statement and Variable Statement panels to complete the following table for the original production level. Then prepare similar

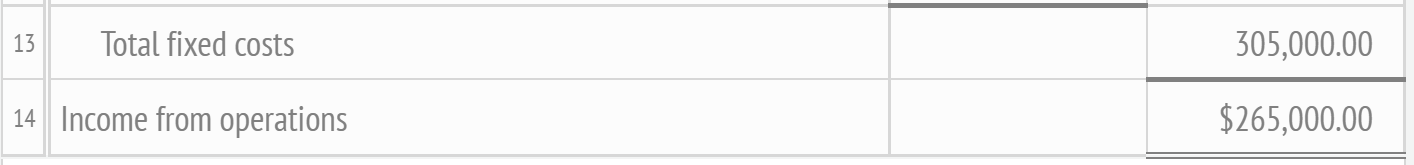

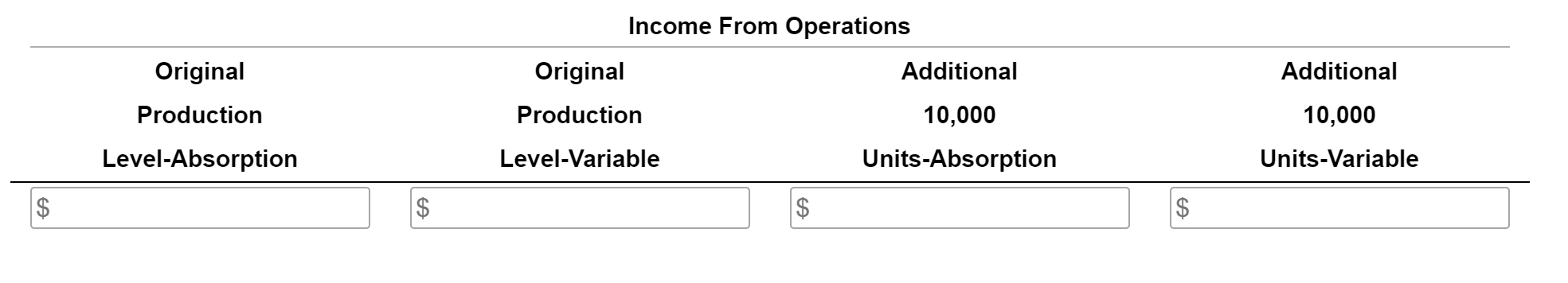

Use the income statements on the Absorption Statement and Variable Statement panels to complete the following table for the original production level. Then prepare similar income statements at a production level 10,000 units higher and add that information to the table. Assume that total fixed costs, unit variable costs, unit sales price, and the sales levels are the same at both production levels.

What is the change in income from operations from producing 10,000 additional units under absorption costing?

What is the change in income from operations from producing 10,000 additional units under variable costing?

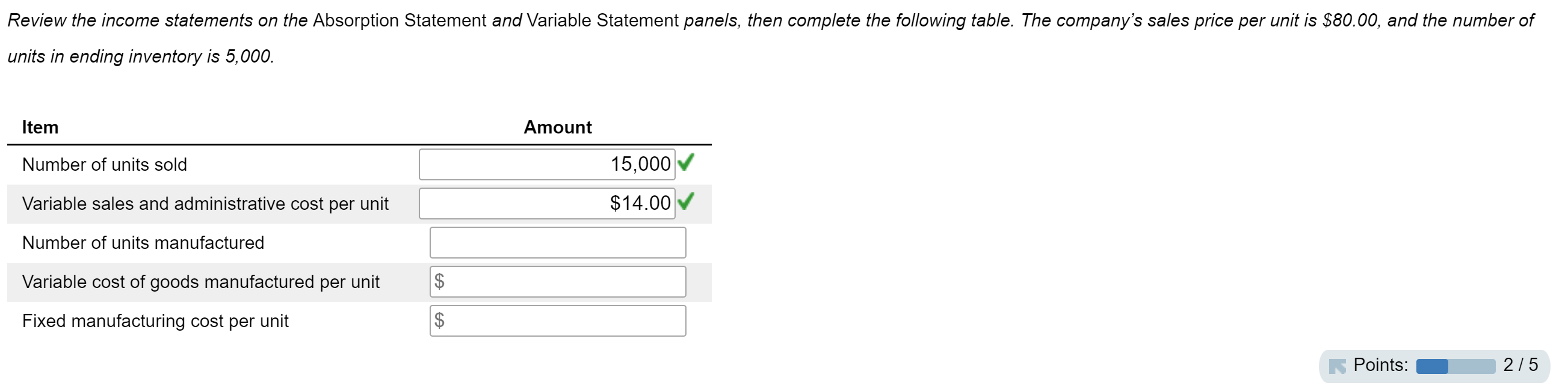

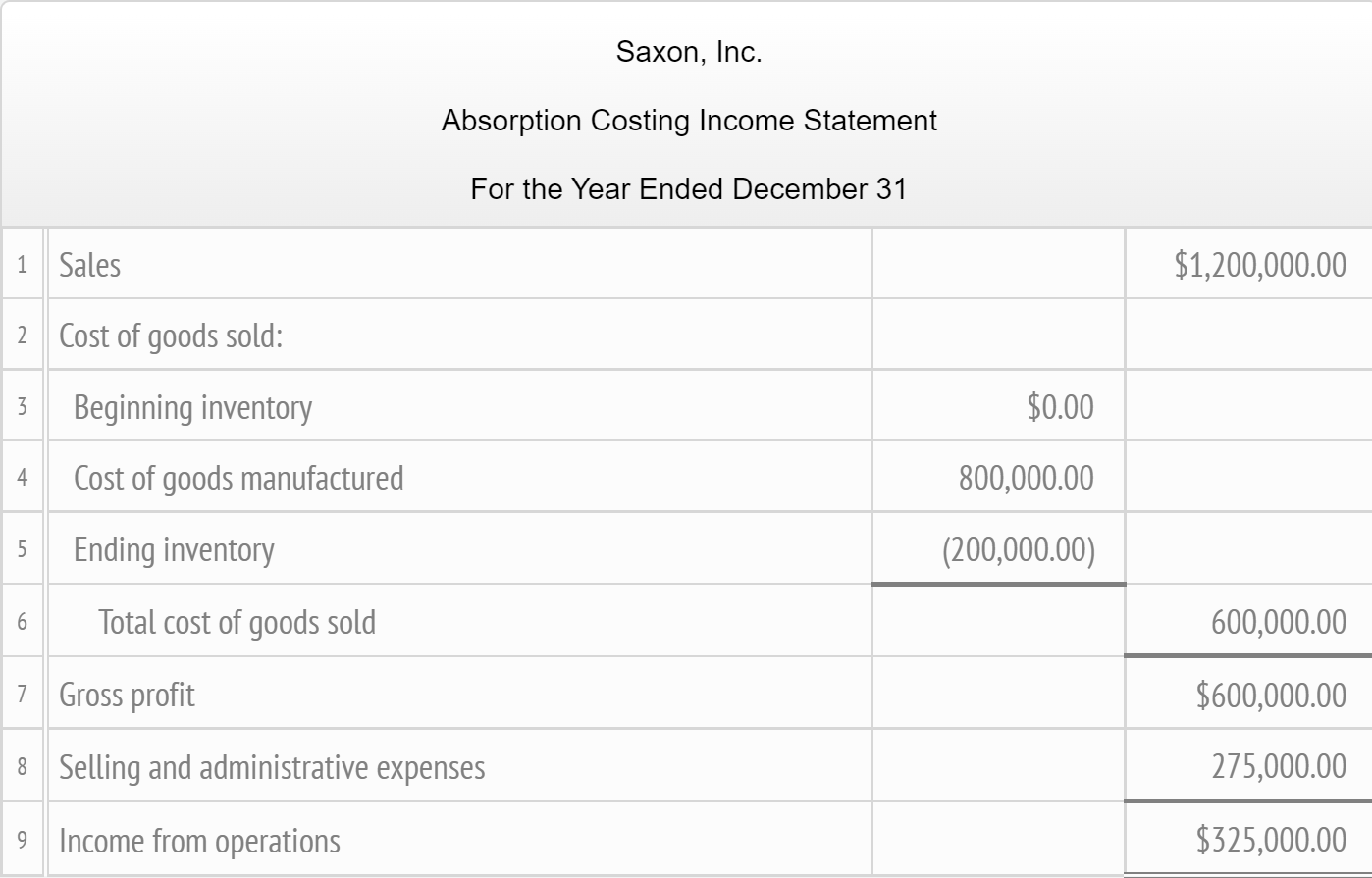

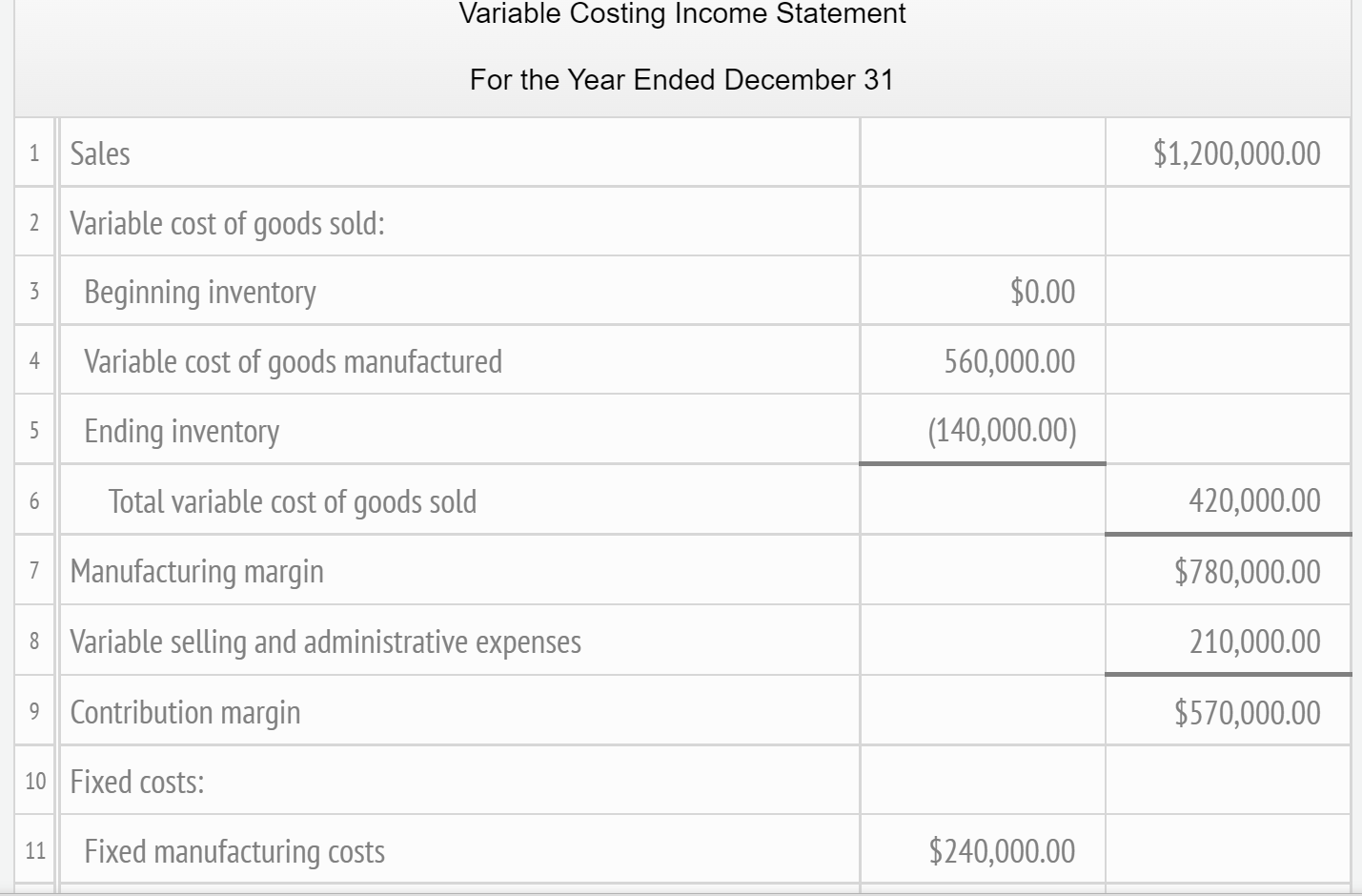

Review the income statements on the Absorption Statement and Variable Statement panels, then complete the following table. The company's sales price per unit is $80.00, and the number of units in ending inventory is 5,000. Item Amount Number of units sold 15,000 Variable sales and administrative cost per unit $14.00 Number of units manufactured Variable cost of goods manufactured per unit $ Fixed manufacturing cost per unit $ Points: 2/5 Saxon, Inc. Absorption Costing Income Statement For the Year Ended December 31 1 Sales $1,200,000.00 2 Cost of goods sold: 3 Beginning inventory $0.00 4 Cost of goods manufactured 800,000.00 5 Ending inventory (200,000.00) 6 Total cost of goods sold 600,000.00 7 Gross profit $600,000.00 8 Selling and administrative expenses 275,000.00 9 Income from operations $325,000.00 Variable Costing Income Statement For the Year Ended December 31 1 Sales $1,200,000.00 2 Variable cost of goods sold: 3 Beginning inventory $0.00 4. Variable cost of goods manufactured 560,000.00 5 Ending inventory (140,000.00) 6 Total variable cost of goods sold 420,000.00 7 Manufacturing margin $780,000.00 8 Variable selling and administrative expenses 210,000.00 9 Contribution margin $570,000.00 10 Fixed costs: 11 Fixed manufacturing costs $240,000.00 13 Total fixed costs 305,000.00 14 Income from operations $265,000.00 Income From Operations Additional Additional Original Production Original Production Level-Variable 10,000 10,000 Units-Absorption Level-Absorption Units-Variable $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started